Leading cryptocurrencies bitcoin, ethereum, litecoin and ripple have made people very rich within a very short time. Ripple for instance shot up by more than 41,000% in 2017 and Neo by more than 83,000% in the same year.

The market leader bitcoin also made astronomical gains in the past year selling at close to $20,000moner in November a unit from just $1000 at the start of the year. Many people naturally feel left out and that’s why there is a mad rush for cryptocurrencies right now.

How to Make Money out of Cryptocurrencies in 2018

No need to worry if you haven’t invested in cryptocurrencies yet; there is still enough room to make some good money if the trend continues in 2018. You just need to be strategic at how you invest.

Bitcoin is now way too expensive and its stellar run this year seems to have come to a stop. It’s value has been oscillating between $13,000 and $15,000 for several weeks now.

Meanwhile, alternate currencies or altcoins as they are called have been making daily gains of up to 80%.

This is exactly where you should put your money in 2018. Your success rate will depend on which coins you choose to invest in. There is a massive 1426 cryptocurrencies currently in the market. Most of these are outright frauds out to make quick money out of the craze.

Consider these factors when choosing a coin to invest in. You might just ride the wave in 2018.

Price

How is the cryptocurrency priced? Buying cryptocurrencies going for less than a dollar is a good idea. Ripple was selling with a couple of decimals per unit but it is now trading at around $2.

Cryptocurrencies selling for less than a dollar create the illusion of being cheap and are more likely attract many people who have little to spend. These have the real possibility of multiplying very fast. If you need some inspiration, look at ripple which has gone up more than 500 times in under one year.

Cryptocurrency Potential

What problem does the cryptocurrency seeks to solve? Does it have the potential to enter the mainstream? What is its unique proposition? These are just some of the questions you should answer when choosing where to invest your hard earned money.

Ripple for example is being tested by banks as a potential replacement for the antiquated SWIFT system. It could cut transaction costs by more than 60% if adopted by financial institutions. Because of this XRP has real utility and its value can grow exponentially if adopted.

Online Forums

Popular sentiment plays an important role in determining the value of an asset. Be sure to visit online forums like Reddit to gauge the sentiment towards a given cryptocurrency. The buzz, however little, might just be the fuel that drives little known cryptos to new highs.

Supply

How is the supply like? A cryptocurrency with a total circulating supply closer to its total cap is more likely to rise in value as investors scramble for the few remaining coins.

Trends

Check the charts to see the trends. An upward momentum is good sign. Remember this is a highly speculative market. More people are going to jump in the ship when an asset’s value is rapidly appreciating, driving its value further up.

Who is behind it: Check who is behind the cryptocurrency you want to invest in. Do they have a successful industry experience? Is the technical team solid enough?

2018 could just be the year we are going to see 20x gains especially in the alts. Here are the altcoins you should watch closely in 2018 based on our analysis above;

