When it comes to booking a flight to an exotic location or paying for a week’s stay at a hotel, the use of the internet is becoming a favourable option. This is partly due to the convenience of booking for flights and hotels, in addition to the trust factor and the ability to compare various deals.

The future growth of the online travel market is noted in a report published by Allied Market Research. It projects that the global online travel industry will grow to $1,091 billion by 2022. Not only that, but the 21-31 age group are highlighted as the ones driving the online travel market, spending around $200 billion each year on travel.

Yet, even though the market is flourishing, the hospitality sector is seeking alternative measures that will enable them to lower costs while increasing customer loyalty. Rather than disrupting their current business operations, the hospitality sector wants to work with tech companies that will improve efficiencies and reduce costs.

One way of achieving this is through the blockchain. And Swissbloc Capital believes it has the answer to accomplishing this.

According to its white paper, “Swiss Capital is a technology company that wants to assist the hospitality sector by improving the current travel payment and settlement ecosystem by lowering friction costs currently arising in the hospitality sector.”

It goes on to add that it aims to bring this about through the blockchain and via the introduction of a global settlement token known as the GTX Token. The company states that there is an important relationship between agents, suppliers, and consumers. However, these are often challenged by middlemen such as those in the finance sector, with new costs being introduced that undermine the financial viability of them.

Transforming the Hospitality Sector

By introducing the SBC ecosystem between agents and suppliers, the platform is aiming to reduce the cost involved for travel agents, hotels, airlines, rental car companies etc., by moving from a variable per cent model to a fixed cost per transaction model, according to Swiss Capital’s white paper.

By reducing friction costs and removing third-party middlemen between agents and suppliers, in addition to improving the bottom line financial system, savings can be passed on to the consumer as well. Not only that, but the SBC ecosystem will operate in real-time, resulting in accelerated settlement times. The use of the blockchain also reduces the risk of fraud. With the aid of the blockchain a heightened level of trust is maintained among the various players involved.

The platform will also have a GTX Rewards Token for consumers, agents, and suppliers. Consumers can earn the GTX Rewards Tokens when shopping at retail locations, food outlets, booking flights or staying at participating hotels. These tokens will form a global loyalty scheme, which will be available to all consumers across the hospitality sector.

The GTX Token will also be used as an industry reward structure for agents and suppliers.

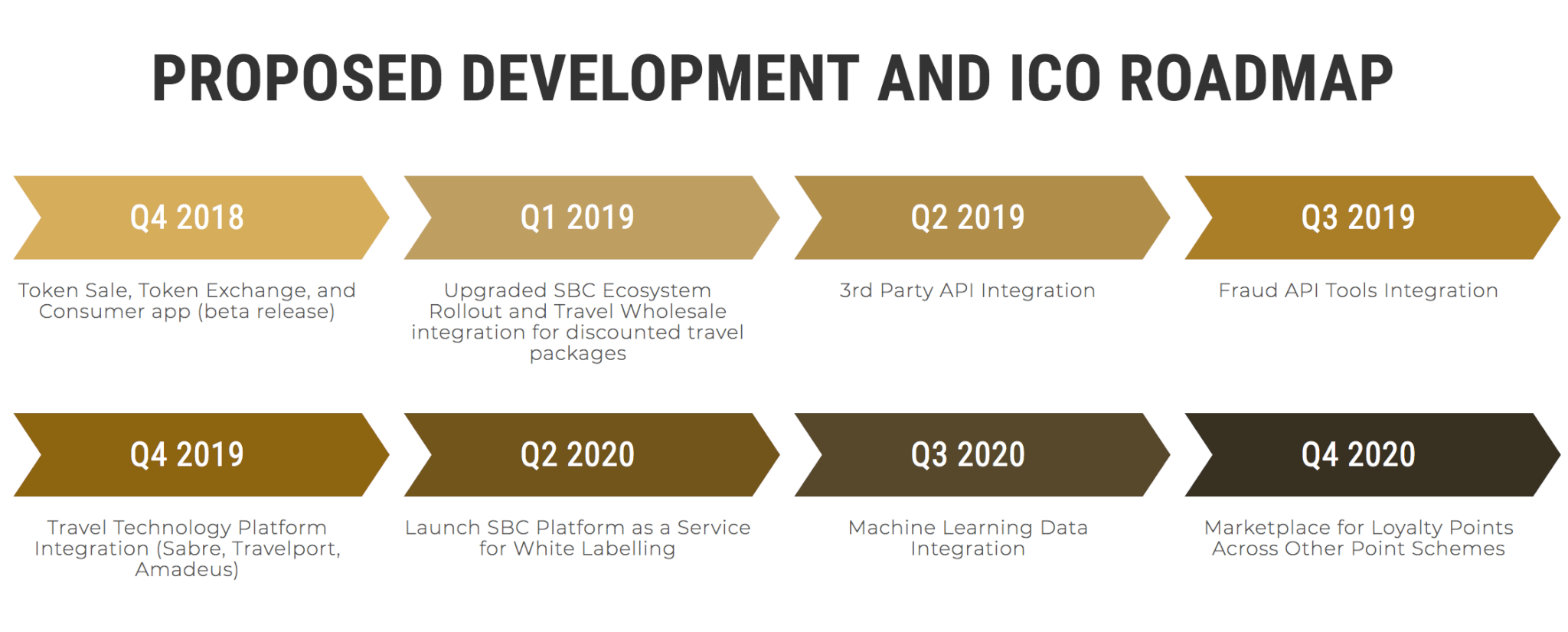

By Q4 2018, Swiss Capital is aiming to have launched a token exchange, a consumer app in beta release, and the rollout of the SBC ecosystem. In Q2 2019, it is intending on having third-party and fraud tool integration, in addition to approval from the U.S. Securities and Exchange Commission (SEC). After which it will issue its second initial coin offering (ICO), targeting the U.S. market.

By Q4 2020, it intends to have a marketplace enabling the conversion of retail, hotel, and airline points into and out of GTX Reward Tokens.