VET is trading around $0.135 amid increased profit-taking and could see further losses short term

VeChain’s VET token rallied to a new all-time high of $0.149 on Saturday, before bears pushed the price back to the $0.135 region the following day.

The cryptocurrency has failed to gather momentum in intraday trades. The VET/USD pair is changing hands at just under 1% in the red, though weekly gains remain an impressive 45%.

A look at the technical picture for VET suggests that weakness has crept in after a major upside since early April. One of the core drivers of the positive outlook for the coin has been recent announcements of major partnerships.

But that seems to have subsided over the past 48 hours and could be the reason VeChain sees a pullback as investors look to cash in on the last rally.

VeChain price outlook

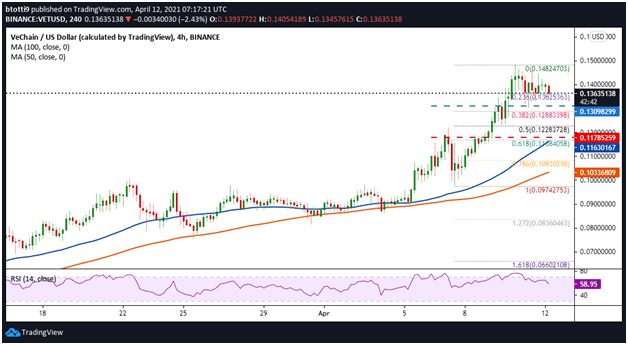

VET is poised just above the 23.6% Fibonacci retracement level corresponding to the move from $0.097 to $0.148. The red candle shows bears are intent on pushing lower, with a horizontal support line near the 38.2% Fib level at $0.128 a key target. If prices breach this cushion, the correction might extend to the 50 SMA ($0.116) and the 100 SMA ($0.103).

The 4-hour Relative Strength Index (RSI) is slipping lower. A reading of 58 with a negative divergence strengthens the possibility of further losses.

VET/USD will take on a bearish outlook if prices cross below the 50- and 100-period simple moving averages to touch $0.087.

Despite the profit-taking seen over the past three days, the MACD remains within the bullish zone to suggest buyers still hunger for more gains.

In this case, a rebound above the $0.140 price level will aid the push towards $0.145, with buy-side pressure likely to propel VET/USD to a new peak above $0.150. If sentiment across the crypto market starts to soar amid a spike for Bitcoin (BTC), expect VET to see a positive flip of its own. Likely targets in this scenario would be $0.160 and $0.20.