10 Best Crypto Exchanges for Day Trading in 2025

Not all cryptocurrency exchanges are created equally. Some are made for buy-and-hold investors, while others are made for trading purists. Our guide focuses on the best crypto exchange for day trading because these volatility chasers need facilities that are unavailable on some exchanges.

In this guide, we explore the crypto day trading exchanges that provide a suitable environment for trading and touch on some day trading rules and strategies for increasing your likelihood of success (or at least reducing your risk of loss).

Best Crypto Exchanges for Day Trading - Our Top 3 Picks

Looking for a quick answer? Here are our top 3 crypto exchanges for day trading.

The Best Crypto Exchanges for Day Trading - Key Metrics

Top Crypto Exchanges for Day Trading - What Makes Them the Best?

Best Crypto Exchanges Reviewed

Best Crypto Exchanges for Day Trading

1. eToro – Best Overall Exchange for Day Trading

2. Binance – Best Crypto Exchange for Day Trading with Futures Contracts

3. Skilling – Best Crypto Exchange for Day Trading Purists

4. Bitstamp – Most Secure Crypto Exchange for Day Trading

5. OKX – Best Integrated Crypto Exchange for Day Trading

6. Coinbase – Simplest Crypto Exchange for Day Trading

7. Capital.com – Best Crypto Exchange for Day Trading Crypto CFDs

8. Bitpanda – Best Crypto Exchange for Day Trading Crypto Indices

9. Uphold – Best Day Trading Crypto Exchange for Casual Users

10. YouHodler – Best Crypto Exchange for Non-Day Traders

Best Crypto Exchanges for Day Trading Compared

|

Exchange |

Fees |

Coins |

Regulation |

|

eToro |

1% |

63+ |

FCA, CySEC, AFSL |

|

Binance |

0.10% |

600+ |

AMF |

|

Skilling |

Dynamic |

55+ |

CySEC |

|

Bitstamp |

0.5% |

75+ |

CSSF |

|

OKX |

0.1% |

343+ |

VARA |

|

Coinbase |

1% |

193+ |

FCA |

|

Capital.com |

Dynamic |

400+ |

FCA, CySEC, ASIC |

|

Bitpanda |

0.025% – 2% |

170+ |

FMA, AMF, Czech Trade Authority |

|

Uphold |

0.8% – 1.8% |

250+ |

FinCEN, FCA |

|

YouHolder |

Dynamic |

51+ |

FINMA, ESFS |

What is Crypto Day Trading?

Crypto day trading involves buying and selling crypto coins, contracts, or derivatives within the best time to trade crypto over the span of 24 hours. The trades executed are opened and closed within one trading day.

Day trading strategies generally leverage market volatility to make tiny profits frequently, and the rules are not different for crypto. Day traders depend on crypto’s volatility to make profit; however, this volatility is often small and yields tiny profits.

Therefore day trading is a numbers game. The more trades you can execute, the higher your chances of making a decent daily profit when the outcomes of all trades are summed.

Usually, you’ll see day traders opening several trades within a 24-hour period hoping to make as many small gains from each one as they can.

What Fees are Involved?

The major fee to look out for when day trading is your broker’s trading fees which could be charged as a commission, spread, or both. While broker trading fees may seem small to the ordinary investor, tiny pip or (percentage) differences could easily accumulate to a significant bill given the number of daily transactions an average day trader makes.

Usually, day traders go for crypto exchanges with minimal fees. Some traders choose brokers who charge commissions and use raw spreads as every little percentage counts when it comes to day trading.

The next set of fees for day traders to look out for are financing fees, which depend on your exchange and payment provider(s). These fees include deposit, withdrawal, account maintenance, software licensing and the like.

Depending on how frequently you deposit and withdraw funds, financing fees can accumulate and eat into your day trading capital, so ensure that you are comfortable with them and you plan your cash movements.

What is the Best Crypto for Day Trading?

There is no one best crypto for day trading. Instead, there are factors that make certain cryptos more suitable than others for crypto day trading strategies.

The most prominent is trading volume. The best crypto exchanges for day trading have sufficient daily volumes to allow crypto traders to enter and exit positions successfully. A high volume also indicates enough liquidity to open positions without moving the market.

For example, crypto market data suggests that it takes about $80 million to move Bitcoin’s price by 1%. This is a good thing as day traders know that a $500,000 day trade will not affect the natural progression of the market.

The next is the crypto’s ability to range or trend. While this usually comes with high volatility, cryptos that either trade within a sideways channel or move significantly up or down, especially on lower time frames, are better for day trading.

Crypto Day Trading Strategies

Ready to start day trading? Here are some cryptocurrency day trading strategies you can try out.

News Trading

News trading involves anticipating how the market will react to certain news reports and events and trading accordingly. Some of these news events are periodic and can be planned for, like inflation reports and interest rate policy announcements.

