Key Takeaways

- FTX crash has left $8 billion hole on its balance sheet, with customers of the exchange footing the bill

- FTX reportedly sent client assets to sister company Alameda as investments at the trading firm turned sour

- Wealth destroyed in Terra crash in May remains the largest in crypto history, with over $18 billion in the collapsed stablecoin UST

LUNA was also worth $30 billion on eve of crisis, before spiralling to zero - Mt Gox crash of 2014 represents the most existential threat to crypto, however, when the exchange handling 70% of Bitcoin volume abruptly filed for bankruptcy

- The 850,000 bitcoins lost amounted to 7% of supply at the time

- The lost Bitcoin would have been worth $16.6 billion today

The past week has been devastating for cryptocurrency investors. Yet again, they are forced to pick up the pieces following another enormous scandal.

This time round, one the largest crypto exchanges in the world is insolvent. But how does the FTX crash compare to others in the space? Coinjournal.net looked at the data to see if this is the most devastating crash that crypto has ever seen.

What happened at FTX?

The FTX exchange toppled due to its tangled relationship with its sister trading firm, Alameda Research. Both companies were founded by Sam Bankman-Fried, who arguably had become a golden boy of crypto. Speaking before Congress recently regarding regulation, Bankman-Fried’s fall from grace has been spectacular.

Alameda reportedly took out a series of loans, for investments that included quantitative trades as well as venture capital. With the market crashing this year, those investments went south. Due to plummeting prices and a complete lack of risk management, Alameda were in trouble when lenders moved to recall the loans.

Alameda couldn’t pay back the lenders. While the details are yet to be confirmed, it appears that Bankman-Fried used customer funds at FTX to foot the bill. Fast forward to today, and there appears to be an $8 billion shortfall.

Although the damage will spread out far and wide, we are taking this $8 billion figure as the crash number, as this is what customers directly lost. Hence we are overlooking the other firms which invariably got caught up in this mess, not to mention the loss in value of FTX as a company, which was only recently valued at $32 billion.

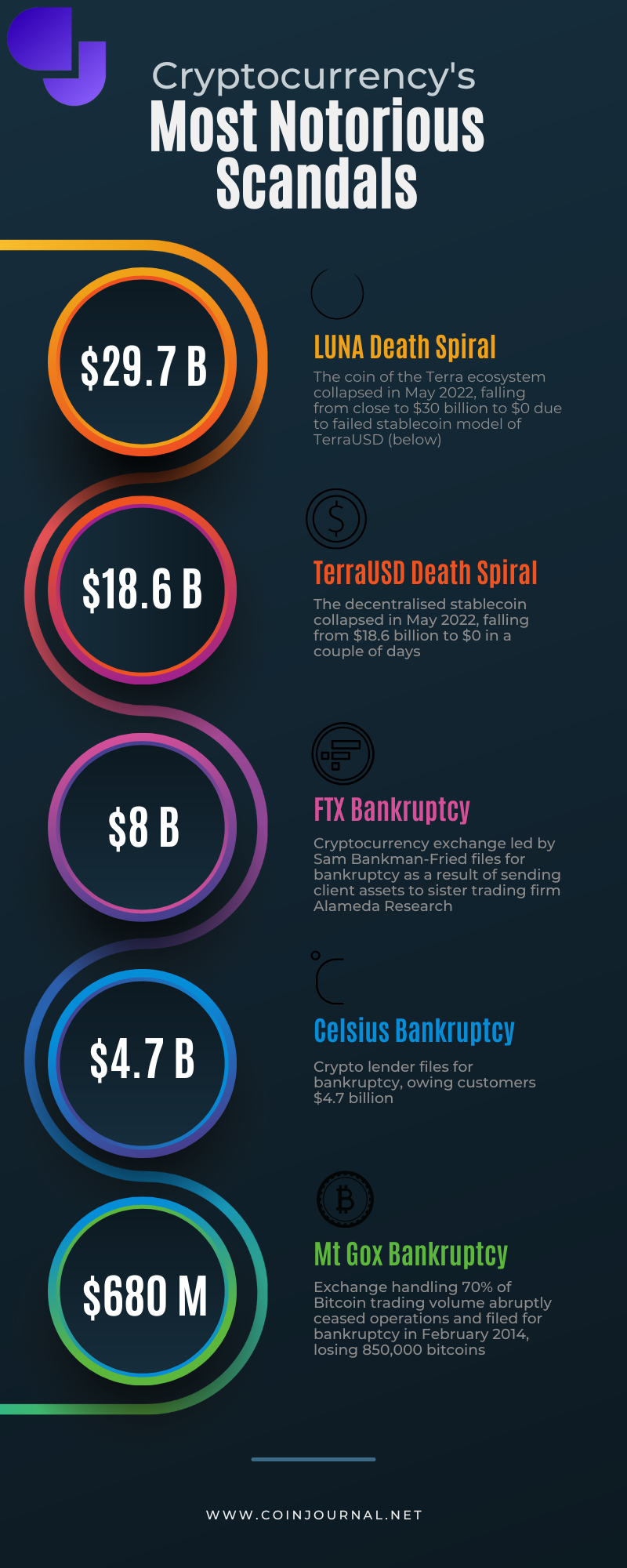

The below is how this compares to previous crashes:

Luna remains crypto’s darkest day

Despite the scarcely believable damage caused by Bankman-Fried, the FTX incident still pales in comparison to the Luna crash earlier this year. In the above chart, we have presented the LUNA death spiral next to the accompanying stablecoin TerraUSD.

