YFI/USD has dropped 50% over the past seven days and nearly 20% in 24 hours

Yearn.finance surged to highs of $44,000, blasting past Bitcoin to trade around $12,500 at the time. This was on the back of a DeFi boom that materialised so suddenly, it pushed several Ethereum-based tokens to new all-time highs.

However, the beginning of October has proved to be hard-hitting for YFI and most other governance tokens in the DeFi space. As we noted previously, the YFI/USD pair is among the tokens to have lost an average of 60% of its value since August and early September.

Despite this, an analyst has predicted that the uncertainty in the broader market, combined with the likely setbacks caused by bad news, could see yearn.finance token dump even further.

YFI/USD is looking very bearish

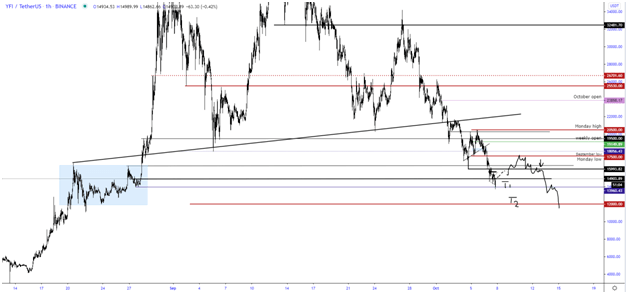

The last three days have seen YFI/USD print a succession of red candles, with the lower highs and lower lows suggesting an already dire outlook.

According to analyst TraderSZ, the token is set to slip to lows of $12,000. The trader previously charted yearn.finance’s price trajectory and forecast its plunge below $14,000.

In the chart below, TraderSZ noted that YFI/USD’s leg down was highly likely after a heavy sell-off pushed it under $20,500. This price level formed Monday’s peak, with bears pushing bulls to lows of $17,500. After that, sellers established a strong advantage by finding support at $14,000, with the expected trigger for an upside at $13,900 also crumbling.

As of writing, YFI is just above the psychological support level above $12,000. The token has dumped more than 20% in the past 24 hours and is nearly 50% down since its weekly open.

With intraday action printing extended red candles, a flip lower to $12K looks ominously possible.

Looking at the charts, the YFI/USD pair is trading below the 10-day and 50-day moving averages to suggest bears have the upper hand. This bearish outlook is strengthened by the MACD and the RSI (extending south) on the 4-hour chart.

Although it could correct to lows of $11K, moves on the upside could still happen short term if bulls hold $12,000 and retake prices above $13,900. Triggering an upside correction at this level could see buyers aim for September lows around $17,500.