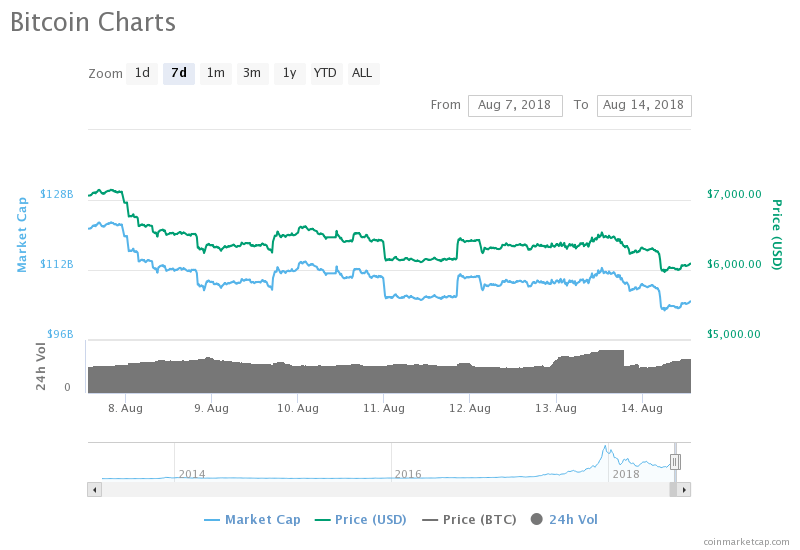

The cryptocurrency market has sustained huge losses in the last 24 hours as the bearish trend continues unabated. Bitcoin has dipped below the major psychological level of $6000 in the last 24 hours although it has rebounded to around $6024 at the moment according to data from Bitfinex. Overall, the leading digital asset has shed 7% in the last 24 hours.

The rout is much more worrying in the altcoin market. XRP is now trading at $0.26 with its value now less than 10% of its highs of more than $3 in January. Cumulatively, it has lost about 15% from its value yesterday. The coin which is ranked third by market capitalisation is now worth $10.3 billion.

Other coins in the top 100 have lost anything between 6% and 26%. Ethereum is currently trading at $268 a unit down 16.5%. Bitcoin Cash is down 14.7% to trade at $498. EOS has also dropped by more than 14% to exchange at $4.40. Litecoin has dropped by a similar margins to trade at $51.68 with its market cap currently standing at $2.9 billion.

Total market capitalisation now stands below $200 billion at $193 billion and it could soon hit new lows if the trend continues. This means a record $25 billion has been shaved off the market in just 24 hours. In other words the market is now less than a quarter of its all-time high of $831 billion in January 2018.

Bitcoin could hit new lows this year

If the sell-off continues Bitcoin could hit $5785, its lowest level this year within a matter of hours. Bitcoin has been praised for its first rising status as a store of value, at least in the space but its high volatility threatens this reputation.

However, Bitcoin is experiencing relatively less price swings compared to other coins which are mostly sliding twice as much. This means that a good number of traders are disposing their altcoins in favour of bitcoin.

Surprisingly, bitcoin and other virtual currencies put up an impressive run last month which saw bitcoin hit more than $8000. The rally was fuelled largely by expectations that the SEC would approve Gemini’s bitcoin ETF application. Fortunes began to decline when the application was rejected.

Another decision regarding another application by VanEck and SolidX was postponed sparking more fears in the market and further deepening the slump. The decision is now slated for September 30.

News that the Intercontinental Exchange (ICE), the company that owns the New York Stock Exchange was planning to offer a more regulated product did little to turn the market around. Another announcement of a collaboration between Microsoft and Starbucks on a common platform similarly did not have an impact on prices.

Bitcoin has also failed to capitalise on the plummeting Turkish lira. Such events have in the past boosted the price of bitcoin.