Bitcoin miners hold more coins than they did two years ago even as price remains capped around $11,400

Miners on the Bitcoin network have increasingly become bullish about the top cryptocurrency’s potential long term gains, per data collated from wallet addresses.

This is despite the price of Bitcoin r struggling to stay above $11,500 and finding the hurdle above $12K too high for the time being.

According to data from on-chain analytics platform Glassnode, the total number of bitcoins held by miners has reached a two-year high. Wallet balances the platform tracks show that miners currently hold nearly $1.9 million bitcoins, the highest amount since 2018.

Importantly, miners’ overall holdings are shown to have increased since September 2019, rising steadily despite Bitcoin’s price crash in March 2020.

Total wallet holdings dipped in June this year, but miners have since held onto more of the minted coins in the last three months.

Hodlers are optimistic about BTC/USD

The bullish sentiment held by miners is visible among most bitcoin holders, with data showing that nearly 44% of Bitcoin supply has not been moved in the past two years.

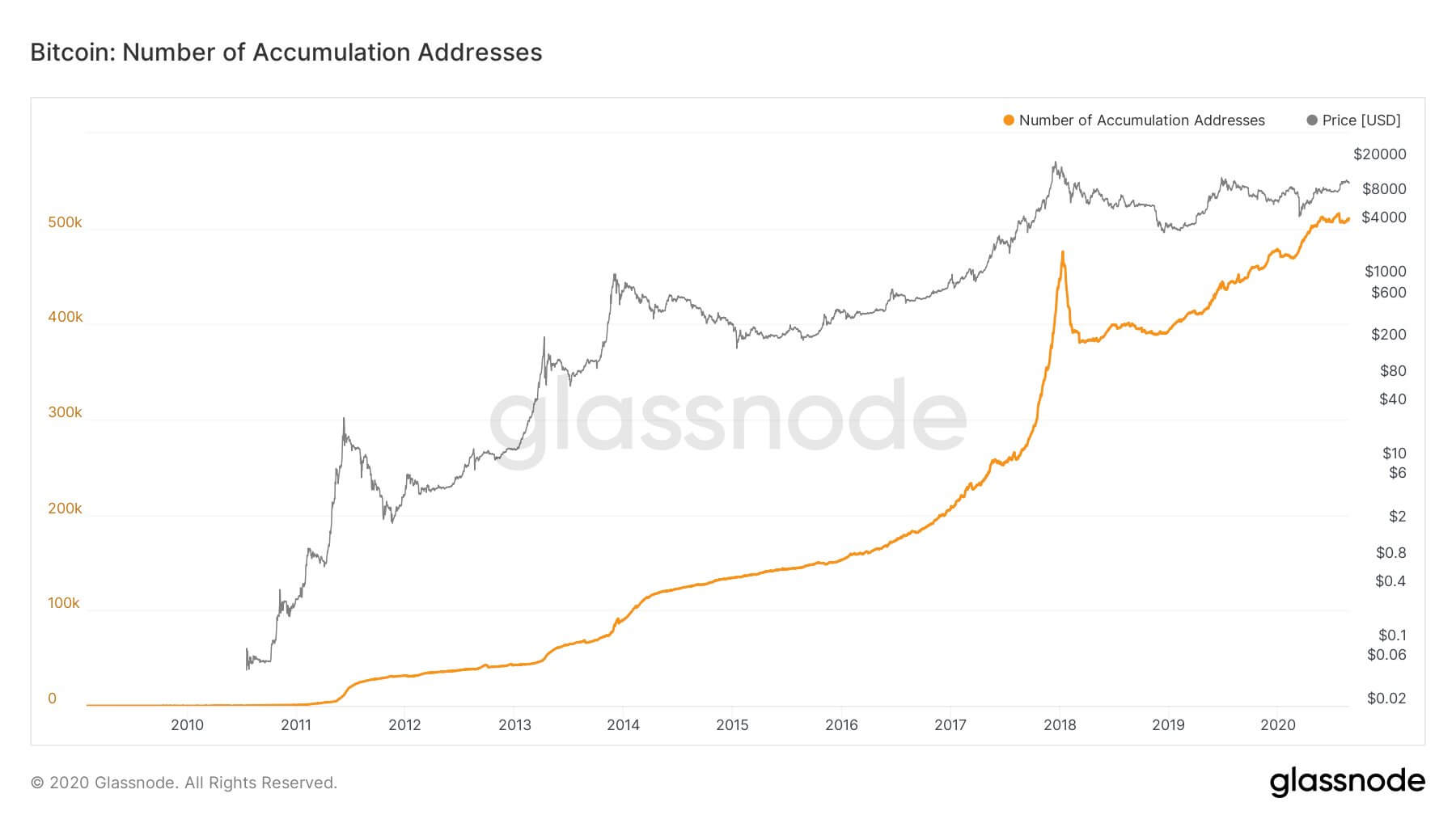

That is around 8 million bitcoins held in wallets since BTC/USD hit an all-time high price around $20K, with 14% of that held in over 500k accumulation addresses.

On-chain data shows that the number of accumulation addresses, which post “at least 2 incoming non-dust transfers and have never spent funds,” hold about 2.6 million bitcoins. It’s a bullish signal for Bitcoin, which is projected to hit a new high in 2021 if the market repeats the last bull cycle.

BTC/USD price

Bitcoin’s slump from highs of $11,800 to lows of $11,100 marked yet another strong rejection for the top crypto after retesting resistance above $12,000.

Although BTC/USD rallied to highs of $11,600 on Thursday, bulls failed to capitalise and prices sank back to lows of $11,250. As of writing, BTC/USD is changing hands around $11,415.

The price levels mean Bitcoin’s value over the past 24 hours has ranged between $11,250 and $11,600. But with over 62,000 Bitcoin options set to expire, added volatility over the weekend could see bulls try to attack the area around $11,800 again.

The area around $11,100 remains key to Bitcoin bulls though as a break below it could trigger a slide to the previously difficult to break resistance at $10,500.