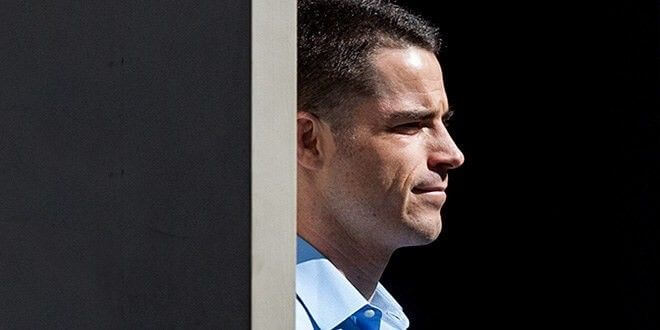

Roger Ver has been a central Bitcoin personality for more than seven years. The early Bitcoin investors made millions as his hefty BTC stash grew thousands of times in value. An entrepreneur of mixed success prior, his incredible cryptocurrency returns made him one of the world’s most successful investors, based upon return on investment (ROI) alone. Then, Ver splintered the Bitcoin blockchain world wide open by backing upstart Bitcoin fork Bitcoin Cash, calling it the “real Bitcoin”.

In the year since the Bitcoin split, Ver hasn’t changed his tune. To him, Bitcoin Cash is the manifestation of Satoshi Nakamoto’s original vision for Bitcoin. And though Bitcoin Cash never overtook Bitcoin in value, transactions, or trading volume, BCH is still widely used.

At press time, Bitcoin Cash is the #4 most valuable cryptocurrency in the world. Bitcoin, obviously, is #1. Roger Ver owns a lot of both (All Bitcoin owners got 1 BCH for every BTC they owned at the time of the Bitcoin Cash fork). Why is he still so committed to the success of Bitcoin Cash? While some believe he’s just doing it for personal gain, and the potential control of the Bitcoin network, we’ll take his claims at face value, at least for the purposes of this post.

Roger Ver’s Argument for Bitcoin Cash

Roger Ver’s argument to buy Bitcoin Cash was most convincing when BCH was brand new. At that time, Bitcoin was slow and expensive. Transactions were stuck in the Bitcoin mempool (the complete collection of unconfirmed transactions) by the hundreds of thousands and often went unconfirmed for days or even weeks. Bitcoin transaction fees had leapt above $10 apiece, and often went much higher.

At this time in history, Bitcoin seemed to be on the verge of collapse. And in fact, on June 20th of last year Bitcoin plummeted in value while Bitcoin Cash soared. Those watching at the time will be remembering the fear that Bitcoin might really be doomed.

And then it recovered.

Since then, Bitcoin reached a new all-time high price, then crashed in value along with everything else in the market. And here we are today.

Bitcoin Cash is still moderately cheaper to use and may be faster during times of high stress in the Bitcoin network. Bitcoin Cash’s variable block sizes enable it to react to network clogs by taking on more transactions, while Bitcoin’s rate is set in stone. Nonetheless, Bitcoin Cash is not significantly faster than Bitcoin (its 2-digit per second transaction rates aren’t the thousands necessary for true blockchain scaling). Nor is Bitcoin Cash as cheap to use as a network like EOS or Ripple, though cheaper than Bitcoin it certainly is.

In late 2018, there seems to be no strong argument that would make Bitcoin Cash inherently more valuable than Bitcoin. In fact, any argument made against Bitcoin could be made just as easily against Bitcoin Cash. Centralization, Chinese interference, and poor scaling solutions continue to plague both platforms.

With forks of its own coming up in November, Bitcoin Cash doesn’t seem well positioned to take over for Bitcoin anytime soon. Its success or failure likely will not be determined for quite some time to come.

(*Information in this article should not be taken as investment advice.)

Featured image source: Pixabay