I always find it interesting when people who are highly accomplished in their respective fields start getting their heads turned by cryptocurrency. One such case is Catherine Tucker, the Sloan Distinguished Professor of Management and a Professor of Marketing at MIT Sloan.

I came across her excellent paper, Antitrust and Costless Verification: An Optimistic and a Pessimistic View of the Implications of Blockchain Technology, which was way ahead of its time, being written in 2018 yet still highly relevant today. Indeed, she surmises that at the time, her academic peers thought digital currencies were merely “a flash in the pan”.

Sitting down to interview Catherine on the paper, as well as changes in the landscape since the paper was written four years ago, I got some answers on some topics that me curious.

CoinJournal (CJ): It was quite early to be writing academic papers on cryptocurrency back in 2018 – how did you first get into crypto and decide to write the paper? What was the initial reaction from your professional peers?

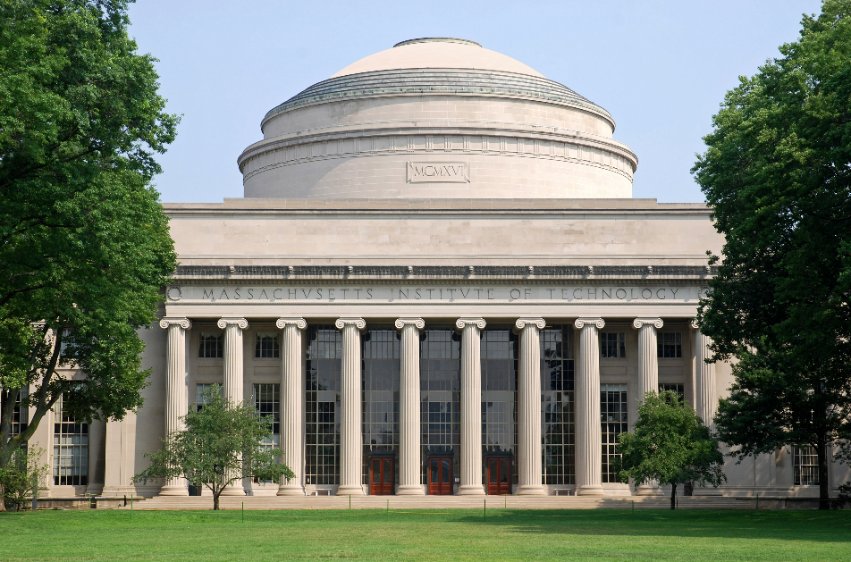

Catherine Tucker (CT): As a researcher I started working on issues of cryptoeconomics back in 2014 when I was part of the team that helped run the MIT bitcoin experiment where we gave $100 in bitcoin to each MIT undergraduate.

At the time my academic peers thought of digital currencies as a flash in the pan.

CJ: Have your views on the impact of blockchain technology changed since 2018?

CT: No. Though I think more people are understanding that blockchain is not bitcoin.

CJ: Would you have expected back in 2018 formal regulation around crypto to have progressed further at this stage, with regards to both antitrust and other areas?

CT: I think regulation has been slow and backwards looking so far. I think we have work to go when we come up with laws that reflect the nature of crypto rather than instead being laws that try and make crypto technologies work like earlier vintages of technologies.

CJ: One area I immediately think of upon reading your (excellent) paper is that of Central-Bank Issued Digital Currencies (CBDC’s). The power this would grant either a large company (say Apple, Google) or a government could be enormous – do you have any thoughts on this, especially from an antitrust perspective?

CT: Well central banks already are in charge of fiat currencies! And we trade off any market power due to tradeoffs about stability and credibility. I don’t think this will be different here. I also think that in general due to low switching costs that any tech firm sponsored cryptocurrency is unlikely to have substantial market power in the traditional economics sense.

CJ: Big tech companies have become even more powerful in the last few years. Do you still believe blockchain alternatives could theoretically offer more democratic platforms and impact growing antitrust, as discussed in the paper in 2018?

CT: Blockchain by making things less physical and more digital reduces switching costs that are the traditional source of market power. So I continue to be optimistic.

CJ: You wrote about open source code, and how it is a key factor regarding blockchain platforms and antitrust, but do you believe that a lot of pump-and-dumps or fraud is as a result of simple copy-paste forks of existing blockchains being so easy to set up?

CT: I think that crypto as an area of technology has been unusual in terms of the amount of scams that have existed. I think this is the combination of so much investment going in, new untested technologies and that there have been unusually high returns relative to other sectors of the economy. This combination has sadly led to scams. I don’t think it is necessarily a reflection of the ease of scamming particularly.

CJ: Since you wrote this paper, decentralised finance (DeFi) exploded onto the scene in 2020. Could this have large impacts on potential antitrust, and the control that such big institutions currently have over financial markets?

CT: I am excited about decentralised finance. If you think about it especially in economies out of the US, banking tends to be unusually concentrated and that there are large switching costs for leaving a bank. Decentralised finance as a movement promises to change this pattern of concentration.

CJ: You wrote in the paper that “whereas the market is nascent and currently no cryptocurrency or blockchain project has reached any meaningful market power, at scale some of the projects will have enough market share to influence prices and consumer welfare”. Do you believe Bitcoin’s large lead in terms of influence and market cap does not constitute meaningful market power, given its ability to move the markets of all other cryptocurrencies?

CT: No. I think Bitcoin as a first mover in a sector where there are untested technologies has had an advantage in terms of attracting attention. I am not aware of any switching costs that would particularly mean though that its large market share implies monopoly power. As many a trader knows it is easy to switch between bitcoin and other competitors.