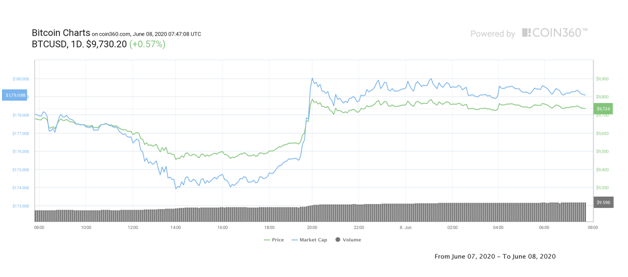

With price trading above $9,700, Bitcoin’s next uptrend could push it over major resistance at $10,500

Bitcoin’s price remains capped below $10,000 as weekend trading saw sideways movement, preventing a break for $9,900. The second week of June starts with Bitcoin posting a low bullish trend, with prices lingering just above $9,700.

Low volatility at press time also means that buyers could consolidate around this level going into the European trading session.

A confluence of factors pointing to an uptrend

Looking at Bitcoin’s network health and participation reveals a confluence of several factors that could see price embark on another uptrend.

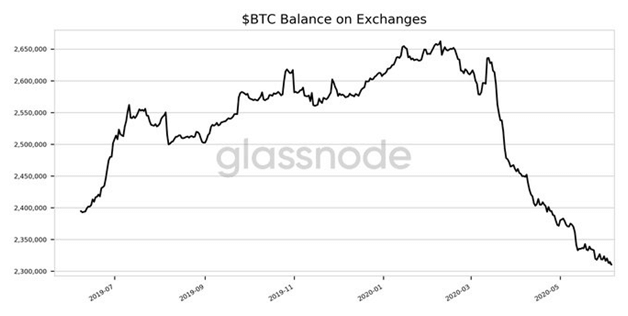

The past week has seen a continuation of outflow from exchanges, with the likely scenario that investors anticipate future price upticks and are thus prepared to hodl. With users likely sending their holdings to wallets, reduced selling pressure plays into a possible breakout in Bitcoin’s price in the medium to long term.

According to the on-chain analysis platform Glassnode, Bitcoin reserves held “on exchanges just reached a 1-year low of 2,310,466.600 [bitcoins].”

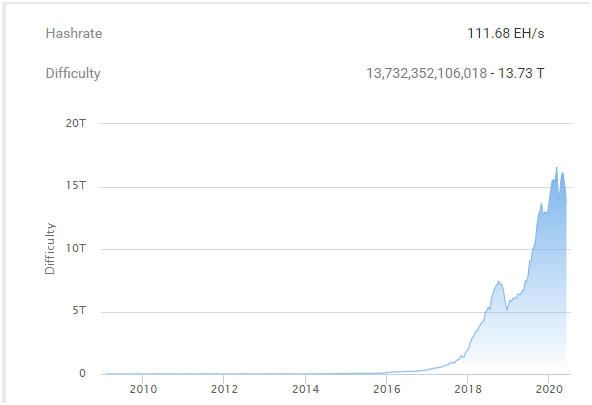

The previous week also welcomed Bitcoin’s latest mining difficulty adjustment, with a 9.3% downward adjustment following a 6% decline recorded in the aftermath of the third Bitcoin halving.

Two negative adjustments could be followed by a third — currently estimated to be down around 7% — this will see the network experience three or more consecutive downward adjustments only for the third time in Bitcoin’s history.

In 2011, the network experienced eight negative adjustments back to back, and in 2018, Bitcoin’s price rallied from a low of $3,100 to top $14k after difficulty declined on three consecutive occasions.

A repeat is likely to incentivise additional participation from miners, whose revenue is finding support after a tumultuous couple of weeks. A rebound in hash rate from dips of around 50% post-halving and a reduction in miner “first spend” sales are all factors that could see a new uptrend take shape.

On-chain data indicates that miners reduced their selling of minted Bitcoin last week and a continuation of the trend will significantly cut selling pressure.

Technical view

On the technical outlook of the market, Bitcoin’s current lethargic moves below $10k might prevail short term and prevent immediate upside movements.

The sideways movement is clearly marked by the levelling out witnessed on the RSI and the moving average convergence/divergence indicator over the past week.

A look at the monthly charts reveals that the week is starting with the price hovering around .382 Fib. However, bulls retain an upper hand and could target $11,900 at the 0.5 Fibonacci retracement level on the ascending channel from $9,960.

Bitcoin has surged past the low level of the 0.5 Fib on three occasions before, but sharp rejections have each time sent price lower. Will bulls experience a fourth-time lucky push short term?

The next upside move must break the $10,500 hurdle and sustain prices above it to test resistance at $11,900. Success would mean bulls have the opportunity to stage a dash for higher levels around $14k. Failure to break $10k might see sellers pushing for $9,000. Support is strong at $7,000 on a sharp decline short term.