The first question to ask when using this strategy is how a certain turn of events will affect the market. For example, will an interest rate increase affect crypto prices positively or negatively?

Then, carry out some research to see where the market is leaning. This is usually reflected in charts, but you can never be too sure.

Next, ask if the market has already priced in the news. An opportunity opens if the market has not fully priced the news in its valuations.

Range Trading

Range trading is a simple trading strategy, especially for day traders, that involves marking out the highest and lowest price range a crypto can get to within a certain period (ideally a day) and trading according to that on crypto exchanges.

You’ll need to carry out research and use indicators like the Average True Range to achieve this. Because you’re trading on a small time frame, price action will usually fluctuate between the high and low points.

However, this strategy only works on a range-bound or sideways market, not a trending one.

Mean Reversion Trading

Mean reversion trading works on the principle that a security’s price action will always revert to its historical mean no matter how high or low it rises or falls. Your job as a trader is to find out where that mean is and when the market is about to reverse.

It’s important to do your analysis on a small enough time frame that the reversion happens within a trading day. You may not use this strategy every day as price action may not revert within a trading session.

Money Flow Trading

Money flow trading involves using the Money Flow Index indicator to gauge the amount of money flowing into and out of crypto. This helps you predict whether a price increase or decrease is incoming.

Usually, an increase in inflow precedes an uptrend while a decrease precedes a downtrend.

Crypto Day Trading Rules

Stick to Lower Time Frames

Because you’re looking to close your trades within one trading session, you should stick to lower time frames. If you’ve chosen the right crypto, you should still have enough volatility and volume on smaller time frames to make a profit. Stick to time frames from 5m to 1h (5 minutes to 1 hour).

Watch the News

News releases can upend the ongoing market trend. Unless you plan to use the news trading strategy, it’s best to stay away from the market on days that major reports are released.

Use Technical Analysis

When trading on small time frames, you rely heavily on technical analysis. Get familiar with indicators and chart patterns. Also, don’t get pulled into the trend of filling up your screen with confusing lines and unnecessary indicators, two or three good ones are fine.

Chase Volatility

Volatility, in many ways, determines how much you can possibly make. Cryptos that aren’t volatile don’t provide profitable opportunities for day traders. You can measure volatility using an indicator called Bollinger Bands.

Use Screeners

Day traders aren’t worried about fundamentals. They don’t care about crypto’s legitimacy, or whether its tokenomics is sound. As such, they have a lot more options which could be overwhelming.

Learn to use crypto screeners to narrow in on coins that meet predefined criteria i.e., are ready for day trading.

How to Day Trade on Crypto Day Trading Platforms- Step-by-Step Tutorial

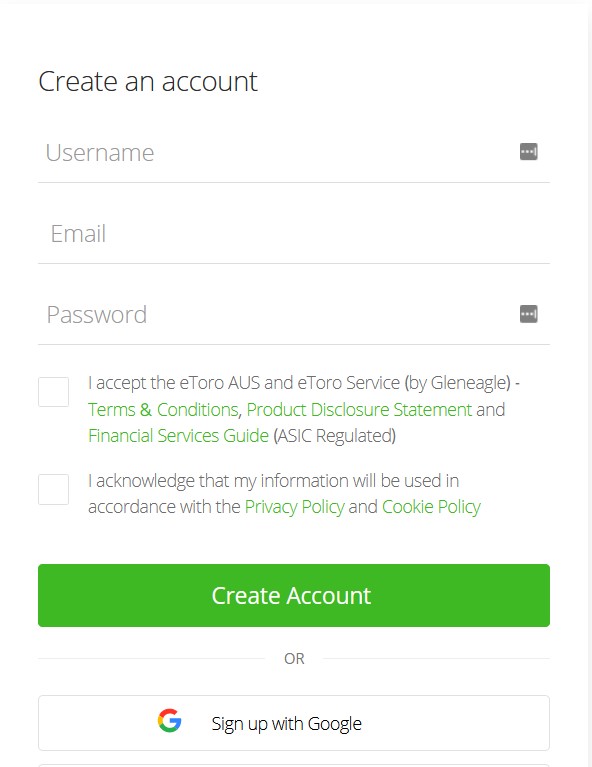

1. Open an Account

Navigate to the eToro website and click on the Start investing icon to begin. Alternatively, you can download the mobile app from the Play Store/App Store and click on Sign up. Fill out the form with your full name, email address, and password.

