The never-ending battle of Ethereum against the psychologically-important $3K barrier continues. The DeFi king broke through the resistance earlier, meaning it is now up 16% on the week.

Ethereum 7-day returns, data via CoinMarketCap

Ethereum 7-day returns, data via CoinMarketCap

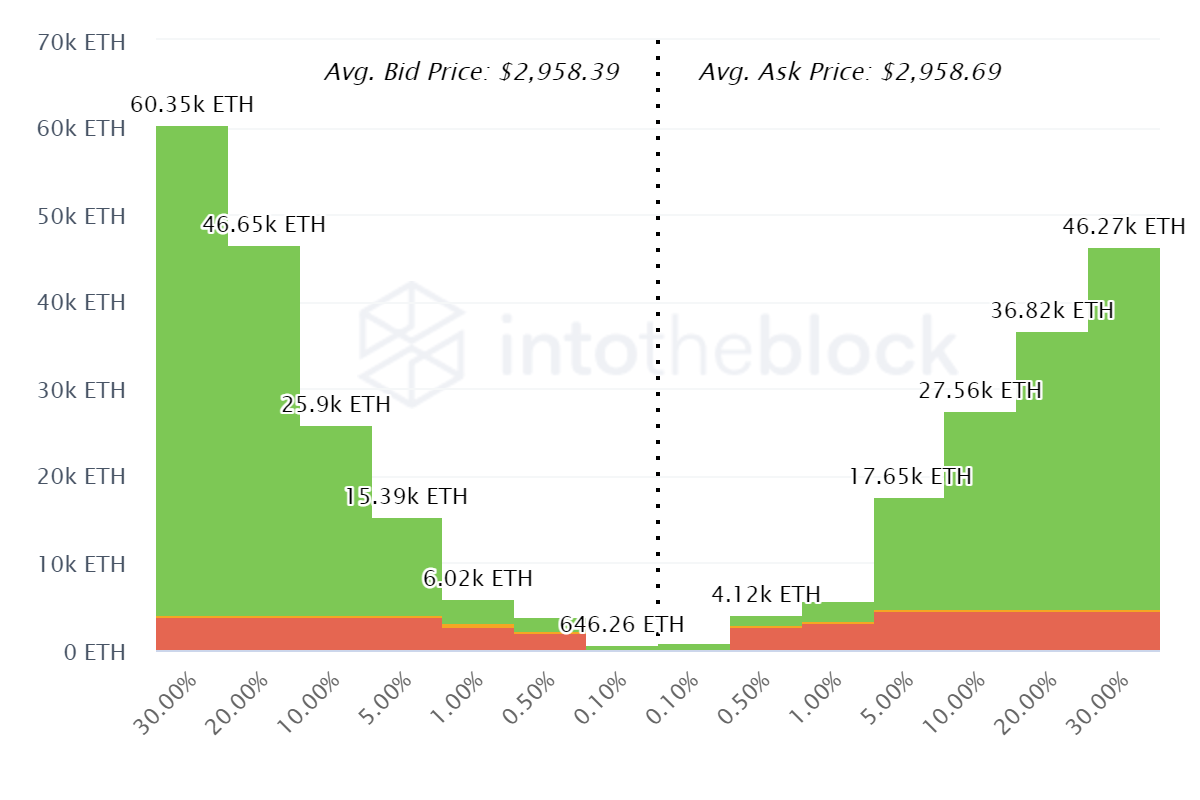

Order Volume

The $3K area has been a tug-of-war over the last while, and today reads no different. Data below via IntoTheBlock shows the boisterous volume on both sides of $3K, as order-books burst with bids and asks. It’s difficult to ascertain where ETH will go from here; like most financial assets, it may depend on external geopolitical developments, which have been plentiful in recent times.

