Firm buys $425 million worth of Bitcoin as price looks to break above $11,000.

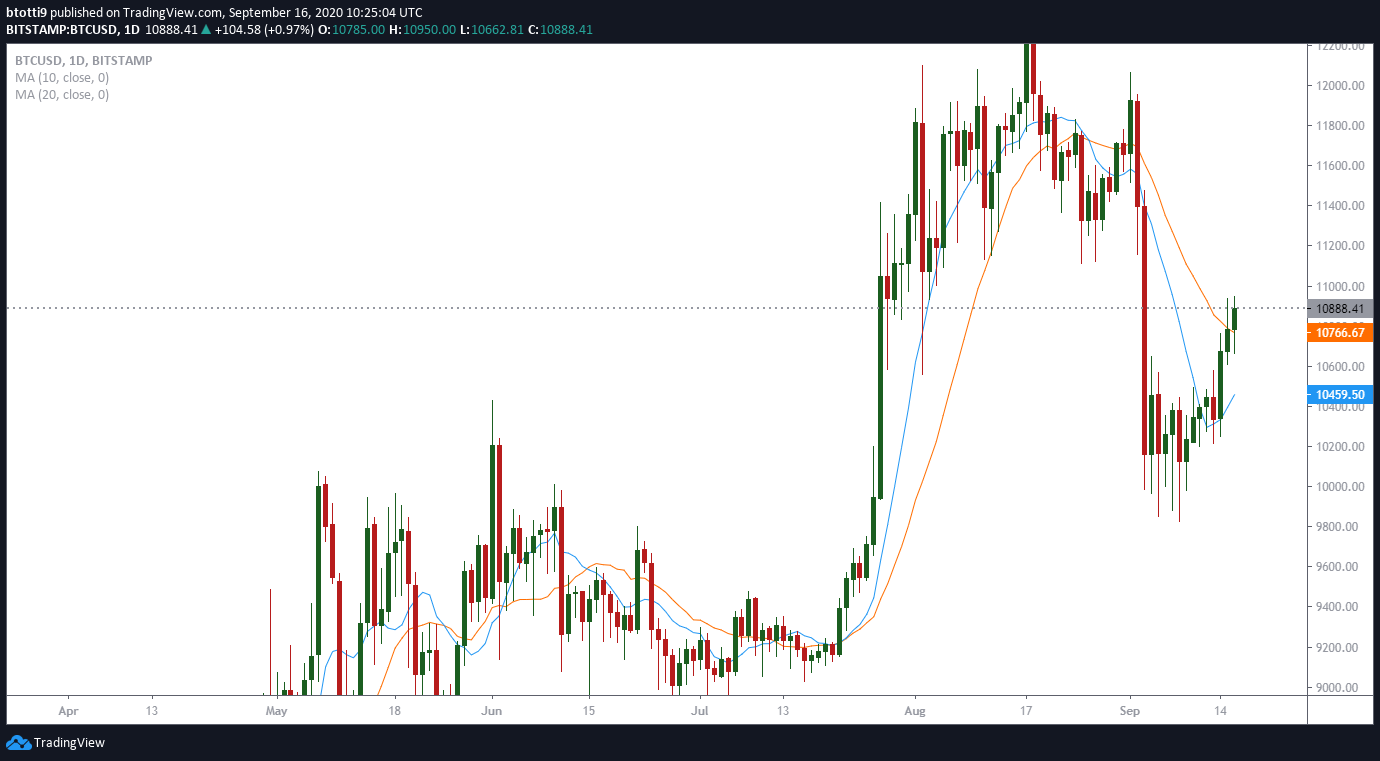

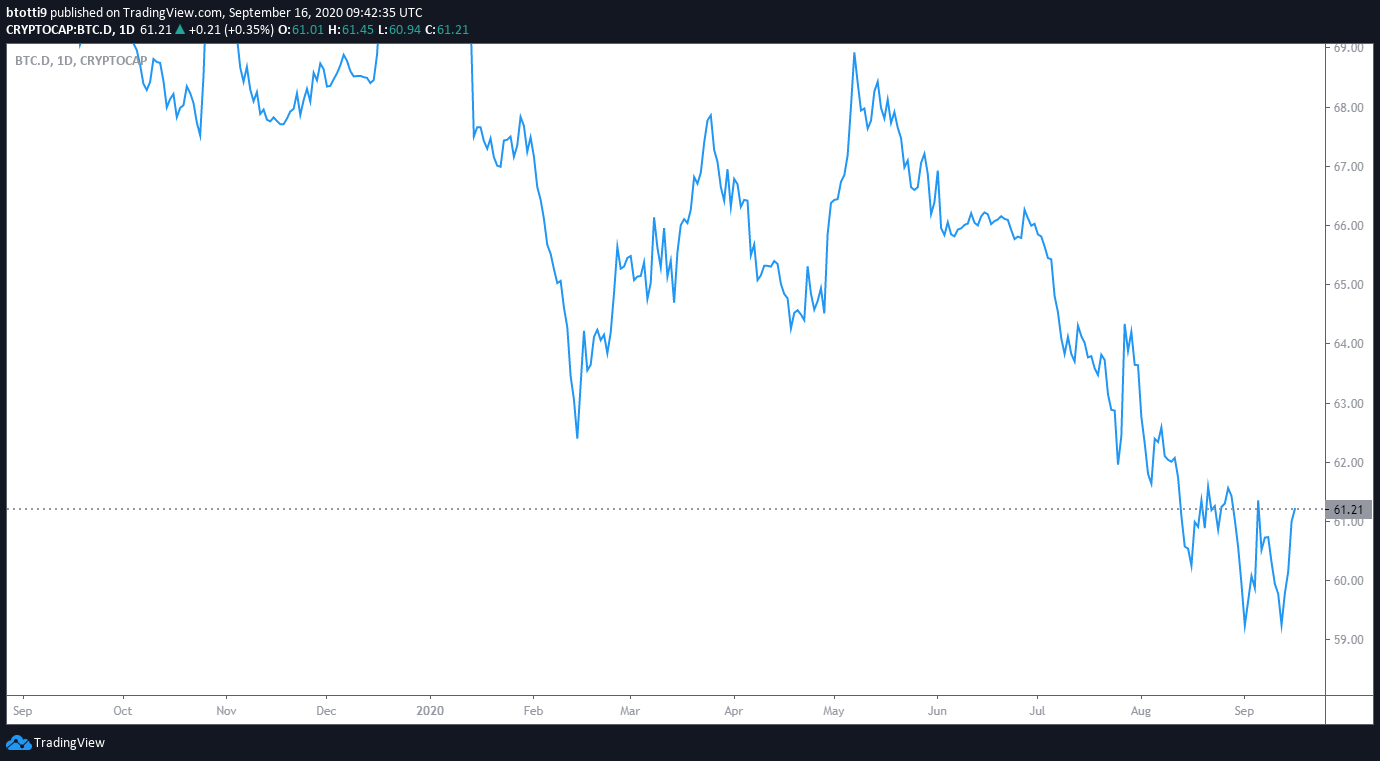

After touching an intraday high of $10,840 yesterday, the top crypto continued the upside by hitting $10,950. Although the declines registered in the altcoin market have meant the overall cryptocurrency market cap has lost nearly $6 billion in 24 hours, Bitcoin’s steady match towards $11,000 has seen its dominance index jump nearly 3% since Monday.

While Ethereum, XRP, Bitcoin Cash, and most of the alternative coin market has faced bear pressure, BTC/USD has printed a series of higher highs over the past three days.

As Bitcoin climbs, most altcoins are seeing red on the day. Ethereum has lost about 3% in the past 24 hours to slip below $365, while XRP has dipped nearly 2% to change hands around $0.24. Other top 10 coins seeing losses include Polkadot at -2.4%, Bitcoin Cash is down to $232 with a 3% slip and Binance Coin continues a bad few days with more than 7% in losses over the past 24 hours.

Aave and Band Protocol have both slipped 14% while SushiSwap is down 24% to lead top DeFi losers.

These losses have seen Bitcoin make ground on lost dominance. As of writing, the number one ranked cryptocurrency has a market cap of $201 billion, against a total of $348 billion for the entire cryptocurrency market. It gives Bitcoin 61.24% dominance over the market, rising from a low of 59.20% on September 14.

MicroStrategy buys $425 million worth of Bitcoin

The upside for BTC/USD is also building at a time one company has amassed Bitcoin worth nearly $500 million over the past few weeks.

Yesterday, MicroStrategy founder and CEO Michael Saylor revealed via Twitter that the publicly traded company had acquired an additional 16,796 bitcoins for around $175 million. That means the total haul for the company has now jumped to a mouthwatering 38,250 bitcoins purchased at a whopping $425 million.

MicroStrategy’s move is a strong suggestion that Bitcoin’s use as a store-of-value is likely to grow among Wall Street firms. However, analysts are also pointing to the possibility that should the company decide to dump its assets on the market, a massive sell-off could tank Bitcoin price.

From a technical perspective, BTC/USD needs to clear resistance at $11,000 to maintain the uptrend. A dip at prevailing levels should see BTC/USD rely on support at the crucial $10,500 and $10,000 pegs.