BitX, a bitcoin startup headquartered in Singapore that offers consumer wallets, exchanges services and APIs to businesses, has been accepted into the UK’s Financial Conduct Authority (FCA) regulatory sandbox. BitX will be testing its remittance solution on the blockchain. The news marks the startup’s entry into the UK and European market.

Speaking to CoinJournal, Vijay Ayyar, BitX‘s head of business development who also leads the company’s Asia business, said that the FCA sandbox will help the company build a sustainable, licensed business model for its enterprise product. It will further help build trust in and knowledge about bitcoin and blockchain technology in the industry.

Ayyar indicated that BitX is planning to apply to other country sandboxes as well “where we believe it is appropriate for the product and market.”

“This is likely to include Singapore. We are already in talks with a number of other regulators in various countries about similar arrangements,” he said.

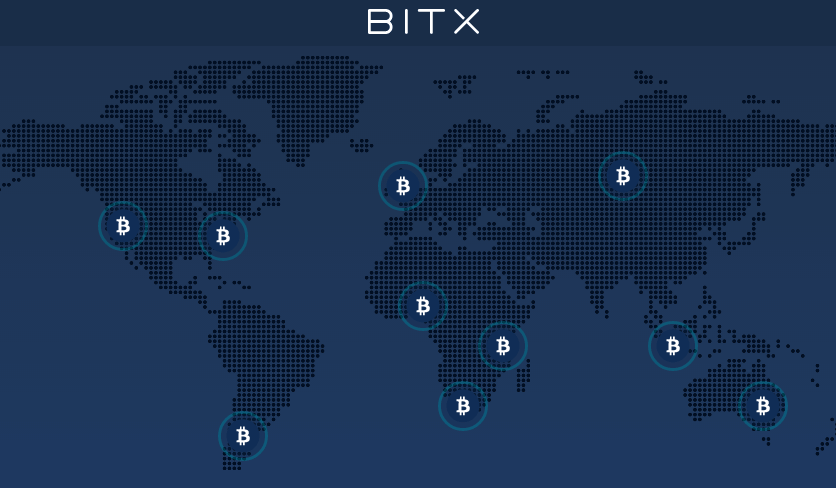

Founded in 2013 and with offices in London, Singapore and Cape Town, BitX is the largest cryptocurrency platform in Southeast Asia and Africa in terms of volumes. It is also the bitcoin company with the most active country presence across these two regions.

Alongside having expanded to the UK and the European market, BitX also serves the Indonesian, Malaysian, Nigerian, Singaporean and South African markets.

As part of the FCA regulatory sandbox, BitX will be running specific tests for both its Enterprise and Consumer businesses. The Enterprise tests will focus on BitX’s FALCON protocol, which will aim at helping existing, licensed remittance businesses move GBP to other currencies using blockchain technology and digital currencies.

Commenting on the news, Marcus Swanepoel, CEO of BitX, said:

“We see these tests as an important first step in building trust and confidence in Bitcoin and blockchain technology, and believe that this type of constructive cooperation between all stakeholders will be critical to the long-term success of our industry.”

Yesterday, the FCA unveiled the 18 companies it has accepted into its first cohort of the regulatory sandbox, among which nine bitcoin and blockchain companies.

Alongside BitX, the eight other bitcoin, blockchain companies are:

Billon, an e-money platform that facilitates the transfer and holding of funds using a mobile app;

Epipythe, a payments service provider specializing in cross-border payments;

Govcoin Limited, a provider that has partnered with the Department for Work and Pensions to determine the feasibility of making emergency payments to mobile devices;

Nivaura (formerly Crowdaura), a platform for issuance and lifecycle management of private placement securities;

Otonomos, a platform that represents private companies’ shares electronically on a blockchain;

SETL, a smart-card enabled retail payment system based on the OpenCSD distributed ledger;

Tradle, an app that creates personal and commercial identity and verifiable documents on a blockchain;

Tramonex, an e-money platform that facilitates the use of smart contracts to transfer donations to charities.

The FCA regulatory sandbox aims at providing businesses with a safe harbor to test innovative products, services, business models and delivery mechanisms in a live environment.