There’s no doubt that 2020 was a great year for Bitcoin, as it saw an increase of over 300%, but certain indicators are suggesting that 2021 has yet more excitement in store!

Generally, halving events tend to have a positive impact on the price of Bitcoin, and over the course of 2021, we could see some of the effects of the most recent halving in May 2020. Historical analysis of previous halvings by Rekt Capital shows that the first halving spurred a growth of 13,378% from the pre-halving bottom, while the second halving drove a 12,160% rally. If the third halving leads to a similar increase from Bitcoin’s December 2018 bear market bottom, we could see a price of ~$383,000 to ~$420,000 per coin by the end of this rally. The research also shows that the amount of time between the pre-halving bottom and the halving was roughly the same as the length of the post-halving rally on both previous occasions. Bitcoin bottomed 511 days before the 2020 halving, so if this temporal pattern repeats itself, we would expect Bitcoin to peak in October 2021.

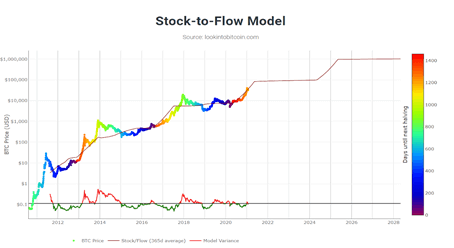

Another promising indicator is the Stock-to-Flow model created by institutional investor PlanB. The model uses the scarcity of Bitcoin to quantify its value and suggests that the price could hit $100,000 before the end of 2021.

Continued institutional Bitcoin accumulation will likely increase scarcity in the long run, eventually sending the price even higher. 5.85% of all Bitcoin is now held in the treasuries of public and private institutions and ETFs according to data from Bitcoin Treasuries. Frequent news stories about large corporations putting faith in Bitcoin also builds confidence among retail investors. Indeed, a recent survey by OnePoll showed that almost a third of Britons were curious about investing in cryptocurrencies, and were only held back by a lack of understanding.

Diem launch in early 2021

With the launch of this long-awaited project, Facebook will attempt to make Diem the ‘currency of the internet’. The Diem Association announced in December that the ‘Libra’ project would be rebranded as ‘Diem’ going forward, thereby distancing itself from Facebook. The rebranding also came with new members of the project team, including ex-VMWare and Microsoft employee Dahlia Malkhi and former US attorney Steve Bunnell. Although a precise launch date has not yet been given, the team have indicated it will take place in early 2021.

Diem has faced a number of regulatory hurdles and Facebook has received criticism for its business practices, such as changing Whatsapp privacy laws, Cambridge Analytica and tax avoidance, so the brand may suffer from a PR problem at launch. Diem will also have to face competition from Paypal and the wider tech industry. However, the new leadership is focused on making sure the project meets regulatory expectations and Facebook’s enormous user base, as well as its pre-existing marketplace for businesses to sell products, makes it an ideal place to facilitate the adoption of an internet currency. Many aspects of Diem, like total supply, transaction times and exchange support still haven’t been made clear, so it’s hard to say at this point what its potential will be, but a promising sign is that the Diem testnet recently hit a milestone of 50 million transactions, according to data from blockchain explorer inDiem.

COVID vaccine will be rolled out and the global economy will gradually open up again

The COVID-19 pandemic was likely one of the drivers of the 2020 crypto market boom. Governments around the world have been distributing relief packages to their citizens and businesses in an attempt to rescue their economies from pandemic-driven disaster. In particular, the US government has spent trillions on stimulus packages, which contributed to the Federal Reserve reportedly printing a fifth of all US dollars last year. With worries that the dollar is being devalued, many individuals and institutions alike turned to Bitcoin and other cryptocurrencies for the first time in 2020 as a store of value. Furlough schemes also meant lots of people had the time to educate themselves about the crypto market.

So if things start returning to normal in 2021 as the vaccine is rolled out, what will the effect be on the crypto space?

Well, the announcement of effective vaccines towards the end of last year prompted a surge in global stock markets. If traditional markets make a recovery in 2021, it’s possible some institutional investors could start selling off their crypto holdings in order to allocate capital to businesses which are now able to open up again, though it seems likely many will still use Bitcoin as a risk diversification asset. However, the pandemic has taught us all the importance of saving for emergencies, so those who have had their eyes opened to crypto may continue to use Bitcoin as a hedge against inflation and future crises, even as the economy returns to normal.

DeFi and ETH 2.0

2020 was an incredibly strong year for decentralised finance (DeFi), with total value locked (TVL) in DeFi increasing almost 2200% from roughly $675 million at the start of the year to nearly $15.5 billion at the end, according to data from DeFi Pulse. It seems likely that the DeFi sector will continue to grow in 2021, but with the top 30 DeFi projects by TVL all being developed on Ethereum, the fate of DeFi is very much intertwined with that of Ethereum 2.0.

The Eth2 upgrade will solve Ethereum’s scalability problems while making the network more secure and sustainable by transitioning from a proof of work to a proof of stake mechanism. The Beacon Chain, the first stage of Eth2, went live at the start of December 2020, and so far more than 2.8 million ETH – worth almost $3.8 billion – has been committed to the deposit contract, which represents a huge vote of confidence in the upgrade.

The next stage of Eth2 is shard chains. These will expand Ethereum’s capacity to process transactions and store data and are expected to arrive sometime in 2021. Ethereum Co-founder Vitalik Buterin also suggested that rollups – a Layer 2 technology which takes much of the burden of computation and storage out of the blockchain – could provide much of the scalability Ethereum needs, even before Eth2 is fully delivered. So there is certainly much cause for optimism this year.

NFTs

Non-fungible tokens (NFTs) are provably unique tokens which can take many different forms and they experienced a boom in popularity last year. There was much interest in 2020 in NFT artwork, with some heralding it as a digital renaissance. In October, Christie’s became the first major auction house to sell an NFT when “Block 21”, a physical artwork and accompanying NFT, sold for over $130,000. The total trading volume of NFT artwork hit an all-time high of $8.2 million in December 2020, according to data from Crypto Art, and the enthusiasm shows no signs of subsiding.

NFT gaming was also popular last year. Gaming studio Skymarch Entertainment announced in November they were partnering with Enjin to integrate NFTs into their games, while Axie Infinity and Upland grew by 810% and 516% respectively, as shown by data from DappRadar.

As for what we can look forward to in the coming year, the brothers of the founder of Synthetix revealed they are developing an NFT collection and auto battler game called Illuvium, and their token genesis event is scheduled to take place late Q1 2021. Aavegotchi co-founder Jesse Johnson has also suggested that leveraging DeFi could lead to some more interesting NFT products in the future, so there should be plenty to look forward to on this front.