-

AVAX is in recovery as the crypto market bounces back.

-

Avalanche has a major summit coming up in March that could help drive the price past $100.

-

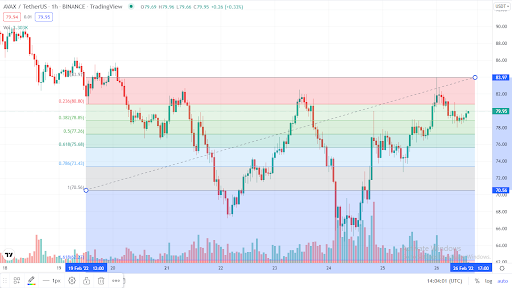

Avalanche is currently trading at a major resistance level.

Avalanche (AVAX) has been one of the best performing cryptocurrencies in the past week. While the broader market is in a sharp bullish reversal after a selloff earlier in the week, Avalanche is among those showing the most promise.

Avalanche has emerged as one of the platform blockchains best positioned to give Ethereum a run for its money. That’s because it has some of the lowest transaction fees in the platform blockchain space and is highly scalable. Avalanche has the capability to handle up to 4500 transactions per second.

Avalanche has also proven to be quite resilient, and so far has not experienced any network hacks that could destabilize it. Such performance capabilities and a good reputation make AVAX a potentially good cryptocurrency to buy in 2022.

The upcoming summit in Spain could uplift AVAX

While the broader crypto market is doing well at the moment, Avalanche has internal factors that could see it outperform the market in the coming month. One of these factors is the upcoming summit that will be held in Spain between March 22nd and March 27th, 2022.

The summit aims to bring together some of the most influential people in crypto and will discuss some of the hottest crypto topics today, including Web 3.0. Some of the key speakers that will make a speech at the summit include Emin Gun Sirer, the founder of Ava Labs, Harold Bosse, the Vice President of Innovation at MasterCard, Sergey Nazarov of Chainlink, and Monica Tather an El Salvador government official among many others.

The anticipation of the announcements that could come out of this summit could help propel Avalanche (AVAX), especially if the broader market remains bullish in March.

Should you buy Avalanche?

Source: TradingView

Source: TradingView

Avalanche has been on an uptrend for the last 48-hours. However, it seems to have hit strong resistance at $80.17 on the 61.8% Fibonacci.

If Avalanche breaks the $80.17 resistance, then prices above $100 could be tested ahead of the summit in Spain.

However, if it fails, especially due to downside pressure from the broader market, then prices below $70 could be retested in the short term.