- ProximaX – Blockchain-powered infrastructure and development platform

- Plutus – Crypto personal finance application

- XinFin – Hybrid blockchain for global trade and finance

Blockchain and distributed ledgers are a fast-evolving technology with an ever-growing number of applications. The improvements they offer to efficiency could revolutionise numerous different industries.

Many enterprises are already exploring and developing this technology to create innovation in their respective sectors, and here we’ve featured 3 business blockchain pioneers that we think are worth checking out this month.

ProximaX – Blockchain-powered infrastructure and development platform

We are becoming ever more reliant on the internet and its applications in our day-to-day lives. However, businesses built on centralised computing suffer from vulnerabilities such as fraud and face issues with security, privacy and scalability.

Blockchain can provide solutions to these problems, but many enterprises struggle to adopt and deploy this new technology due to its often complicated and fragmented nature. This is where ProximaX provides a vital service.

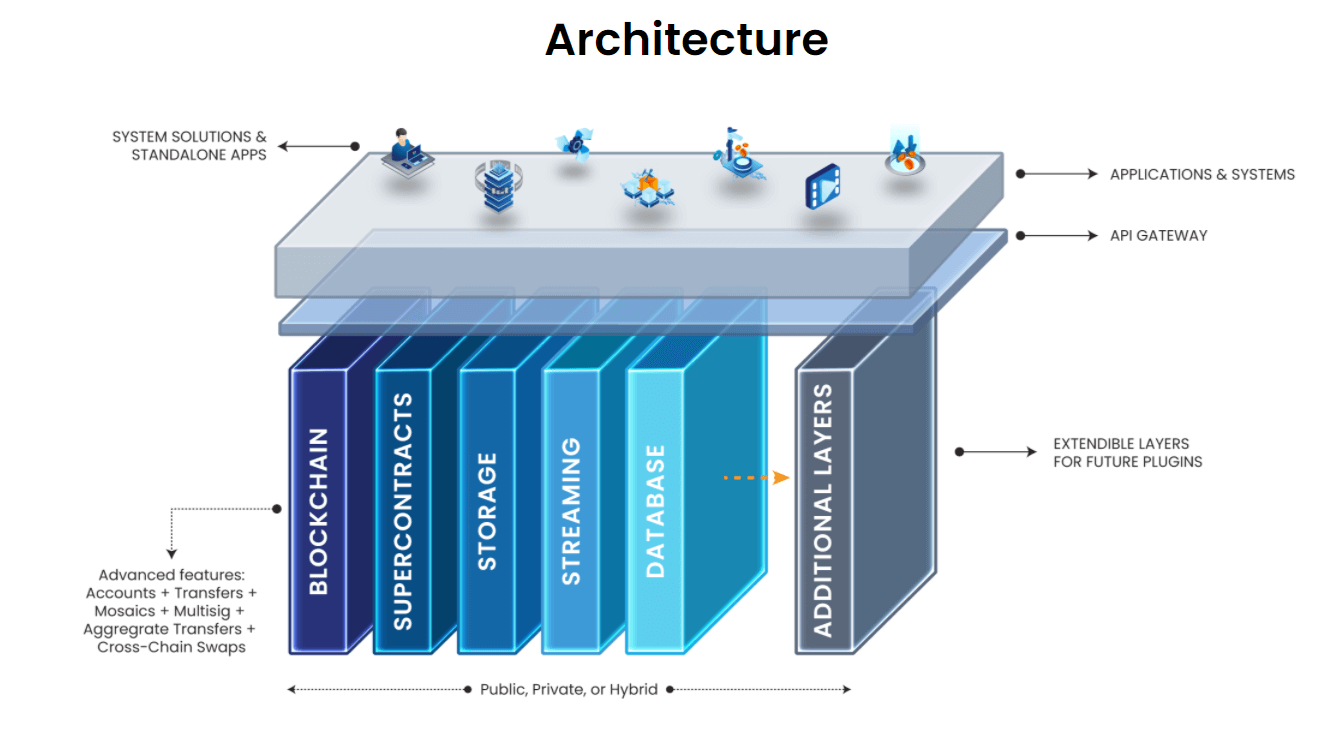

It combines blockchain with distributed service layers to make adoption and integration easy and cost effective for businesses.

What does it do?