Order volume around the $3K barrier, data via IntoTheBlock

Order volume around the $3K barrier, data via IntoTheBlock

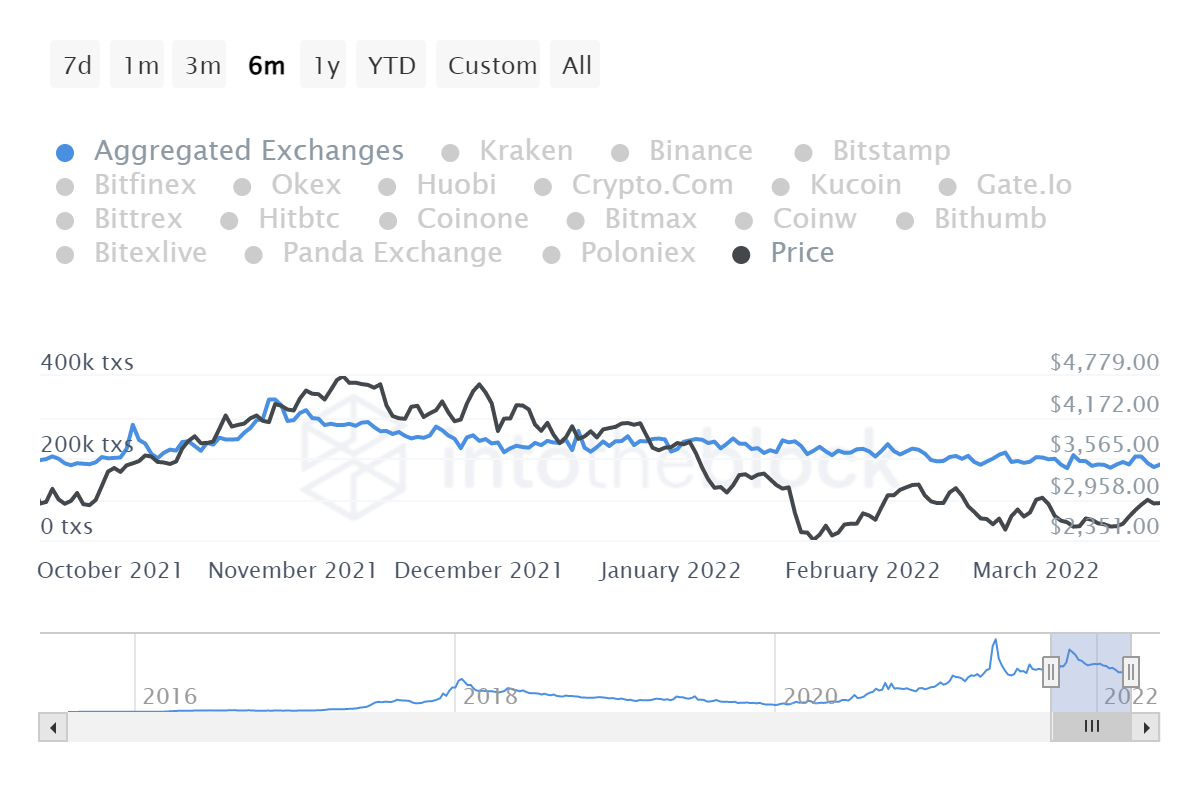

Volume

Volume provides no clue in either direction, with withdrawals from exchanges continuing to follow a slow but steady decline. This suggest hodlers are staying put, despite the volatility Russia has caused across the market this month. Looking at the 30-day movement, we are seeing 3% less transactions now than we were last month – not exactly a figure that will shock anyone, but an important indicator that long term holders have remained resolute.

Outflow transactions over last 6 months, data via IntoTheBlock

Bitcoin Correlation

ETH has notably outperformed Bitcoin the last week, with the world’s biggest crypto only up half of what ETH has managed over the last 7 days, at 8%. Looking at correlations, ETH has been slowly dropping over the last month, but nothing too notable – and correlation to Daddy Bitcoin remains extremely high at 0.88.

So while a decoupling has long been forecast by ETH enthusiasts, that day has not yet arrived. With ETH’s market cap at $360 billion while Bitcoin remains clear at $807 billion, talks of the “Flippening” have also died down. However, with the eagerly awaited ETH 2.0 upgrades inching closer – I suspect this summer may be the fateful day – expect talk of both a Decoupling and the Flippening to resume. It will be very interesting to keep tabs on the correlation between the two biggest cryptos once ETH transitions to Proof-of-Stake.

Data via IntoTheBlock

Data via IntoTheBlock

Macro

With on-chain metrics looking good but unspectacular, it looks like we need to search elsewhere for the catalyst behind this surge in ETH. I could sit here and data-mine; I could try to infer it’s because of this metric or that metric, but the reality is that on-chain metrics are incredibly useful when used in conjunction with a holistic view of the market – but should not be viewed in isolation; nor provide the sole source of input to one’s model or prognosis.

