The leading cryptocurrency posted a massive slump over the weekend after enjoying an impressive rally

Bitcoin touched an all-time high north of $41,000 before sharply retracting to around $35,000 today. The correction raised several questions among retail crypto investors as they tried to figure out their next move. Fearing that the parabolic rally was coming to an end, many have withdrawn their investments.

The thought of incurring more losses has driven many small traders and investors to let go of their market positions. However, a key group of investors has gone against this play even as the asset continues bleeding value. Contrary to weak hands, whales have moved to acquire more of the asset during this decline period.

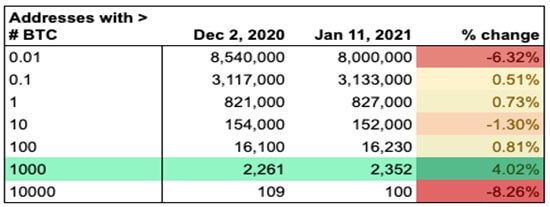

Elias Simos of Bison Trails reported that addresses holding more than 1,000 BTC are increasing, backing Santiment’s previous findings published at the end of last year. The uptrend in the number of ‘whales’ has persisted so far this month. The independent researcher noted that wallets with over 1,000 bitcoins (the equivalent of $350 million at the current BTC/USD price) have been steadily rising.

Addresses with more than 1K $BTC continue growing at the expense of all others–even as this most recent downturn is taking effect. “While you were selling, whales were gobbling up your Bitcoin,” he wrote.

Crypto addresses with varying amounts of BTC. Source: Twitter

Crypto analyst Lark Davis has warned that the whales may gobble up small investors. Davis pointed out that whales are good at influencing the market through sly schemes, and they have the financial backing to do so.

“There are very rich and very powerful players in this market who are very good at manipulating the market. They’re good at playing the game, right? And they play the game with billions of dollars in capital at a time”, he said. “They shake the market with massive selloffs while at the same time shorting the market. Then, when the market’s down, they take your Bitcoin that you panic sold after a 10% drop. Rinse and repeat. Rinse and repeat. Gaining more Bitcoin, adding to their positions”.

He asked crypto investors to be careful when making plays in the market to avoid becoming ‘whale food.’