The global pandemic in 2020 has created several talking points, be it social, economic or political. Technologically, similar talking points were created after the financial crisis of 2008/2009 which resulted in the birth of Bitcoin.

As we head into the Autumn months, market uncertainty is at its peak. The Coronavirus outbreak has seen financial markets move like never before. Gold prices have recently reached new highs, going to as high as $2,070, Crude oil prices in the Spring went negative for the first time in living memory. Plus Stock markets have continued to climb to set new records in recent weeks after huge falls in March. But what of Crypto, and in particular Bitcoin?

Below we identify the top 4 reasons Bitcoin Prices may be set to move this Fall.

1. The US elections

Debates, rallies and general political commentary surrounding the 2020 US elections have so far been muted. This has come as not only the US, but the wider world has been battling the impacts of COVID-19 on modern-day society.

However, as the November 3rd date looms, traders and investors are preparing for the volatility that will be created in the days and weeks ahead. The uncertainty surrounding the elections typically leads to moves in the strength of the US Dollar. Crypto traders will typically see a stronger USD be negative for Bitcoin, and a weaker USD positive for Bitcoin.

In the last few months, March through to August, USD has significantly weakened against most of its counterparts, in particular the British Pound. GBPUSD moved from $1.14 on 15th March, to $1.32 this week. Within that same period, BTCUSD moved from $3,755 – to a recent high of $12,450.

As voters in the United States decide between Trump and Biden, the policies of both candidates and the impact they could have on the economy will come under scrutiny. Depending on shifts in polling between now and the election, expect potential moves in the Dollar, which in turn could cause bullish or bearish runs in Bitcoin.

2. Rising unemployment

COVID-19 initially started as a health crisis, but quickly became an economical issue as the spread of the virus resulted in numerous nations around the world closing their doors. These lockdowns saw businesses of all sizes forced to either completely shut, or instead work from home where possible.

Companies which were forced to close, have slowly started to reopen, however the demand for goods and services has been rocked, and consumer confidence dented. As a result businesses, especially retailers have had to make significant layoffs in staff in order to remain afloat.

With millions of workers losing their jobs, disposable income falls. The growing number of budding day traders are no longer able to sustain Bitcoin investing as a second income, and instead are using their savings to sustain themselves. It is said that around 25% of the market is derived from retail investors. If this percentage drops, and investments are not replaced by another market segment – could this see Crypto prices fall?

3. New Wave of COVID-19 cases

COVID-19 is said to be a Flu-like virus which thrives in colder climates, so as we head into Autumn, many fear that cases could be set to spike. If that does happen what would the impact be on markets?

The above question is rhetorical, as we have already seen the impacts of the initial spread of the Coronavirus. However, the real issue becomes will there be a second wave of lockdowns. If that does happen, as took place during the peak months of the outbreak in March and April, we could see significant drops in markets, as the world effectively grinds to a halt.

The only difference now, however, is that the markets and society, in general, has already experienced lockdown, and will be better prepared to cope with its limitations. If panic levels are not as high as seen in the Spring, this may mean Bitcoin prices could have a more muted reaction. However this remains unknown, and depends on the severity of any potential lockdown.

4. Herd Mentality

Within financial markets, there is a saying that, “history often repeats itself”, what happens once has the potential to reoccur. Looking at the Cryptocurrency market, in particular Bitcoin, traders now have the benefit of hindsight. Most analyse how an instrument may move at a certain level. If the market looks like it is heading back to said level, a trader may take a position in the direction that the market moved the last time it was at that point.

If many traders take the same approach, and place bets at a similar price, the markets will automatically move at that given point depending on the overall volume of orders – this is called herd mentality in trading.

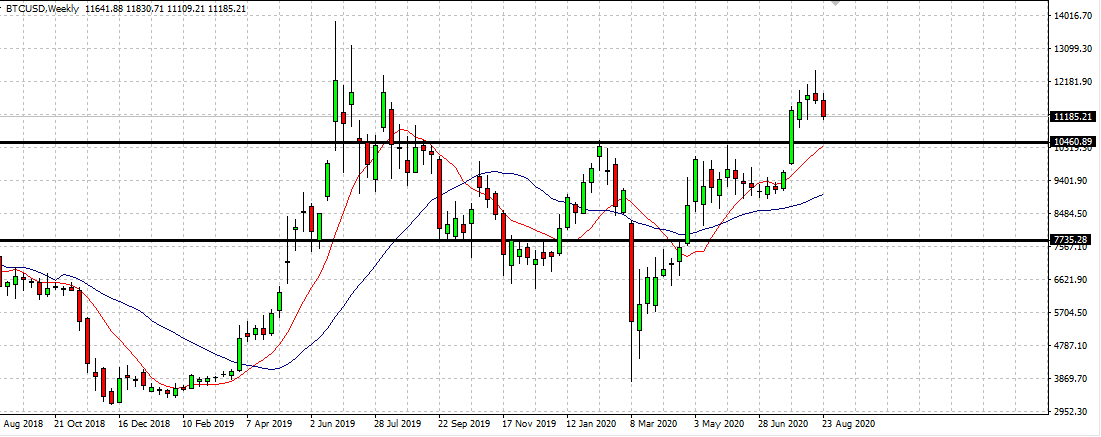

In recent years, we’ve seen BTCUSD have huge bullish runs around this time of year, remember the move in 2017? Bitcoin prices climbed to as high as $20,000 from September to early December. However let’s move away from the time of year and look at the charts. History shows that although we are now trading below $12,000, this area has often been a major resistance level in the past, which could be one of the reasons why sellers have recently re-entered the market to short at that price.

However, as the past also shows, once the uncertainty ended and that bulls gained momentum, the price could potentially rise to as high as $15,000, last seen around June 2019.It should not be lost that this “self-fulfilling prophecy” approach can only work depending on the amount of people in the market.

Conclusion

Overall one thing is for sure, there are many questions that need to be answered. Not within Cryptocurrencies, but the wider world, and as long as there is uncertainty, and a lack of clear direction there will be volatility within the market.