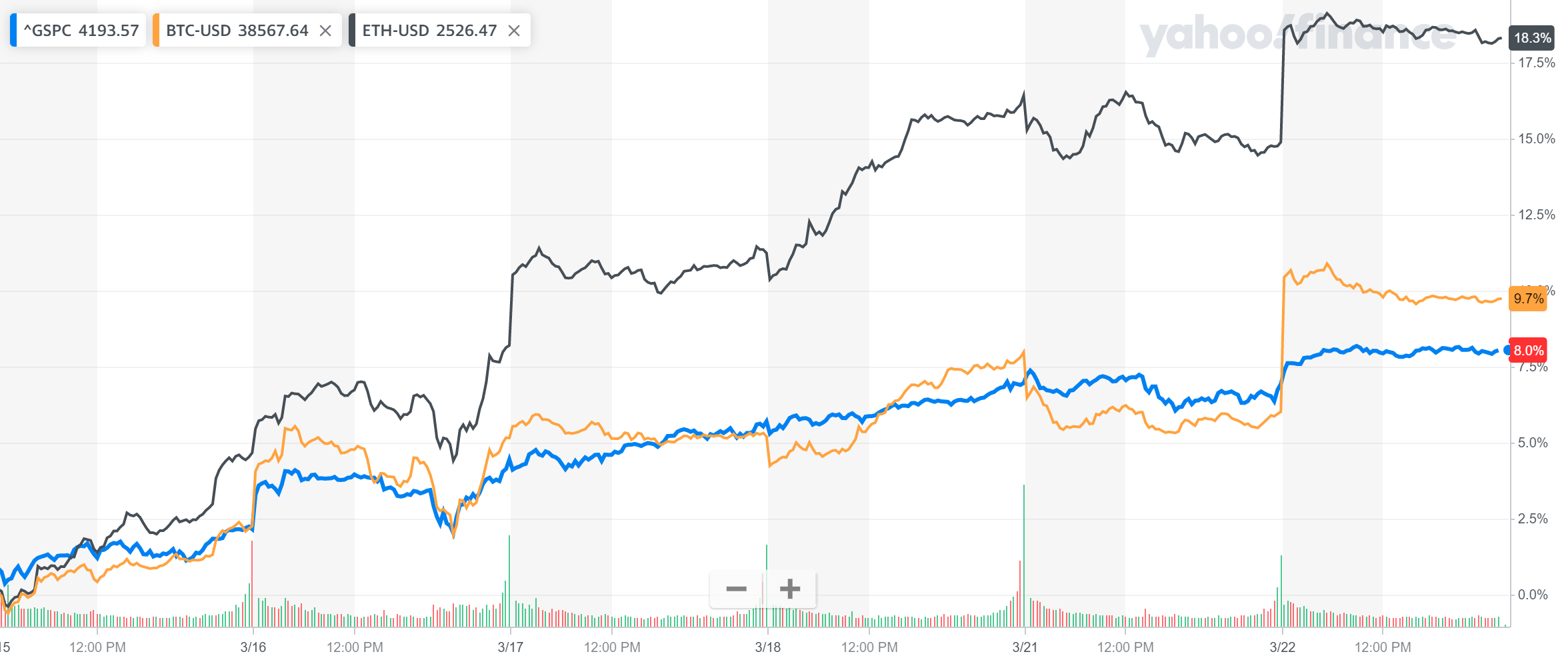

In reality, while ETH has surged, the financial markets have had a boom week all round. We mentioned Bitcoin above, but stocks have also been buoyant. S&P 500 is up 8%, as the market seems to have priced in a more optimistic view on the Russian developments. ETH has been using this momentum to turn upwards.

The graph below also highlights visually how in sync Bitcoin, Ethereum and stocks have been over the last week.

7-Day returns of S&P 500 (blue), Bitcoin (orange) and Ethereum (black), data via Yahoo Finance

Conclusion

A strong week for Ethereum, as not only did it jump in sync with the rest of the markets, but it comfortably outperformed most cryptos and other asset classes. ETH 2.0 has no doubt caused much frustration among followers given the endless delays, but with it creeping ever closer, it will be interesting if the above on-chain metrics will shift and whether we see different patterns in ETH’s price action. Maybe – just maybe – that sky-high correlation with Bitcoin may even fall a bit.