1. Neo (NEO)

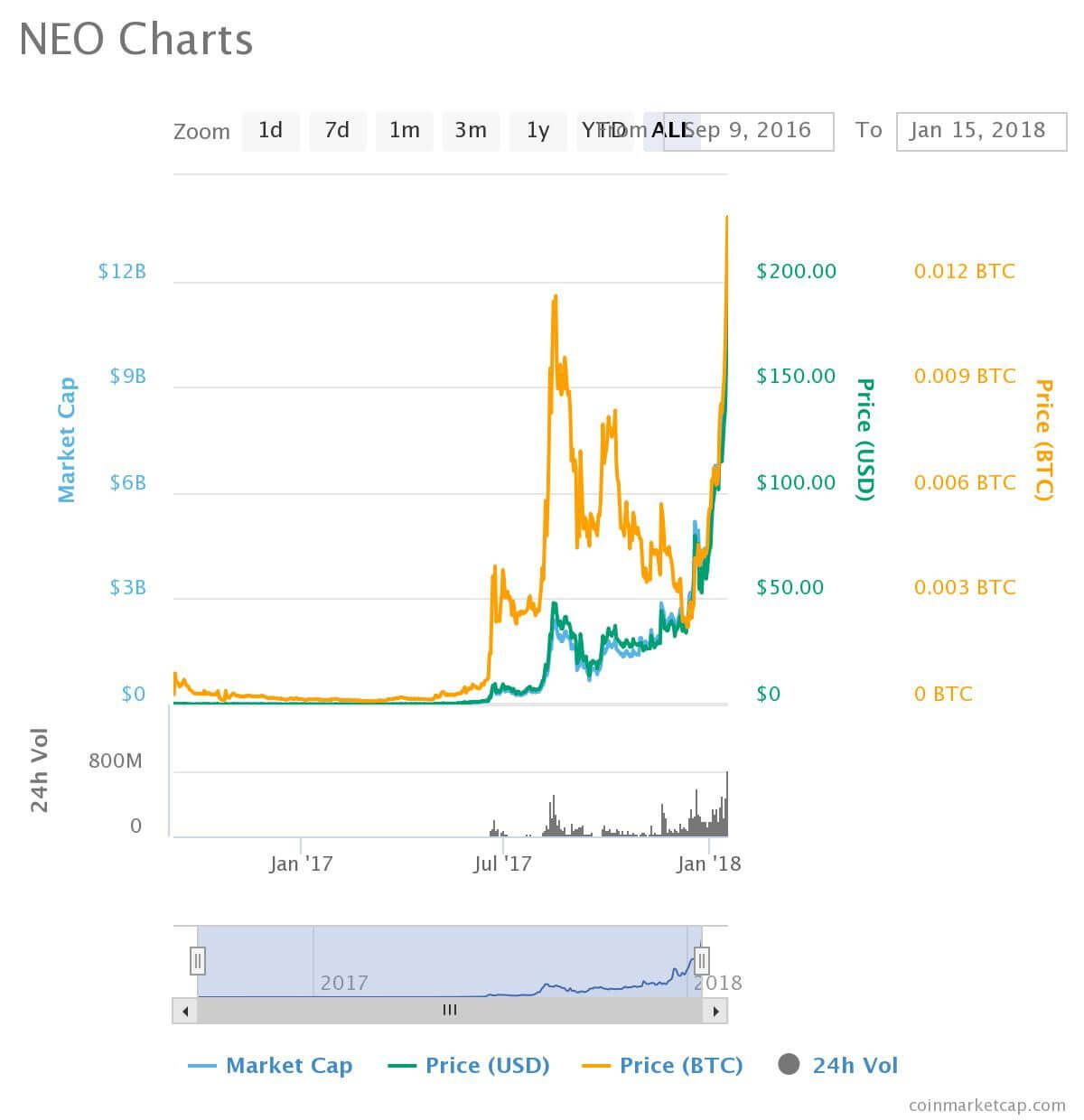

This cryptocurrency climbed $83,570% in 2017 and it keeps going. Even on the most gloomy of days, Neo has almost always maintained its momentum. This cryptocurrency was created by Da Hongfei of Onchain and Erik Zhang.

Neo is sometimes referred to as the ethereum of China although it still has a lot of catch up to do in terms of market capitalisation. It is fast closing the gap however and currently stands at $10.5b in market cap.

The coins are capped at 100m with a circulating supply of about 65m so far.

2. Monero (XMR)

Monero is a privacy focussed cryptocurrency. Transaction details such as the sender and receiver as well as the size are inaccessible on this network. Some have observed that this complete anonymity makes it a cryptocurrency of choice for criminals, a fact which Monero founders have vehemently denied.

Hackers for example demanded to be paid in Monero in the Wannacry ransom ware incident of 2017. Founders and supporters however argue that there are many legal use case scenarios.

Famous musicians and celebrities like Dolly Parton are already accepting Monero payments for their perfomances.

About 15.5 million coins are in supply. There is no supply limit.

3. Cardano (ADA)

Cardano has more than $20b in market cap and rose more than 3300% in 2017. Although it was launched recently, its coin called Ada quickly surged to become one of the top ten cryptocurrencies. There is a strong team behind the project and boasts of having a “scientific philosophy” behind it.

Cardano is doing well especially with private transactions and is designed to meet the needs of regulators. Cardano has already proven itself in the market even though it is just starting out. It’s framework is set to be updated to fully integrate smart contracts somewhere in the middle of the year according to the founders.

Just over half of the 45 billion coins are already in circulation.

4. Ripple (XRP)

Ripple is probably the most remarkable coin in the past one year. From near insignificance the coin has appreciated 41,000%. Obviously, it has made many people rich in the process.

Large financial institutions have taken notice and dozens are already testing it. If successful, it could replace the old SWIFT system used for banks transfers.

You might think ripple has already reached its peak in terms of value. But you might be mistaken. If the tests are successful, ripple could cut transaction costs by a massive 60%.

Moneygram, Bank of America are just of the organisations testing the network. Ripple could literally explode any time if there is a positive announcement. All indications are that it meets the cut.

Ripple’s technology has already been licensed to over 100 banks as we speak.

XRP’s are capped at 100 billion and there is a circulating supply of about 39 billion.

5. IOTA (MIOTA)

IOTA uses a distributed ledger technology called the tangle. It was the first cryptocurrency not to use the blockchain technology. There are no miner, no trading fees and no blocks. Your processing power is instead used when making transactions.

Everyone who makes a transaction is therefore a miner. This radical approach which allows for much faster transactions is what catapulted MIOTA to one of the largest cryptocurrencies right now. There is word about a partnership with Microsoft which could see its value skyrocket.

There are currently about 2.8 billion MIOTA in circulation and the possibility for scalability is infinite.

6. Bitcoin Cash (BCH)

Bitcoin cash was forked from the bitcoin blockchain ledger and is now controlled by independent teams of developers. The developers were keen to solve the problem of slow transactions and high transaction fees in the bitcoin network.

Since July when it was created, bitcoin cash has gone up 623%. Bitcoin cash seems to be doing well so far but it will need to do more to convince businesses to adopt it and miners to validate the transactions.

Just like bitcoin, it has a maximum supply of 21 million coins with about 17 million currently in circulation.