Bitcoin looks set to linger around $11,000 before seeing further upside movement

Despite testing price levels near a major resistance area of $11,500, Bitcoin has seen its overall market dominance fall in the past 48 hours.

Total market cap stands at around $345 billion, with Bitcoin’s $208.9 billion accounting for 60.4% of total cryptocurrency capitalisation.

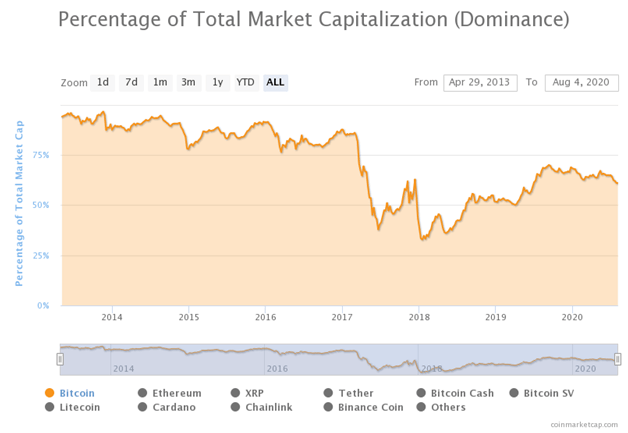

On July 28, the Bitcoin dominance index rose to 63.4%, just as the price rally that took it past $10,000 began to take shape. Although it appears bulls had the momentum that would take it well above $12,000, a run to a high of $12,134 ended with bears pushing prices back to lows of $11,000.

As a result, Bitcoin’s dominance has dropped from the 63.4% mark to today’s low of 60.4%. If the metric drops below the 60% mark, it would be the first time it does so since dipping to 55.8% in June 2019. According to historical data from CoinMarketCap, the lowest level the Bitcoin dominance index has dropped was 32.81% on January 15, 2018.

With the Bitcoin market witnessing far less volatility compared to the dramatic moves of last week — it’s been altcoins that have looked more likely to make significant gains. Bitcoin price rose to within $11,500 in the late hours of trading on Monday, only for the upside to cool off as prices closed around $11,250.

Ethereum and XRP have both gained over 4% in the past 24 hours, while Chainlink is the hottest coin in the market among the top 20 cryptocurrencies by market cap. LINK/USD has swung 15% in the same period to hit a new all-time high of $9.56.

According to Glassnode, sentiment towards a new uptrend is strong. As such, BTC/USD could benefit from strong network health and liquidity to tick above $12k and kick start the next bull market.

However, the price of Bitcoin could suffer an extended short term setback if traditional markets crash in a fashion similar to Black Thursday with more economic uncertainty on the horizon.

“BTC remained confidently above $10k throughout Week 31, and Bitcoin’s on-chain fundamentals point to the beginning of a potential bull market – but external market forces could still impact this possibility” the firm tweeted yesterday.