-

AAVE’s trading volume increased by 77% in the last 24 hours.

-

CAKE’s trading volume saw an increase of 47% in the last 24 hours.

-

CRV’s value increased by 10%, and its market cap saw an increase of 15% in the last 24 hours.

Aave is a decentralized finance protocol that allows users to lend as well as borrow crypto, and its AAVE token allows for yield farming.

PancakeSwap is an automated market maker (AMM) as well as a decentralized finance (DeFi) application that lets users exchange tokens, provide liquidity, and engage in yield farming through which they can earn fees in return for doing so through the CAKE token.

Curve is a decentralized exchange for stablecoins that leverages an automated market maker (AMM) to manage liquidity. Users of Curve tokens can engage in yield farming.

Should you buy Aave (AAVE)?

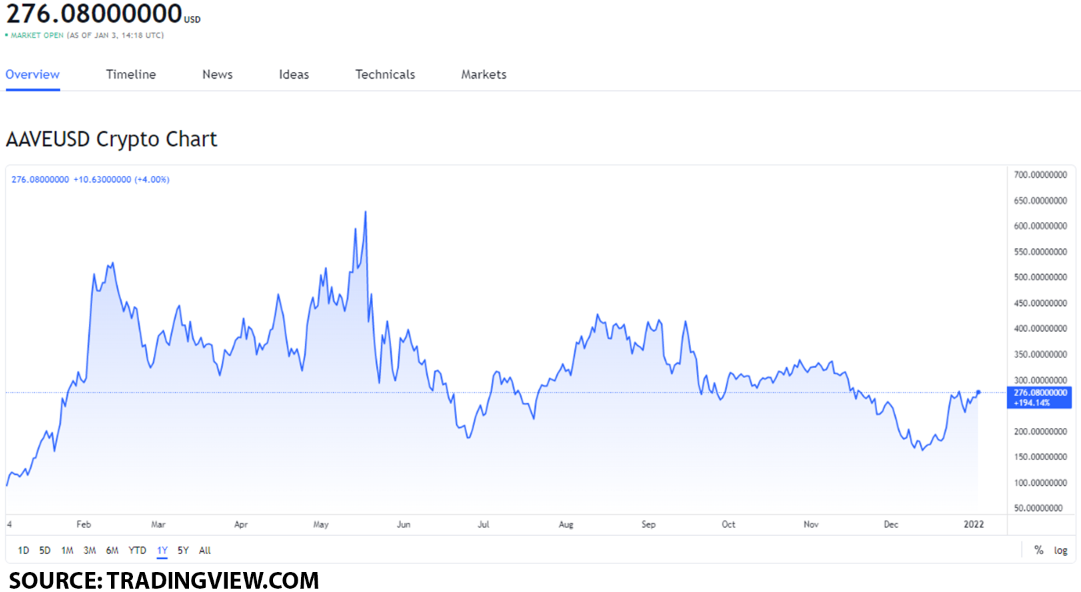

On January 3, Aave (AAVE) had a value of $276.08.

To get a better perspective as to what this value point means for the AAVE token, we will go over its ATH value point as well as its performance last month.

AAVE had its all-time high value on May 18, 2021, when it reached $661.69. Here, we can see that at its ATH point of value, the token was $385.61 higher in value.

When we look at the token's performance in December, on December 15, the token had its lowest value point of $160.05.

The token’s highest value point was on December 28, when it reached $292.84. Here, we can see that AAVE increased in value by $132.79 or by 82%.

With this in mind, AAVE is a solid buy at $276.08 due to the fact that it has the potential to reach $300 by the end of January.

Should you buy PancakeSwap (CAKE)?

On January 3, PancakeSwap (CAKE) had a value of $12.41.

To see what this value point means for the CAKE token, we will go over its ATH point of value as well as its performance in December.

CAKE had its all-time high value on April 30, 2021, when it reached $43.96. Here, we can see that at its ATH point of value, the token was $31.55 higher in value or by 254%.

When we go over the token’s value in December, we can see that its highest value point was on December 1, when CAKE was worth $14.62.

Its lowest value point, however, was on December 5, when the token decreased to $10.65. This gives us an indication that the CAKE token decreased in value by $3.97 or by 27%.

However, from December 5 to January 3, the token increased in value by $1.76 or by 16%.

With this in mind, we can expect CAKE to reach $15 by the end of January, making it a solid buy.

Should you buy Curve DAO Token (CRV)?

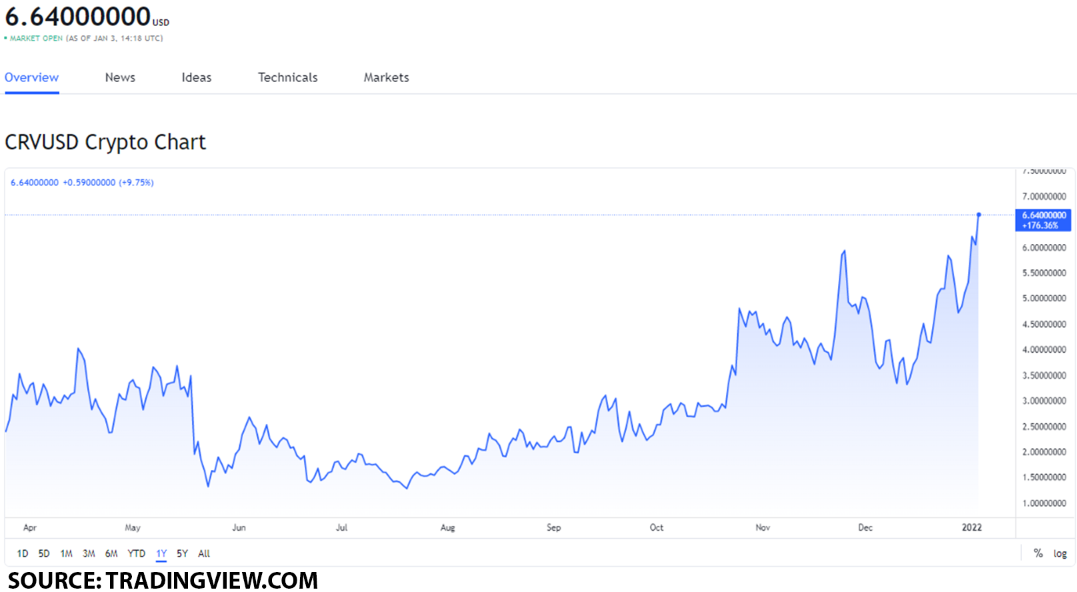

On January 3, Curve DAO Token (CRV) had a value of $6.64.

To get an indication as to what this value point means for the CRV token, we will go over the performance of the token in December, alongside its ATH point of value.

CRV had its all-time high value on August 14, 2020, when the token was worth $54.01. Here, we can see that at its ATH point of value, the token was $47.37 higher in value or by 713%.

When we go over the performance of the tokens in December, on December 6, CRV had its lowest point of value at $3.26.

The token's highest value point of December was on December 26, when it reached $5.99 in value. Here, we can see that the token increased in value by $2.73 or by 83%.

With this in mind, at $6.64, the CRV token is a solid buy as it has the potential to reach $8 in value by the end of January.