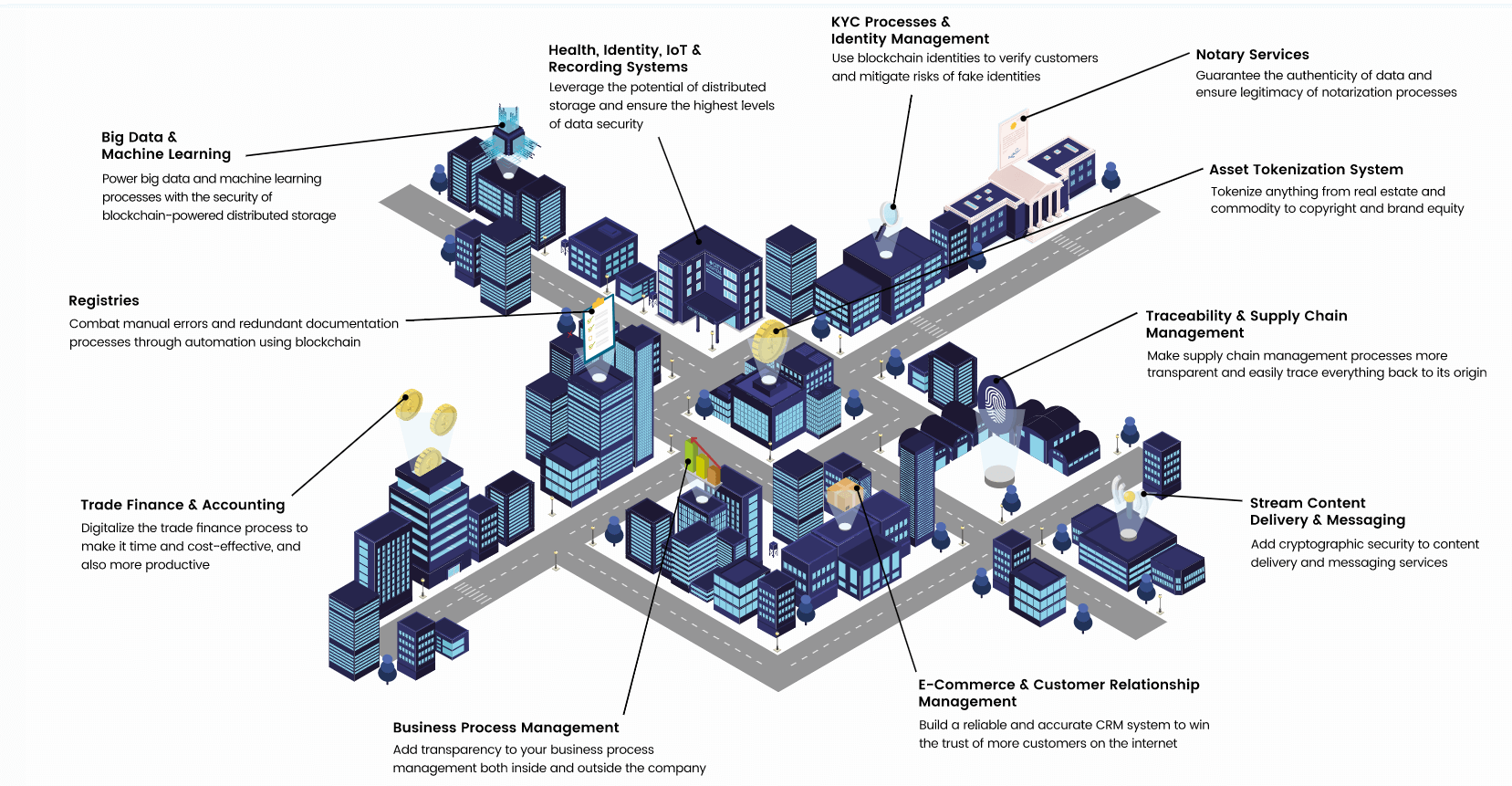

The ProximaX Sirius platform combines blockchain with storage, streaming and database layers in a distributed network. This structure provides many useful features such as the ability to stream text, video and voice data, and the encryption of all messages, transactions and storage. It also means that every event is time stamped on the blockchain and business processes can be automated through the use of off-chain Supercontracts.

The ProximaX APIs (application programming interfaces) and SDKs (software development kits), along with its support for a wide range of different programming languages, make the platform very simple to use for app developers.

Networks built on ProximaX Sirius have a whole host of advantages, including transparency, configurability, interoperability and zero downtime. This technology has a plethora of use cases, from finance and e-commerce to supply chain and governments.

