- NEO price soared more than 40% to hit a two-year high above $22.

- Toncoin extended gains seen on Monday as price discovery drove TON to a new all-time high.

The crypto market recorded a decent bounce on Monday, with Bitcoin price hitting highs above $72,000 to buoy multiple altcoins. Toncoin and NEO are some of the top performers in the past 24 hours. Here is a brief price outlook for TON and NEO.

Both altcoins are extremely bullish as analysts share predictions for BTC ahead of Bitcoin halving.

Toncoin price prediction as TON extends gains

Toncoin (TON) is one of the coins to surge amid the BTC bounce. As highlighted yesterday, Toncoin price rose to a new all-time high as fresh bullish momentum hit the crypto space.

Read more: Toncoin (TON) price hits a new all-time high

TON has extended its gains to a new all-time high of $6.96, with price up more than 23% in the past 24 hours. Toncoin’s trading volume has increased more than 600% in this period, reaching over $843 million at the time of writing.

Toncoin price chart

A look at the daily chart shows the Toncoin token price is above the 50-day exponential moving average. RSI and MACD indicators also suggest bulls have an upper hand.

With price in discovery mode amid overall bullishness for the coming months, it is possible TON price could target $10 and possibly higher.

On the downside, bulls may have immediate support around $6.34 and a robust demand reload zone around $5.00

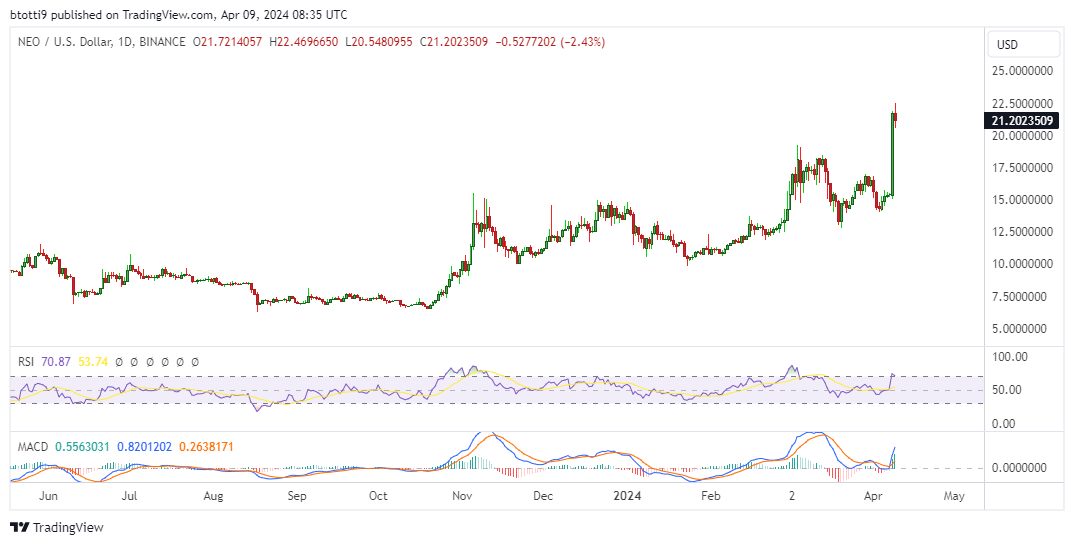

NEO price prediction: What next after 40% surge?

The price of NEO spiked more than 40% on April 8, surging as to highs of $22.46. This saw NEO reach a two-year high, with prices at levels last in April 2022.

Gains also extended NEO’s upside above the tough hurdle around $18.15. The upswing brings the recent resistance zone at $16.93 into play as a potential reload zone for buyers.

NEO price chart

On the upside, NEO could retest prices at March 31, 2022 highs of $29.63. A bullish flip could catapult NEO/USD to November 2021 highs of $41.49.

Currently, NEO is trending around $21.06 as some traders take profits. While the paring of gains could increase with a dip below $20.00, its likely bulls remain in control. The daily RSI and MACD indicators suggest this scenario.