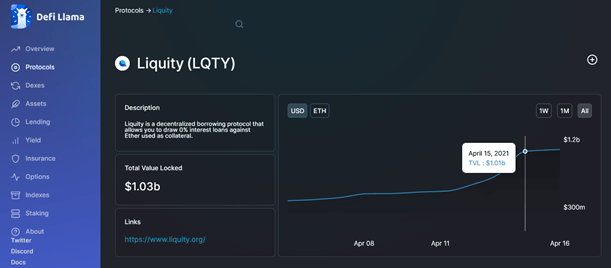

Liquity, the Ethereum-based interest-free borrowing protocol, announced yesterday its total value locked (TVL) figure surpassed $1 billion for the first time

Liquity has joined the “three comma club” after it confirmed its total value locked (TVL) had reached $1 billion as of yesterday. The DeFi protocol has notched this figure in less than two weeks, having been launched on 5 April. This is indeed an incredible start for the decentralized lending protocol that has not been around for a month.

The protocol, based in Switzerland, allows users to obtain interest-free loans using Ether as collateral. It is worth noting that this governance-free project is supported by the California-based venture capital firm Pantera and the quantitative investment firm Alameda Research. Both firms were actively involved in Liquity’s series A funding round completed a week before the protocol’s launch. Contributions from the two, as well as angel investors, totalled $6 million.

The borrowed loans are settled using LUSD — the protocol’s stable coin pegged to the US dollar and secured by the Stability Pool and other borrowers. The former serves as the liquidity source to clear liquidated debt, whereas borrowers are treated as guarantors. To earn rewards through the protocol, users have to stake liquidity and leverage the issuance and redemption fees.

Liquity’s social media team shared the news through a tweet followed by a breakdown of charts highlighting the growth based on data from the blockchain analytics firm Dune Analytics.

“From $0 to $1B TVL in 10 days,” Liquity Protocol wrote.

According to the data from Dune Analytics, a total of 480 million stable coins have been minted. The analytics firm also highlighted that the number of LUSD coins being minted is more than the number of those burned since the protocol was launched in early April.

Liquity has a minimum collateral ratio of 110% as a standard requirement for a loan. The data shows that most users are going for safety, with the majority of them keeping their ratio between 150% and 250%.

The Liquity Protocol team pointed out there has been a growing demand, saying, “Consistent borrow demand has been good news for $LQTY stakers. They continue to see a nice inflow of protocol fees to the staking contract.”

Liquity currently has a total value locked of $1.03 billion, according to DeFi Llama. Meanwhile, the collective TVL of all protocols sits slightly above $123 billion. Compound and MakerDAO lead the way with TVL figures of $10.95 billion and $9.31 billion, respectively.