Adoption and development

ProximaX successfully launched Sirius Storage and Supercontract on mainnet last year, while the development of Sirius Stream is 75% complete. It was also invited by partner Morpheus Labs to present its blockchain-powered mobile wallet, mWallet, at the inaugural Huawei Cloud Day last month.

The many and varied adopters of Proxima X technology include the National University of Malaysia for blockchain-powered e-voting, the Blockchain Energy Saving Consortium to help companies track their energy consumption, and logistics pioneer LOGYCA to power their Supply Chain Value Network.

Plutus – Crypto personal finance application

While cryptocurrencies may herald an exciting new era of finance, they are still detached from our current infrastructures. This means that keeping track of your fiat and crypto balances, as well as all your transactions between them, can get pretty complicated.

Different wallets and exchanges may display the value of your cryptocurrency balances in different fiat currencies, which makes monitoring your finances difficult, and when you decide you want to spend your crypto, this often means embarking upon a slow process which can leave you vulnerable to certain risks.

Plutus creates a bridge between traditional and new-wave financial systems, making it an important innovator on the road to mass adoption of cryptocurrencies.

What does it do?

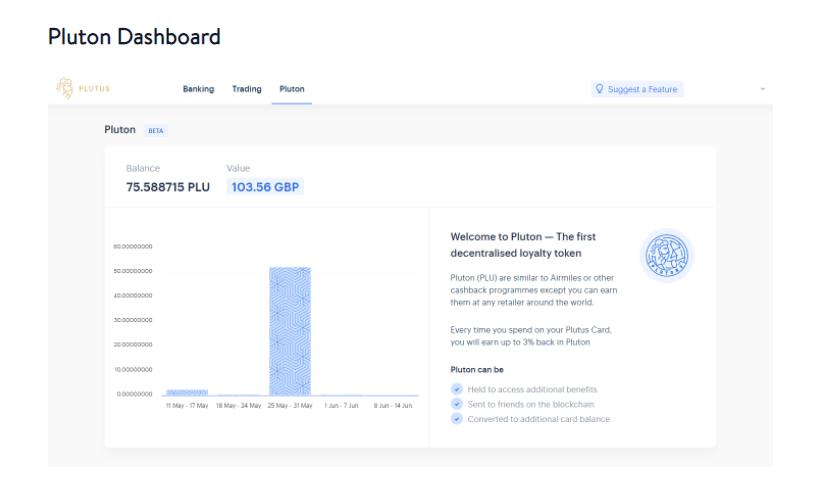

Plutus enables users to manage their fiat and crypto from a single app, securely swap between them via a decentralised exchange (DEX) and spend them with a Visa debit card while earning rewards in cash and cryptocurrencies.

Customers of Plutus can attach their private wallets like MetaMask to their regular finances, without having to give up possession of their private keys. This means users’ crypto assets would remain safe and accessible even if Plutus were to experience downtime or a hack.

The Plutus card links a DEX to a debit card so that customers can top it up with converted cryptocurrencies and spend them around the world at more than 60 million merchants, making it easy for anyone to interact with crypto in their day-to-day spending.

Plutus pioneered the decentralised loyalty rewards concept, and its customers can enjoy up to 3% back on their Plutus Card purchases in the world’s first decentralised loyalty token – Pluton (PLU). Pluton can then be converted to fiat, gifted to friends or staked to receive Plutus Perks like bonus crypto and up to 15% in rewards at certain retailers.

Adoption and development

Since its foundation in 2015, Plutus has enabled tens of thousands of people with varying levels of blockchain knowledge to engage with cryptocurrencies on a daily basis. The Plutus card was released in 2017, followed by the launch of its mobile app and DEX in 2018.

The company recently embarked upon the Pluton Liquidity Injection Programme, which will aim to increase accessibility to the Plutus app and PLU. The token has already been listed on well-known exchanges like Bitfinex and KuCoin since November, and many more PLU listings are planned for the future.

Other exciting developments include Plutus’ expansion to Asia and Latin America, planned for this year, and its commitment to obtaining a banking licence, which it aims to achieve in 2022.

XinFin – Hybrid blockchain for global trade and finance

International trade and finance today suffers from many inefficiencies arising from manual processes, disjointed systems, multiple intermediaries and a lack of trust between parties doing commerce. Latencies in cross-border payments pose a big challenge for merchants and the largely centralised nature of finance means that we are still lacking a truly global financial marketplace.

