Online reputation company Traity has launched Kevin, a chatbot that provides micro-insurance for peer-to-peer transactions against theft, fraud, scams, and more.

Kevin was built in partnership with Suncorp, the largest Australian insurance conglomerate. Another product will be launched in the coming months, Juan Cartagena, founder and CEO of Traity wrote in a blog announcement.

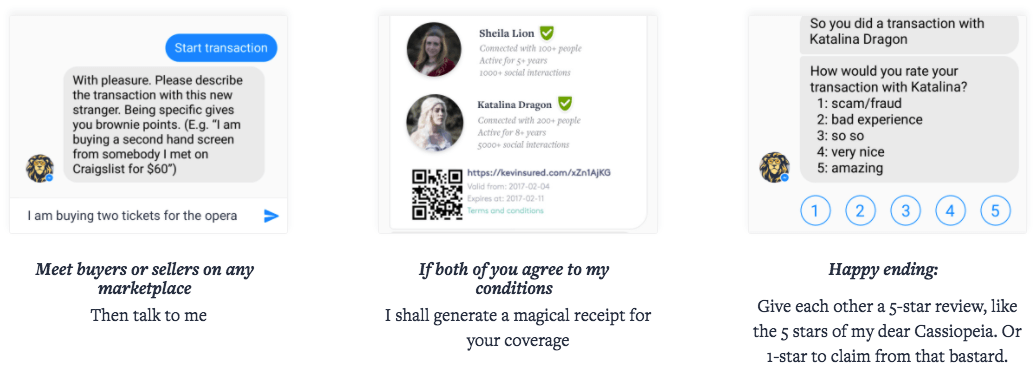

Kevin runs on Facebook Messenger and works like this: when you buy or sell something, you send a message to Kevin and tell him about your peer-to-peer transaction. Kevin will send you a unique link in return. You then send this link to your counterpart, and once that person gets approved, your peer-to-peer transaction is insured for up to US$100 absolutely for free.

The Kevin protocol takes the reputation of both users, and if both are good, it creates a transaction on blockchain to timestamp that they have agreed to such transaction. This triggers three things:

The Kevin protocol takes the reputation of both users, and if both are good, it creates a transaction on blockchain to timestamp that they have agreed to such transaction. This triggers three things:

- It timestamps the transaction

- It buys bitcoin to cover the liabilities in the company’s Blockchain Balance Sheet, and

- It timestamps the reputation review.

For every new transaction Kevin approves, Kevin buys US$10 worth of bitcoin. When a transaction ends positively, Kevin sells US$10 worth of bitcoin. When a transaction ends negatively and Kevin needs to pay the guarantee, an additional US$100 is added into Kevin’s Open Balance Sheet.

Kevin’s Open Balance Sheet can be verified and audited by any person at any time. The process is also auditable: for every policy created, a blockchain transaction can be tracked in the balance sheet. Essentially, it means that an untrusted financial entity can become as trustworthy as a well-known entity.

“The point of our Open Blockchain Balance Sheet is not to be fully decentralized,” Cartagena wrote in a separate blog post.

“Our objective was to show transparency and trustworthiness in the way we handle money, we handle policies, we handle balance sheets, we limit leverage, available liquid assets, etc., and to be a project with which other businesses, insurtechs, and insurance companies can get inspired to create more trust in the value chain and financial transparency.”

Kevin currently uses Namecoin but the company plans to move to Ethereum in the future. Kevin is available for consumers in Australia, the US, the UK and Spain. The company plans to release an API for peer-to-peer marketplaces.

“Insurance is a business where you only communicate with your provider twice. When you buy, which forces you to pay with no immediate benefit, and the moment you claim, which is an unhappy moment regardless,” Cartagena wrote. He continued:

“Kevin is more of a companion. Some people will use it for all their transactions, maybe once a month, or once a week. So it opens a completely different story about how to engage with an ‘insurance service,’ a companion who helps you along the way. This is a small concept today, but it can lead to big things in the future.”

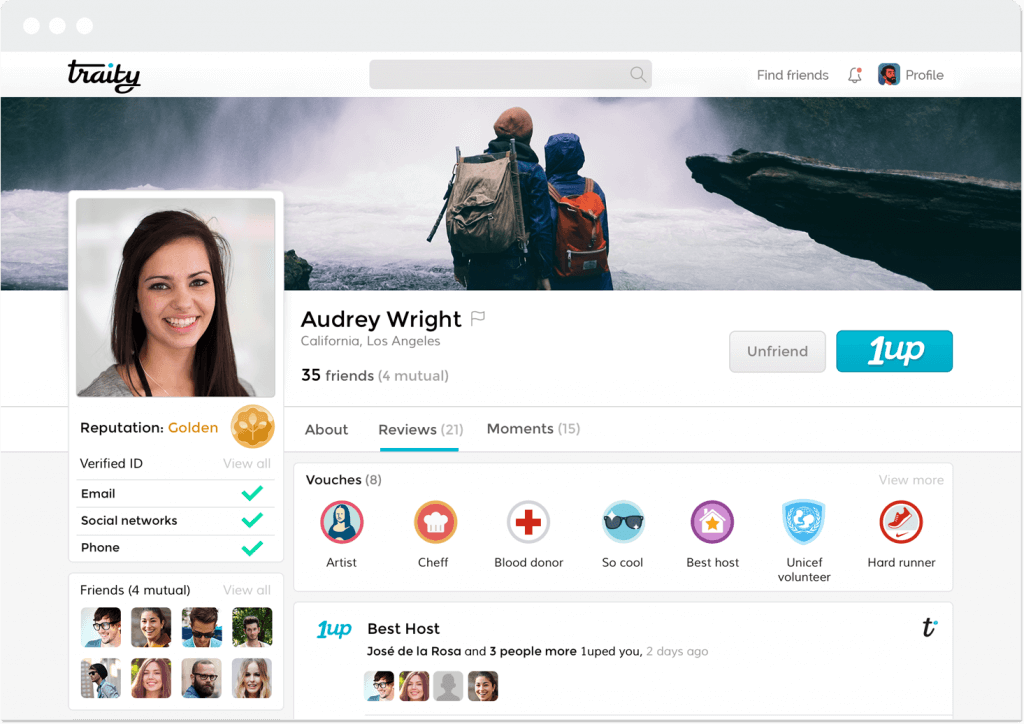

Traity, an alumnus of Europe’s Seedcamp and Silicon Valley’s 500 Startups, measures people’s trustworthiness using their online behaviors and actions. This includes analyzing people’s public social profiles, such as Twitter, taking personality tests within Traity and studying reviews on sites like eBay. With the data, Traity creates a profile that shows one’s reputation and credibility.

Traity has over 4.5 million registered users. The company is backed by some of the most renowned venture capital investors including Horizons Ventures of Li Ka-Shing in Hong Kong, BDMI of the Bertelsmann group in Germany, and Lanta Digital Ventures from Spain.

Traity has over 4.5 million registered users. The company is backed by some of the most renowned venture capital investors including Horizons Ventures of Li Ka-Shing in Hong Kong, BDMI of the Bertelsmann group in Germany, and Lanta Digital Ventures from Spain.