Japan’s Financial Services Agency (FSA) plans to take administrative actions against hacked cryptocurrency exchange Coincheck after the company announced the loss of 523 million units of NEM cryptocurrency (about US$530 million) from a hack.

The FSA suspects that a lack of proper security measures allowed hackers to steal a record haul of cryptocurrency on Friday, according to a report by Nikkei Asian Review.

The regulator will issue a business improvement order to Coincheck later on Monday and order the company to strengthen its safeguards to prevent a recurrence, Japan’s chief cabinet secretary Yoshihide Suga told a regular news conference.

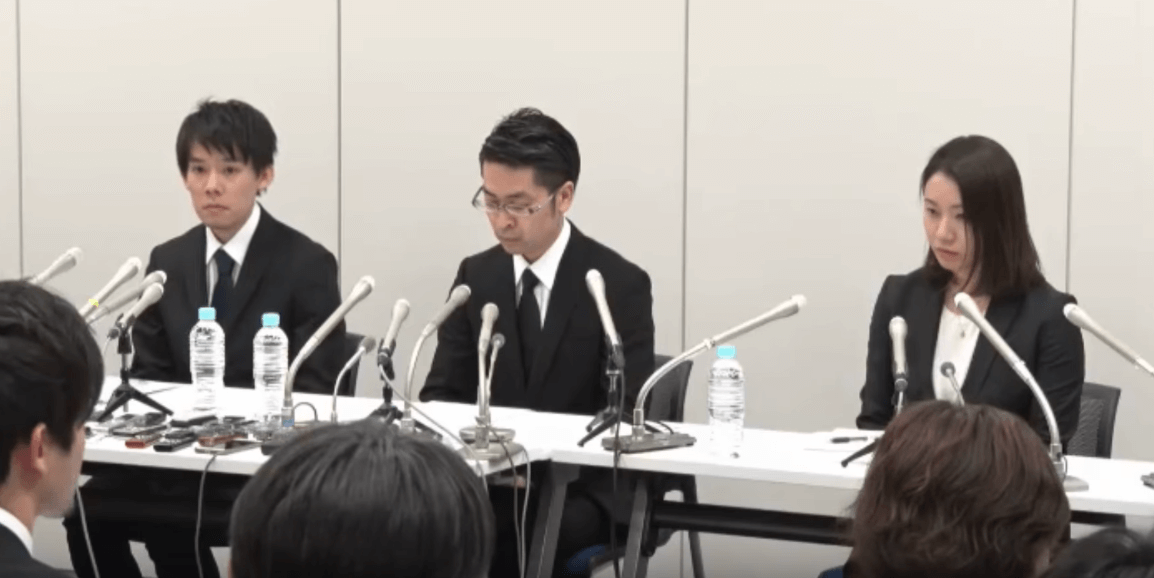

The theft is said to be the biggest-ever losses of cryptocurrency to hackers. Coincheck halted withdrawals and trading in all cryptocurrencies on Friday, except bitcoin, and said in a statement that it would return the stolen money to the roughly 260,000 affected users. According to the announcement, the refund will be done using the company’s own capital. No date has been set yet for the payments or for a restart of trading on the platform, Coincheck’s chief operating officer Yusuke Otsuka told reporters.

Tracking the stolen funds

The NEM.io Foundation‘s vice president Jeff McDonald said in a statement on Sunday that the organization was “working on solutions to do the most we can to help Coincheck and also ensure the NEM community is protected.”

“We are currently reaching out to exchanges and exploring three different options,” McDonald said. “We also have a full account for all of Coincheck’s lost NEM cryptocurrency (XEM) on the blockchain. At this time, the hacker has not moved any of the funds to any exchange, nor to any personal accounts of NEM community members.”

The foundation said it was developing an “automated tagging system” to follow the stolen funds and tag any account that receives the tainted money.

In an interview with Inside NEM, McDonald said that when the stolen funds were moved out of Coincheck it appeared that the funds were stored in a hot wallet that had an exposed API and probably an exposed private key.

Coincheck should have used NEM’s multi-signature contract and cold storage to secure the funds, he said.

McDonald added that a NEM hard fork was out of the question. “A hard fork is not an option. The NEM protocol worked exactly as it was designed to work. It’s a terrible thing but I think if the funds were going to be returned that it would have to be the hacker returning the coins to Coincheck,” he said.

New self-regulatory body in Japan

In the wake of the hack, two cryptocurrency trade groups in Japan, namely the Japan Blockchain Association and the Japan Cryptocurrency Business Association, have decided to merge into a self-regulatory body. The FSA had been encouraging the two organizations to join forces but they had been unable to agree on a way forward until now.

The new rule-setting body is expected to make it easier to set common rules for protecting investors. Having uniform disclosure standards would also aid customers in choosing a cryptocurrency exchange.

Surging interest in blockchain and cryptocurrency as well as the collapse of bitcoin exchange Mt. Gox in 2014 have pushed Japan to make legal revisions in April 2017 to tighten regulations on digital currency activities.

Cryptocurrency exchanges are now required to register with the government and submit annual reports. The FSA is also allowed to conduct on-site inspections and issue business improvement orders.

Coincheck is not a licensed cryptocurrency exchange but has applied to become one. As of January 17, Japan had 16 licensed cryptocurrency exchanges.

Japan is one of the largest markets for cryptocurrency trading. According to data from Cryptocompare.com, bitcoin trading in yen accounted for 30-40% of the global total trading volume in the past month.