Buy the rumour, sell the news.

The Ethereum Merge was completed without a hitch, but prices in the immediate aftermath have disappointed investors. I dive in quickly here to take a temperature check on all things on-chain.

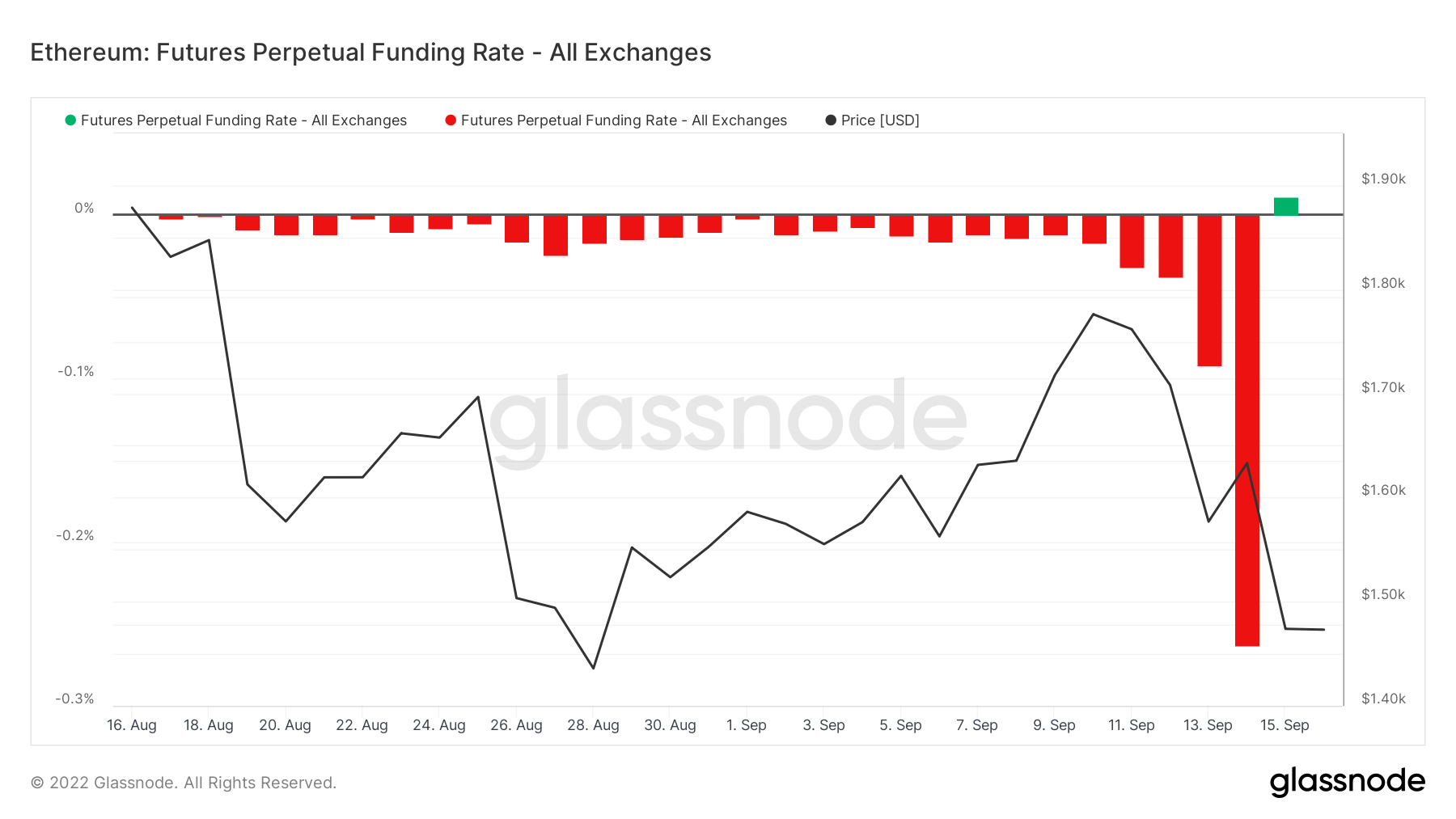

Funding rate turns positive

In the run-up to the Merge, funding rates on Ethereum hit all-time lows. This caused headlines but was to be expected. With holders of Ethereum receiving an ETH PoW token, it meant investors moved to long spot ETH and short futures in order to receive the token while removing price exposure.

Given this was an apparent arbitrage opportunity, the laws of simple market dynamics dictate that the funding rate has to come down to reflect the outsized number of investors shorting ETH futures into the Merge in order to long spot and receive the ETH PoW token.

Post-Merge, the all-time low funding rates have now reverted to normal levels – and even turned slightly positive. So, nothing to see here and normal service resumed.

Why did Ethereum fall post-Merge?

Why did Ethereum fall post-Merge?

As I ate my breakfast Wednesday morning (toast and a croissant with honey), Ethereum completed its Merge – at block 15,337,393, to be precise.

The price of ETH traded at around $1,598 and jumped slightly to $1,620, a rise of 1.4%. However, it then pulled back and as I write this over my breakfast on Friday morning (this time oats and blueberries) ETH is trading at $1,470, 8% below the level of the Merge.

And so, the Merge turned out to be a classic sell-the-news event. Given Bitcoin is only trading 2% below the level it was at as the Merge completed, there does seem to be some underperformance from ETH.

Options also give a hint at the bearish sentiment. There was a volatility smile with a bearish divergence visible in the run-up to the ETH. This means that when the strike price was plotted against implied volatility, there was greater implied volatility (of over 100%) at lower strike prices – showing traders were betting on a sell-the-news scenario.

Looking at options open interest by strike price, there were also more puts than calls – meaning traders were betting on the price falling rather than rising.

Federal Reserve will ultimately dictate price

Of course, all this will be overshadowed by the key Federal Reserve meeting being held on September 20th and 21st, when the Fed is expected to announce another substantial rate hike following the disappointing inflation reading this week.

Nonetheless, it hammers home the point that simply because there is a large event in the pipeline does not mean the price will rise. It’s an absolutely classic example of a buy-the-rumour, sell-the-news event, one we see in the stock market all the time.

Having said that, in terms of Ethereum’s long-term future, the Merge is now in the past and it went by smoothly. It’s a huge achievement and very bullish for Ethereum overall. Jerome Powell and the economy just need to cooperate now!