“FTX’s insolvency is yet another body blow for the crypto industry. However, in terms of wealth destruction, the Terra crisis remains the worst crash the space has seen”, said Max Coupland, Director of CoinJournal.

“In a certain respect, it may have even contributed to the FTX crash, as reports suggest Alameda’s liquidity issues stem from losses suffered in the aftermath of the Terra debacle”.

While there are a number of ways to assess the amount of wealth lost in the crashes, no matter what way you swing it, the Luna crash destroyed more wealth. The UST stablecoin was worth $18.6 billion on the eve of the meltdown, with many using it as a quasi-bank account. They lost everything, with the stablecoin melting down to zero.

The sister coin Luna also death spiralled to zero, worth close to $30 billion before the crisis.

Perhaps looking at Bitcoin’s reaction to the crises is the best way to gauge how damaging each was. Bitcoin plummeted from $40,000 to $29,000 in the immediate aftermath of the UST collapse, before falling further to $19,000 as news came out about Celsius and other firms who had been caught up in the contagion.

While the market is still reverberating in the wake of the FTX crash, Bitcoin has fallen less, from $19,500 to $16,500. Although, again, it remains early days.

Voyager Digital & Celsius

The scale of the damage caused by Terra was so large that it pulled down several other firms with it. While the number of insolvencies the scandal caused are too numerous to list, perhaps the most infamous are those of Celsius and Voyager Digital.

Voyager Digital owes $1.3 billion to over 100,000 creditors, however even that is dwarfed by Celsius’ bill. The once-high flying firm, led by ex-CEO Alex Mashinsky, filed for bankruptcy with $4.7 billion owed – with creditors also above 100,000.

Less than 24 hours after assuring investors that Celsius was OK (including the below tweet), Mashinsky shut withdrawals down.

https://twitter.com/mashinsky/status/1535767334668861440

There were more firms in this category, but we have not included them in our above analysis. Although it is worth mentioning Three Arrows Capital, the hedge fund which went under in the aftermath of the Luna crisis, owing $3.5 billion. While customers were burned here too, the bulk of this does seem to be institutional cash, however, and therefore we have placed it below the other collapses – including the final one in the next section.

MT Gox the most existential crisis

The other massive scandal which cost customers dearly is that of Mt Gox. This refers to the exchange which abruptly ceased operations in 2014 and filed for bankruptcy protection, with zero prior warning – much like FTX. 850,000 bitcoins were lost (although 200,000 were later found).

At the time, this amounted to less than $700 million worth of bitcoin.

While this pales in comparison to the numbers above – it even ranks below Voyager Digital, who did not make the infographic – it remains the biggest existential threat that Bitcoin has endured and hence it cannot be emphasised enough how damaging it was.

This was 2014, when each bitcoin was trading at around $800 per coin. Mt Gox was processing over 70% of Bitcoin trading volume. Hence, the crash threw up genuine questions about whether Bitcoin would even survive.

The lost 850,000 coins was 7% of the total supply at that point. At the $19,500 price when FTX imploded, it would have represented $16.6 billion (or $14.2 billion at today’s prices). With court proceedings still ongoing eight years later (200,000 bitcoins were later found), customers have yet to see a single cent. This context shows quite how devastating it was for the industry, at a time when Bitcoin was nothing but a niche asset on the Internet.

Final thoughts

The FTX saga is a crippling blow for the cryptocurrency industry. While the dominoes are still falling, it nonetheless appears unlikely that the wealth destroyed will eclipse that of Terra.

In terms of how much of a threat it was to the entire landscape, Mt Gox retains the crown as the scariest day in Bitcoin history, as there were tangible concerns whether the cryptocurrency would even survive.

Yet, one question that remains to be asked is which was most hurtful to the industry’s reputation.

With crypto now firmly in the mainstream, Sam Bankman’s face is plastered across publications and news channels across the world, while the fact this crisis comes so soon after the Terra crash is an even greater source of embarassment for the industry.

In that context, even Terra and Mt Gox didn’t cause this much damage.

If you use our data, then we would appreciate a link back to https://coinjournal.net/. Crediting our work with a link helps us to keep providing you with data research.