Blockchain provides many advantages over the traditional system due to its decentralisation, the immutability and auditability of its digitised ledger and the improvements to efficiency it offers. In particular, blockchain technology can facilitate cross-border transactions and offer digital contracts, real-time payments and asset digitisation.

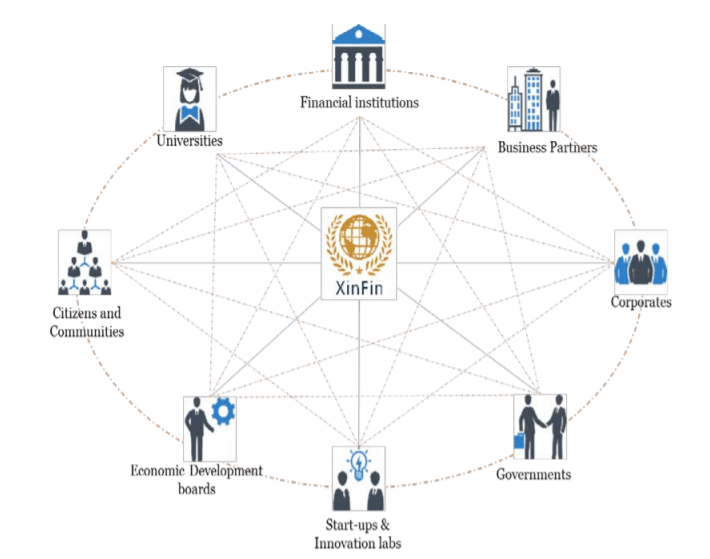

eXchange inFinite, or XinFin, aims to leverage this fast-evolving technology to help bridge the global trade and finance deficit.

What does it do?

XinFin’s hybrid blockchain technology combines the best of both private and public blockchains, meaning that financial data is secure yet transparent and verifiable. The hybrid nature of the blockchain also makes it interoperable with other blockchain platforms and legacy systems.

The network is secured by an innovative delegated proof-of-stake (XDPoS) consensus and powered by its native XDC token. Real-time data can be fed into the blockchain thanks to the protocol’s internet of things (IoT) layer.

So, the XDC protocol can operate as a messaging and confirmation layer for payments – both domestic and cross-border – or the XDC token, with the support of financial institutions, can be used as a payment and settlement layer. The protocol facilitates real world contracts and transactions and is useful across many different industry sectors.

The XDPoS mechanism ensures optimal scalability and enterprise-grade usability for the network, which can handle 2000 transactions per second at a fee of just $0.0001. Thus, application of the XinFin solution can improve efficiency of business processes and is currently being deployed across varied sectors, including banking, supply chain, power, tourism, aviation and solar.

Adoption and development

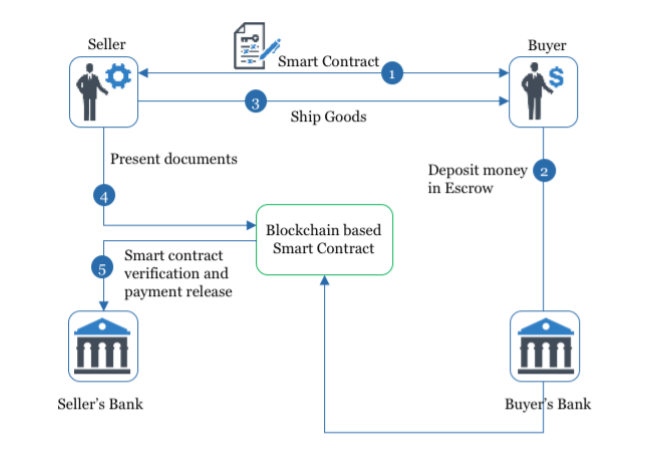

Peer-to-peer trade finance platform TradeFinex leverages XinFin technology to connect marketplace participants and create legally binding digital smart contracts. The platform’s use of blockchain provides many benefits such as lower cost of capital, participant incentives and improved trade and cost efficiencies.

Other use cases built around the XDC utility token include digital asset creation and management dashboard MyContract; decentralised travel ecosystem XcelTrip; and Land Registry, for accessing, verifying and transferring ownership pertaining to land records.

XinFin’s goals for this year consist of building a robust infrastructure through new wallet integrations, driving XDC adoption with decentralised apps already on the network, gaining more exchange listings, developing interoperability with Ethereum, achieving legal clarity on the token and enhancing XDC staking.