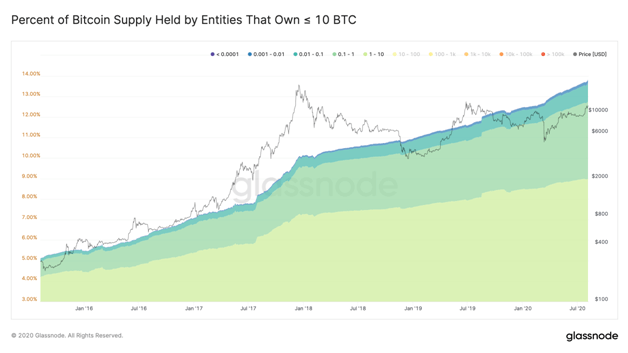

Bitcoin wallets holding 10 or fewer coins have surged to account for nearly 14% of total supply

According to data shared by analytics firm Glassnode, more and more of Bitcoin’s circulating supply is going into wallets controlled by small account holders.

The data suggests that Bitcoin is seeing an increased redistribution of its supply, with the percentage of supply held by large entities decreasing significantly over the same period.

Wallets with 0.1-10 Bitcoins surge

As Bitcoin price edges towards a retest of $12k, Glassnode data shows that demand for the cryptocurrency among retailers is as strong as it has ever been. This, according to the firm, is shown by the steady increase in the number of wallets holding up to 10 bitcoins.

While wallets with 0.1 or fewer bitcoins make up just 1% of supply, the total number of wallets holding between 0.1 and 1 bitcoins has grown from 0.89% in 2016, to levels of 3.6% today.

There has been a huge jump in the number of wallets with 10 or fewer bitcoins. Statistics show that wallets in this category have increased from about 5.1% to over 13.8% in the past five years.

The redistribution has also seen the percentage of wallets with between one to 10 bitcoins grow from 4.6% to 8.78%.

The largest accounts, which hold more than 100,000, surprisingly saw a significant increase to rise from about 6% five years ago to around 13%. This percentage compares to the percentage of bitcoin supply held on exchanges, which saw a huge influx of Bitcoin after its rise to $20,000 during the last bull market.

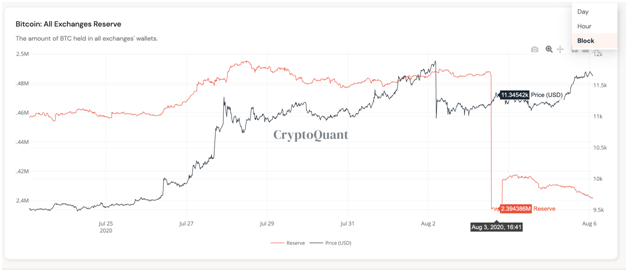

Exchanges Reserves Drop By 4%

A chart shared by cryptocurrency analyst Cole Garner shows that the amount of Bitcoin reserves on exchanges recently plummeted by 4%; claiming it “dropped off a cliff.” The analyst suggests that the drop was occasioned by whales who “bought up the sell-off,” and that this is bullish for Bitcoin price.

Bitcoin was trading at around $11,786 at the time of writing and could retest resistance at recent highs around $12,000.