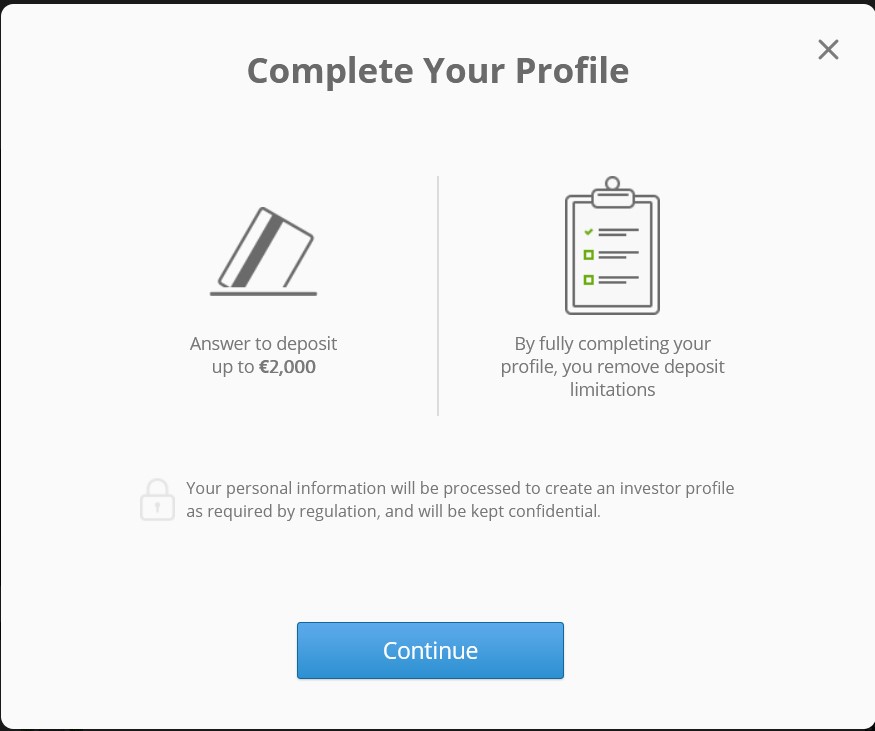

2. Verify Your Account

Verify your account by submitting KYC documents like proof of ID (National ID or driver’s licence) and proof of residence (utility bill). Then, finish setting up your profile.

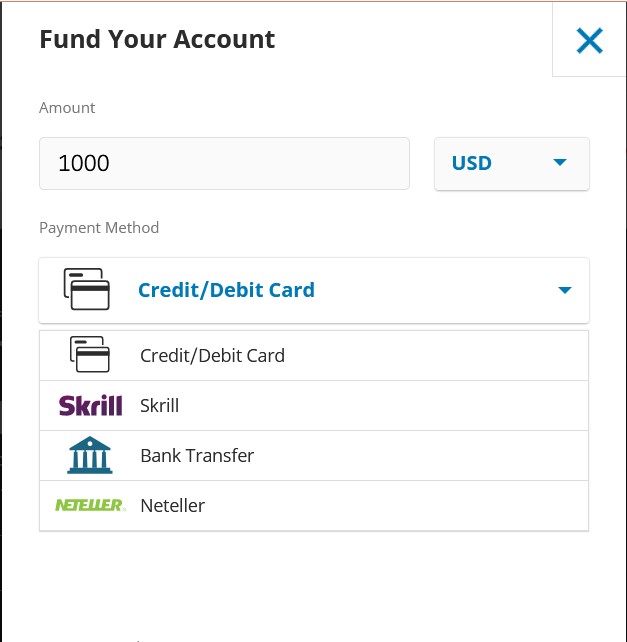

3. Make a Deposit

Once your account has been verified, click on Deposit funds on the left pane of the page. The deposit options available will be displayed. Choose one and set the amount you’d like to deposit. Note that the minimum is $10.

4. Load Crypto Charts

Once your account is funded, search for any crypto in the Discover tab. An interface like the one below should load. You can carry out your analysis on the chart or use external charting software. Set your parameters, like a buy or sell price and set your order.

Latest Crypto Day Trading News

-

Crypto spot trading volume rose by 16% in June with derivatives trading volume also increasing.

-

Binanace has delisted 40 trading pairs specifically for advanced trading pairs.

Final Thoughts

We explored the best exchanges for day trading and chose eToro as our first choice because of its copy trading features, social community, and ease of use.

While all the exchanges are great options for traders, core traders whose main goal is to profit from price action may want to check out more trading-focused platforms like Skilling and Capital.com.

Remember to check the fee structure of the exchange you choose to ensure it is conducive for frequent trades of the next cryptocurrency to explode.

To start day trading with eToro, visit their website.

Methodology - How We Picked the Best Crypto Exchanges for Day Trading

The platforms covered in this guide were chosen through rigorous testing, research, and reviews. We paid attention to security, transparency, reputation, trading fees, deposit and withdrawal methods, coin selection, and trading facilities.

The platforms listed are the best we found in the various categories we listed them. For example, we found that Skilling had a great platform for core trading, and hence named it the best cryptocurrency exchange for trading purists.

Check out our why trust us and how we test pages for more information on our testing process.