Bitcoin (BTC) is riding high on a wave of extremely positive sentiment as it prepares to take on the $50,000 price level

Bitcoin fundamentals and past price performance

Bitcoin is heading towards the $50,000 mark as it gradually tests the upside. The latest push brought it to a new all-time high of $49,714 on relatively low volume compared to its previous hourly candles. While the overall volume is still quite high, BTC bulls have been seeing a volume decline every day since 11 January.

Markets analyst Michaël van de Poppe summarised the market with the statement: “Huh? #Bitcoin market doesn’t go up in a straight line?” He also warned market participants that strong upward movements cannot be sustainable without proper and healthy pullbacks.

Huh? #Bitcoin market doesn’t go up in a straight line?

— Michaël van de Poppe (@CryptoMichNL) February 15, 2021

However, a fellow analyst filbfilb added that “50k could easily be a squeeze, that’s what the volume says anyways.”

The continually good news narrative we have seen makes me think this is entirely possible.

50k could easily be a squeeze, that's what the volume says anyways. pic.twitter.com/Sy13id3aAc

— filbfilb (@filbfilb) February 14, 2021

Bitcoin’s overall outlook is extremely bullish, mostly due to the institutional interest it has received lately, causing it to post weekly gains of 21.83%, outpacing ETH’s 8.44% gain.

At the time of writing, BTC is trading for $47,591, which represents a price increase of 47.22% when compared to the previous month’s value. The largest cryptocurrency by market cap boasts a value of $865.13 billion, making up 61% of the crypto sector’s market cap.

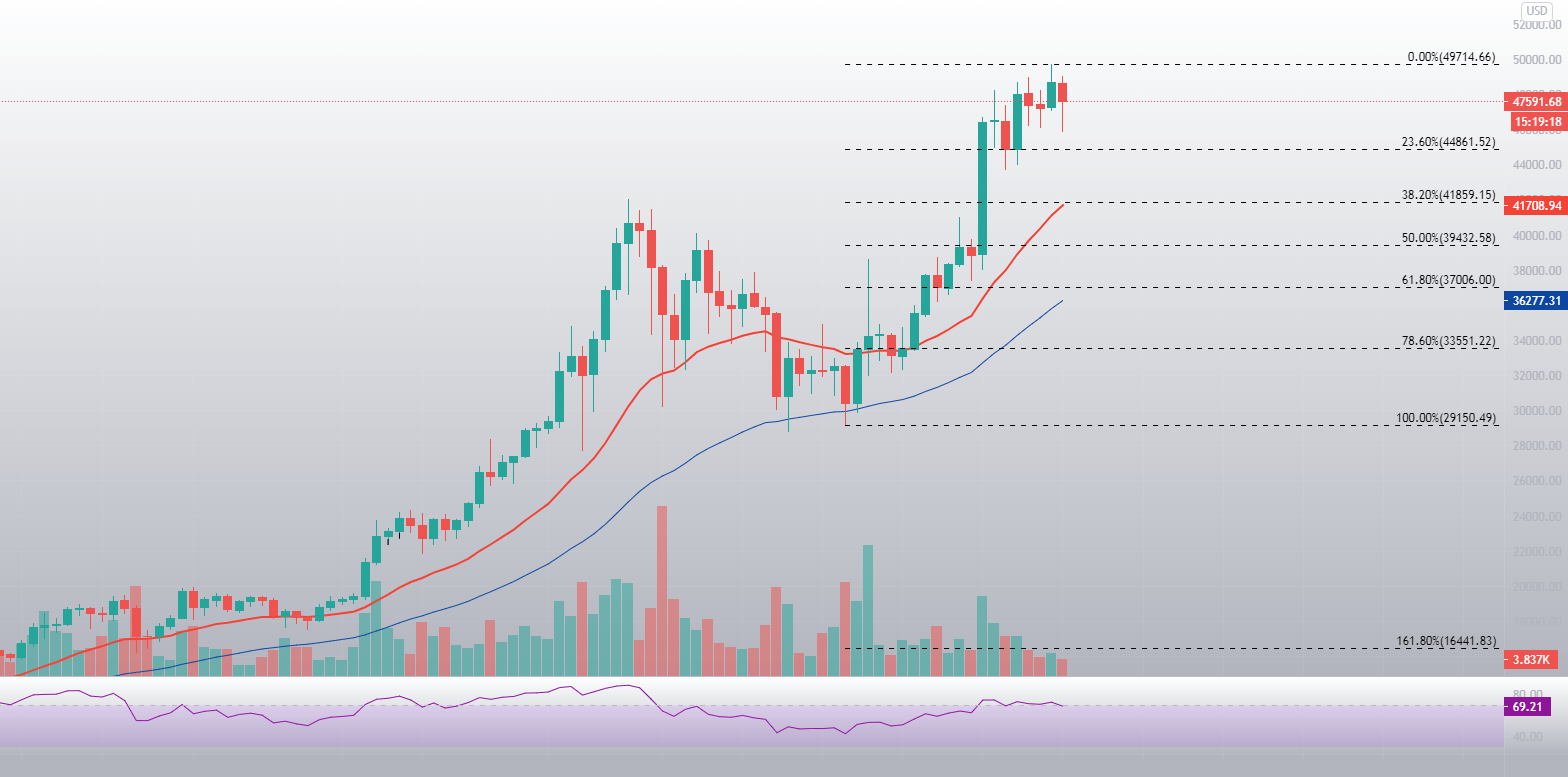

BTC/USD daily chart price analysis

Bitcoin has, after a large candle brought it to above $46,000, been slowly trending upwards for over a week. However, with momentum fading and the number of sellers setting their sell orders around the $50,000 mark, Bitcoin will have a hard time breaking this historical level in the immediate future.

