The most important event in the Bitcoin network is possibly the scheduled ‘halving’ event. It consists of reducing (in half) the block reward received by miners who manage to win each battle for securing a new block to the blockchain. It occurs approximately every 4 years and presents a unique opportunity to the market. It drastically changes the perspectives of supply and demand, being the basis of the deflationary model of BTC emission. With only a couple of weeks left to go before the Bitcoin ‘halving’ in 2020, we offer 5 strategies that could help you make the most out of this historical event.

Bitcoin Halving 2020: Countdown, Charts, and Statistical Data

As the big event draws ever closer, the Bitcoin continues to fly and is trading around $7,500 USD. The 2020 halving date for Bitcoin is expected for May 12th and the change in the network should occur around 08:10 a.m. (UTC). This is according to estimates made by BitcoinHalf, the popular website that carries the countdown and other statistical data such as the number of bitcoins in circulation, annual inflation, mining difficulty and blocks already mined.

This time, the block reward will go from 12.5 BTC to 6.25 BTC, a change that will carry several consequences. With the reduction of the reward, only about 900 BTC will be issued per day and the annual inflation rate of this cryptocurrency will reduce from 3.65% to 1.8% per year.

Another metric that could change after halving will be the mining difficulty. Miners are directly affected by these changes and their activity could cease to be profitable if the price does not respond accordingly. In any case, the current situation of the coronavirus outbreak puts BTC in a promising position. Weiss Ratings assured in a tweet that the halving will “absolutely” have a positive impact on the price of the leading cryptocurrency. So, the question is “how high will the BTC go this time?” They say.

Here’s how #Bitcoin halvings have impacted the market. So, does the Bitcoin halving help drive prices higher? Absolutely. The only question now is how high will #BTC go this time around? pic.twitter.com/YnSp4Y8igO

— Weiss Crypto (@WeissCrypto) February 1, 2020

The Long-Term Game has been Infallible so Far

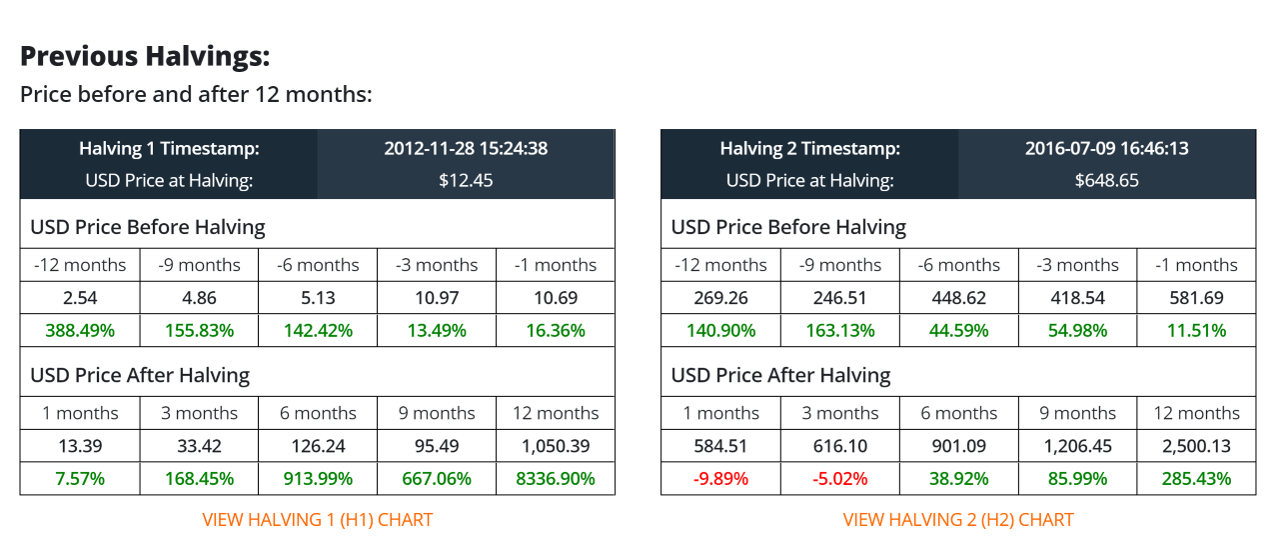

So far, long-term investors have come up with a fool proof strategy to buy Bitcoin before and after halving. Historical Bitcoin halving data cannot predict future results with absolute certainty, as there have only been two prior occurrences. However, they are an interesting metric to take into consideration.

Based on data collected for the first two events, the price moved slowly – or contracted – in the first few months after halving but shot up rapidly after about a semester.

Thus, long-term investing has been a fool proof strategy so far. Will the same premise be fulfilled after the halving of 2020?

The Most Courageous Will Continue with Day Trading During the Halving Event

Although it is a discouraged practice due to the volatility that usually surrounds halving’s in the Bitcoin network, some will seek to take advantage without using high leverage rates. The hours surrounding halving are often full of opportunities for intraday trading if the game is played wisely.

To do this, it is recommended to exercise a balance between bold action and caution. Combine the relevant technical analysis (in small time frames such as 1H, 15min) with other fundamental indicators such as radical changes in the network hash rate.

Boarding the Mining Train: Is it a Good Idea to do it during the Bitcoin Halving in 2020?

Those who are dedicated to mining Bitcoin are the most affected by the next halving. Their reward is drastically reduced, and some may stop seeing profitability, having them choose to shut down their rigs or mining equipment. Occasionally this happens in bulk and drops the Bitcoin mining difficulty significantly enough to incentivise more participation.

