The Vermont Department of Financial Regulation has issued an order to cease and desist to California company LevelNet over alleged violations of the state’s securities laws, the regulator said on Monday.

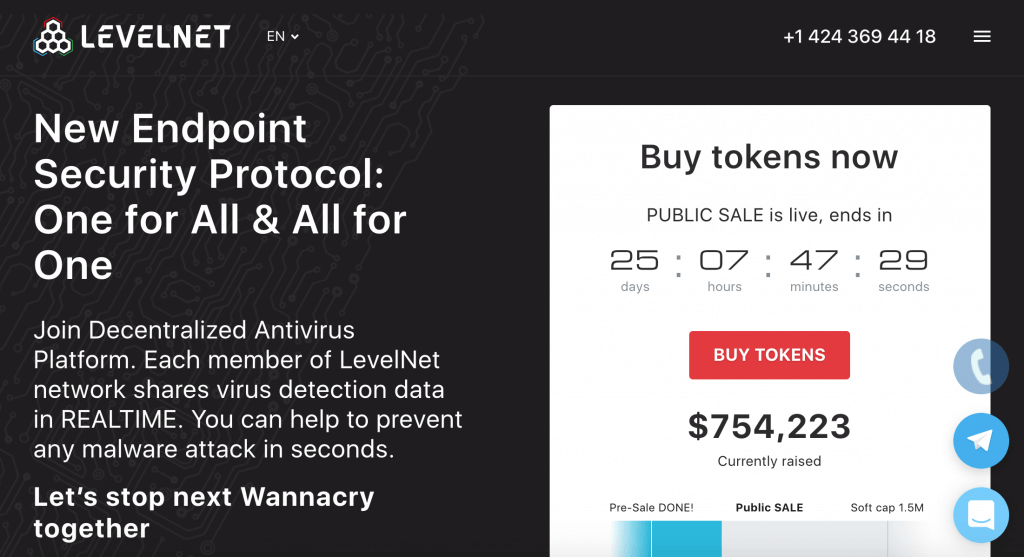

LevelNet is currently conducting an initial coin offering (ICO) to raise money from investors across the country in exchange for LevelNet tokens (LVL). An investigation by the Vermont Department of Financial Regulation determined that the company had been violating the state’s laws by “deceptively advertising unfounded and unrealistic investment returns and failing to properly register the investment.” The department ordered LevelNet to immediately stop advertising and selling in Vermont.

According to its website, LevelNet is developing a “decentralized antivirus platform” to be shared by members of its network. LevelNet’s advertising states that the platform will have rapid success that will result in returns for project investors. It projects that it “will reach one hundred million users by 2021, with over US$200 million in sales and over US$80 millions of free cash flows for distribution to shareholders.”

“The rapid rise of Bitcoin has made Main Street investors aware and interested in cryptocurrencies and ICOs,” said commissioner of the Vermont Department of Financial Regulation, Michael Pieciak. “Although many are legitimate offerings that are fully compliant with law – many are not – and this order serves as a good reminder to exercise caution when considering investing in these products.”

The shut down of the LevelNet token sale in Vermont comes at a time of increased regulatory scrutiny of cryptocurrencies and ICOs in North America.

Regulators from 40 jurisdictions through North America, including Vermont, participated in Operation Cryptosweep which to date has resulted in nearly 70 inquiries and investigations and 35 pending or completed enforcement actions related to ICOs or cryptocurrencies since the beginning of May.

ICOs have raised over US$9.5 billion in funding in just the first half of 2018, according to CoinSchedule, already surpassing last year’s figure.

The largest ICO campaign ever, Block.one, was closed last week, raising more than US$4 billion over the course of the year. Block.one is developing a blockchain platform called eos.ios which promises to support more efficient operations for decentralized applications (DApps).