The crypto market pushed upwards again yesterday, and Aave is leading the charge today with a 16% rally

Yesterday’s crypto rally seems to have stalled a little today, but Aave has carried through strong upside momentum with a 16% rally today. The DeFi token is now at its highest price in a month—$353.17—and looks poised to climb higher as we head into the weekend.

To learn more about Aave and to find the best places to buy AAVE today, keep on reading. We’ve got you covered.

How & where to buy Aave in the UK and elsewhere

We’ve suggested two crypto broker and exchange platforms here, so you can start trading today. Both platforms are fully regulated and licensed, meaning that your investment is protected in the event of a hack, scam, or another type of attack. Simply join up and fund your account to begin trading.

Try to avoid decentralised exchanges (DEXs) if you can, as these sites are usually unlicensed. This could expose you to extra risks, such as those posed by bad actors. You would be unprotected in the event of something going wrong.

What is Aave?

Aave is a decentralised finance (DeFi) protocol built on the Ethereum blockchain. Originally named EthLend, Aave is one of the original set of DeFi platforms and has cemented itself as one of the most popular. The protocol allows users to borrow and lend crypto in a peer-to-peer manner: borrowers deposit collateral into a smart contract and get instant access to capital, whereas lenders deposit their idle coins and receive interest payments on them from borrowers.

Aave is now a fixture in the top 30 cryptos, with a market cap of nearly $4.7 billion. The protocol has $12,347,186,467 total value locked (TVL), demonstrating clearly the popularity of Aave.

Should I buy AAVE today?

As a long-term investment, Aave is arguably one of the most popular and exciting prospects on the market. Interest in DeFi is growing deeper every day, with asset managers such as BitWise and GrayScale continually developing new DeFi funds. BitWise just this week launched an Aave fund, which could provide a platform for further gains to be recorded.

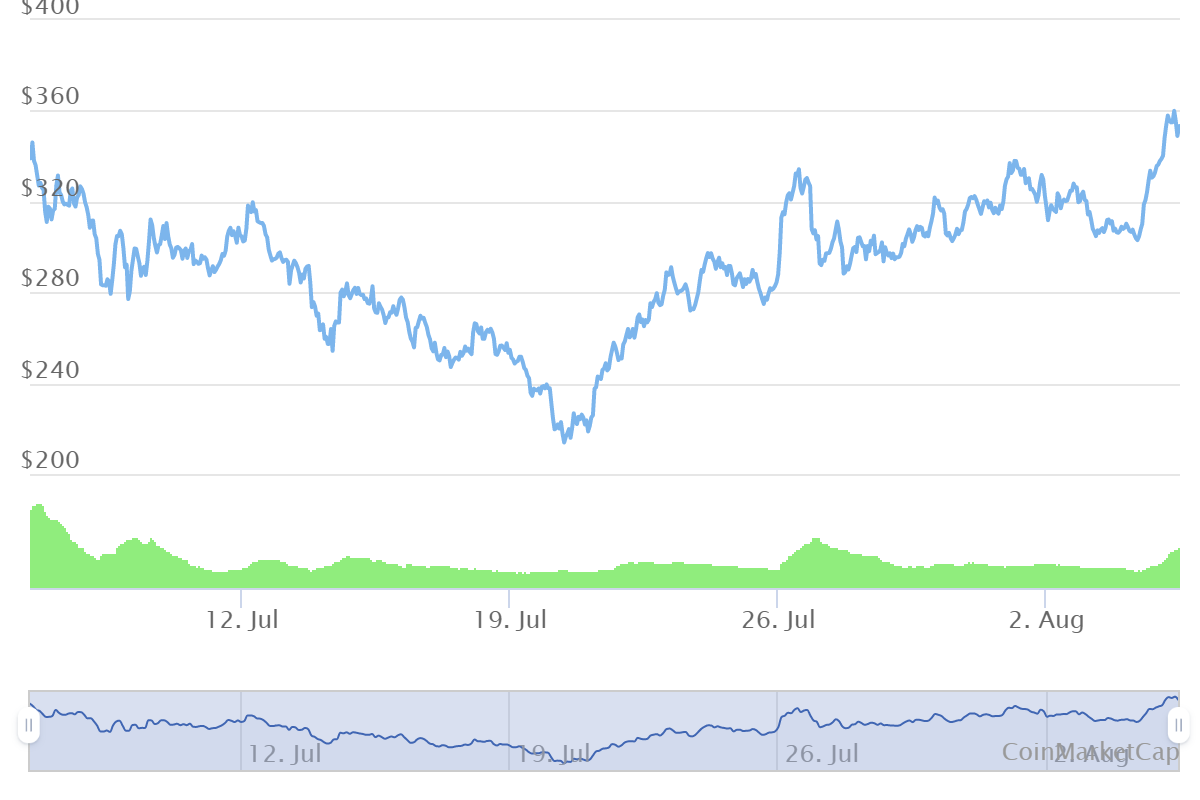

Aave 1-month price chart. Source: CoinMarketCap

AAVE’s 1-month chart points to the continuation of a trend reversal that began towards the end of July. A clear bottom appears to have been formed, after which a recovery began, and strong monthly resistance levels in the $320-$330 region appear to have been broken now. With new monthly highs set today, Aave could have the fuel to move higher.