June 26 marks the expiration of that largest batch of Bitcoin options, and the big question is what next for BTC/USD

Around 114,000 options contracts will expire today across several derivatives platforms, with a combined value of $1.06 billion. The expiration also comes as Bitcoin’s price finds resistance at $9,300, with a reversal taking it to lows of $9,100 at press.

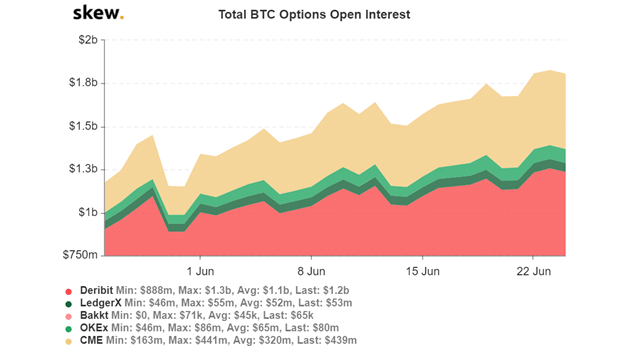

Most of the expiring futures and options contracts are on crypto derivatives platform Deribit with open interest currently at $1.2 billion. Regulated exchange CME accounts for about $439 million worth of open interest.

The market expects low volatility in the hours to expiry, but from there, it would depend on what traders do. A bearish scenario is likely if the current price tanks to levels below $8,500.

Only a handful of the contracts (8,500 on Deribit) are in the money as of writing ($8,500-$12,000). As can be seen on the market data site Skew, most of the open interest (calls and puts) are at strike prices above $10,000 deeming these worthless to traders.

Bitcoin price remains bullish

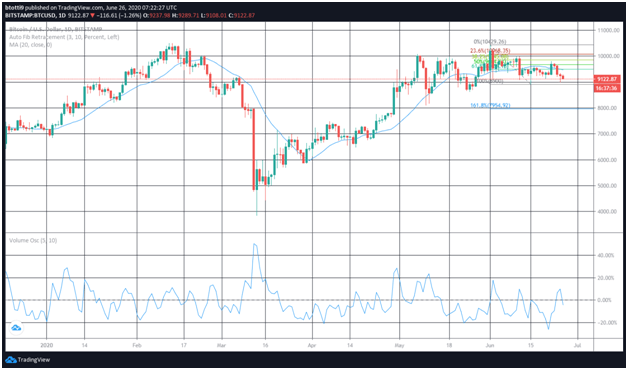

The imminent expiration of the Bitcoin options contracts is an event most traders are keeping tabs on today. The notable thing is that BTC/USD has traded in a range below $10k for much of June, and today’s downturn continues that trend.

A brief peek at $10,500 earlier this month was met with a violent rejection that sent the crypto to a 10% plunge. The bearish scenario has reared its head twice with the price dropping below $9,000 before recovering into a range above $9,400.

Since touching a new local high at $10,500, Bitcoin has traded between $8,900 and $9,966. The price zone near the top of the trendline has been touched multiple times and remains the target price for bulls.

For traders, a close above $9,500 on the daily charts, marked by the 20-day moving averages, could signal a breakout from the descending trendline is within reach. If Bitcoin pushes from this close to breach resistance at $9,800, bulls can aim for $10k again.

On the 4 hour charts, buyers will aim for a close above $9,300, to open up upside towards the 20-MA.

A volatile dash on the downtrend coupled with reduced volume could, however, see sellers push BTC/USD to lows of $8,900, $8,600, and $8,300 (marked by the 200-MA).