Average transaction fees and hash rates are surging, even as BTC/USD holds above $11k heading to the monthly close

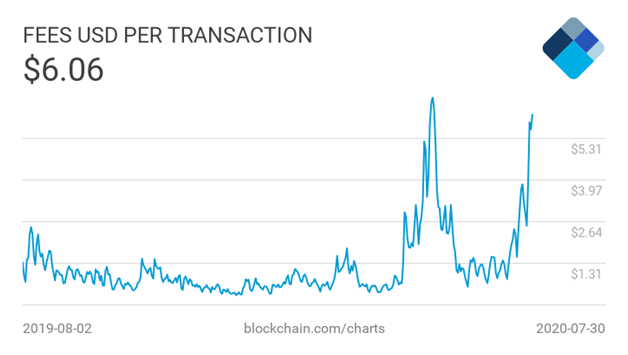

As Bitcoin’s price consolidates near $11,000, demand on the network has peaked. Data shows that average transaction fees have rocketed in the last few days in tandem with the recent spike in price.

After oscillating between $0.60 and $1.60 and averaging around $1.20, network fees have risen sharply to come within touching distance of previous highs.

Network data shows that the network fees have rocketed to $6, surging by almost 500% in a month.

On July 30, the average transaction fees paid on the network was $6.06, which means the average transaction fee paid over the last seven days is close to hitting levels last seen in May; when network demand spiked in the wake of Bitcoin’s supply squeeze.

At the time, the price of the benchmark cryptocurrency rallied to the psychological $10,000 mark, which saw demand rocket. The climb consequently pushed the average fees paid to miners increase to yearly highs around $6.60.

Miner revenues are up

A surge in transaction fees means that miners have seen increased revenues over the past several days. Data from Blockchain.com indicates that miner revenue from transaction fees has rocketed to over $2 million, up from an average of $300,000 on July 1.

Meanwhile, the total value broadcasted across the network is at highs last seen in the days leading up to Bitcoin’s May halving.

According to on-chain data from Byte Tree, over $3.9 billion worth of transactions have been recorded on the Bitcoin network in the past 24 hours. The total transaction value is up by 57% over the past seven days, and by more than 14% over the last five weeks.

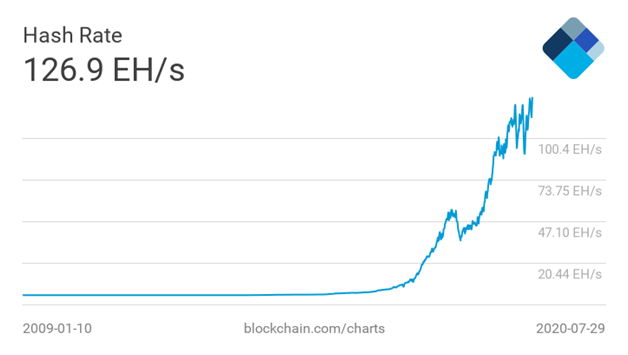

Bitcoin’s hash rate at an all-time high

With BTC/USD price above $10k, the network has also seen an upsurge in hash rate. The total computing power on the network has recently hit and continues to sit near an all-time high of 126 exahashes per second (EH/s).

Growing profitability for miners and the projected increase in price are likely to see the hash rate spike to a new all-time high.

If Bitcoin can hold its head above $10,000 and post a monthly close above $11,000, the crypto market will head into August teeming with bullish sentiment. Analysts are forecasting a run to prices above $14,000 if bulls hold prevailing levels. Beyond that, Bitcoin will test its all-time highs at $20k.

BTC/USD is at the time of writing is trading just above $11,000 and is up 17% over the week.