Mining difficulty statistically measures how many hashes must be generated before finding a valid solution to the cryptographic problem posed by the current block. After the problem is solved, the miners receive the block reward and a new data block is added to the blockchain. To date, the mining difficulty is located at 15.95 THash, very close to its historical maximums. However, after halving it could drop considerably, opening the doors to new miners looking for medium and long-term benefits.

Alternative Cryptocurrencies: A Great Opportunity During a BTC Rally?

This is based on the hypothesis that Bitcoin will experience a strong bullish rally after miners see their reward reduced for solving the enigmatic candidate problem that enables new Bitcoins to be generated.

Two plausible strategies emerge that involve altcoins: All cryptocurrencies that are not Bitcoin, which today constitute a market of more than 5,000 different digital currencies.

Long positions with altcoins of good potential

Whenever the price of Bitcoin skyrockets, many relevant altcoins tend to follow the same path. The price of some against the dollar shoots up to levels much higher than those of Bitcoin and these overshadow the leading cryptocurrency in earnings. Consequently, it is recommended to use robust diversification tactics to avoid placing all capital in a single asset.

Short positions with altcoins that maintain positive projections, but lose percentage market dominance

Now, if the rise in Bitcoin is accompanied by a percentage increase in its total market share, altcoins lose traction when their price is compared to BTC.

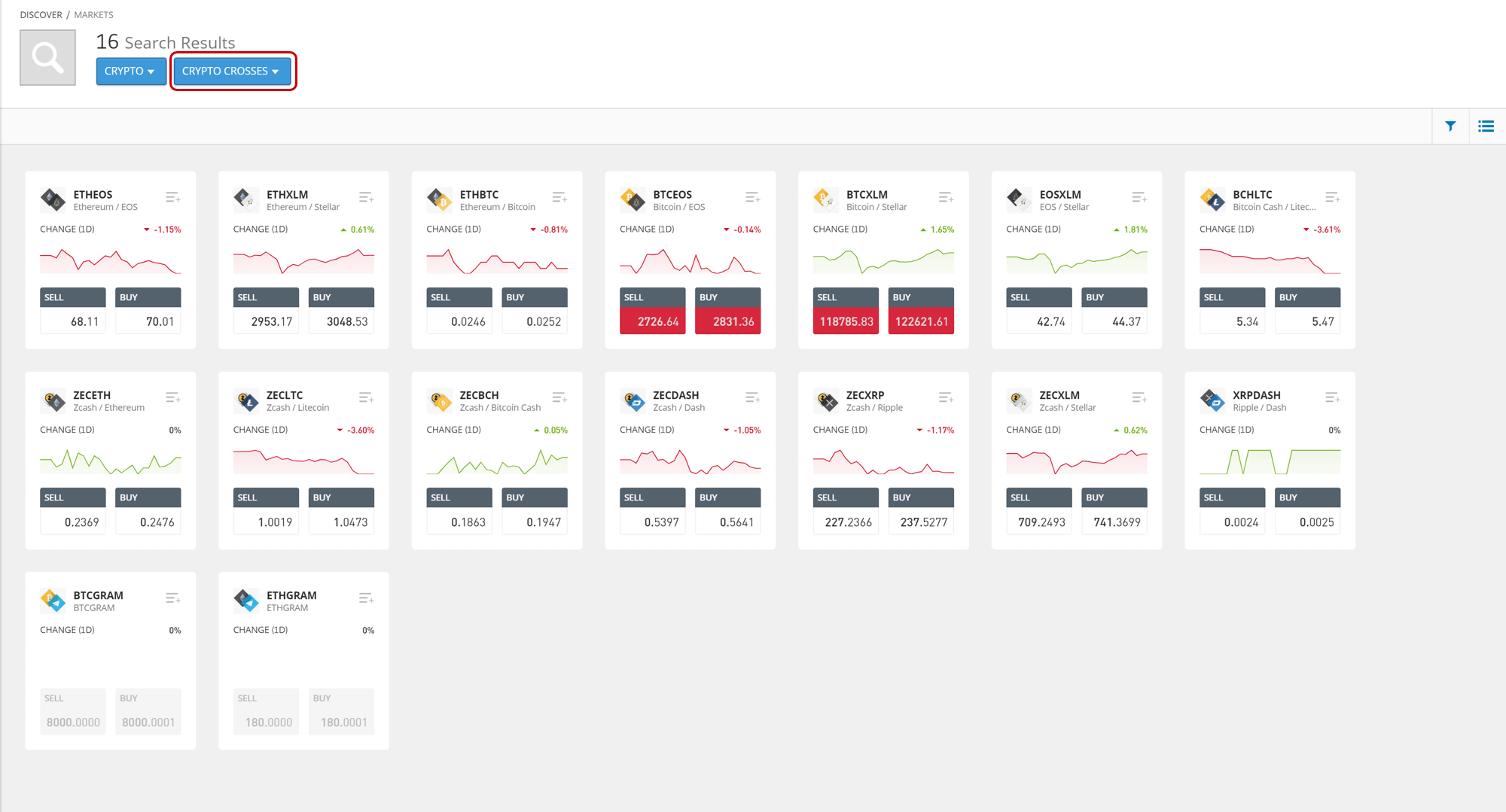

Thus, pairs such as ETHBTC, LTCBTC or XRPBTC could be interesting opportunities to open short positions if the premise mentioned above is achieved. These types of operations are usually available on platforms such as BitMEX. More recently, Binance has also introduced futures trading for some cryptocurrencies.

The eToro broker also offers some cross pairs between cryptocurrencies, a little-known feature, but extremely useful for events such as this.