BTC is currently trying to gather bullish momentum as it consolidates above the $47,000 level.

While a retracement is entirely possible, it is far more likely that Bitcoin will look for a catalyst and try to push its price above $50,000, regardless of the amount of sell orders near the level.

BTC’s RSI on the daily timeframe has just stepped out of the overbought area, with its current value sitting at 69.21.

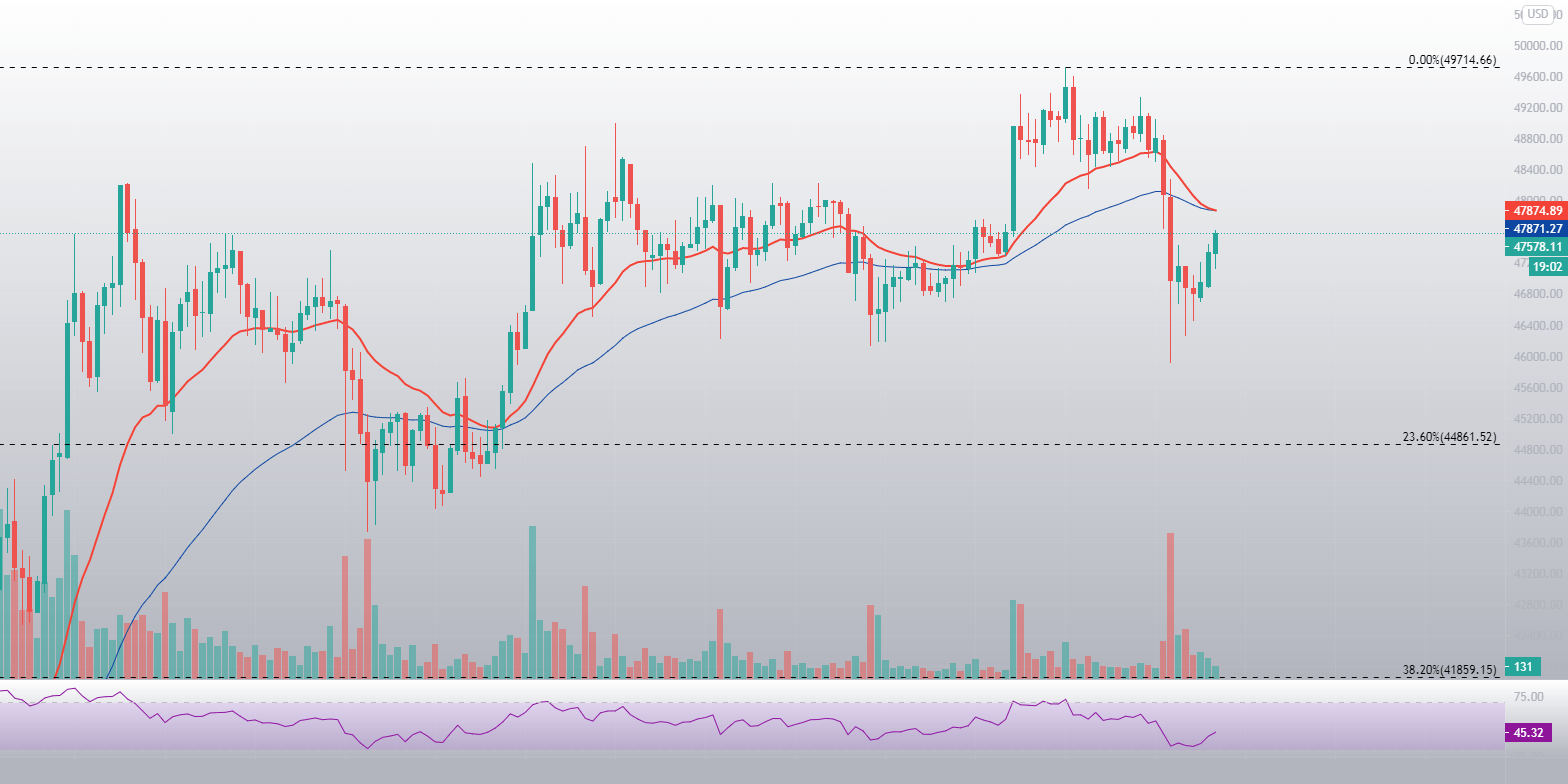

BTC/USD hourly chart price analysis

Bitcoin’s hourly timeframe shows lots of sideways movement, with Bitcoin leaving the consolidation phase briefly to test its upside or downside. However, while the downside was pretty firm, the largest cryptocurrency by market cap kept creating higher highs each time it pushed up, ultimately posting a new all-time high.

The cryptocurrency seems to respond well to the 21-hour and 50-hour EMA, which may be crucial in determining short-term price direction.

With the volume still being this high, a slow retracement or sideways trading for extended periods are seemingly out of the question. Instead, we can expect Bitcoin to push up or down with great force.