Bitcoin price cracked the $10k resistance levels for the first time in over a month to break out of a symmetrical triangle. The surge came despite data that appears to show miners sold more Bitcoin than the miner’s minted over the past seven days

After hitting a monthly close above $9,400 for the first time in months, Bitcoin sprung a major move to hit a high of $10,429. The spike broke Bitcoin’s long term descending trendline that has been in place since the top cryptocurrency hit an all-time high in 2017.

Bitcoin’s close on June 1 at $10,232 benefited from the added volatility to gain over $800 on the value of its daily close on May 31.

Although the market action has cooled off a bit to see prices retract to around $10,117 according to data from Coin360, bulls continue to apply buying pressure, meaning prices could yet hit a new high in the current trading session.

Too early to say miner capitulation is here

The spike in Bitcoin price has happened even as data suggests miners are selling more than they generate in a day.

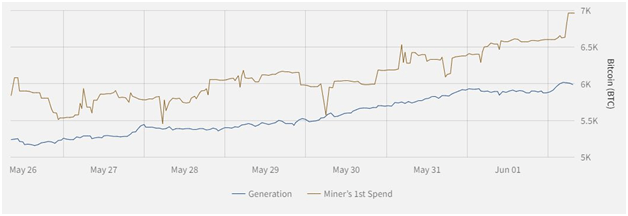

Data on the on-chain analysis portal shows that miners have sold more than they have mined in the past week. ByteTree, which tracks miner wallet addresses and their spend patterns, shows that over the past week, “first spend” transactions by miners rose to 6,977 — 971 more than the 6,006 generated in that timeframe.

Miners sold more Bitcoin than waa generated in the past 7 days Source ByteTree

First spend is a metric that calculates the number of coins that leave miner wallets for the first time after being created. Although miners can hold their assets in a wallet for weeks, months or years, most appear to have been pushed to liquidate to cover mining costs.

Miners sold 11% of their minted Bitcoin over the last week, but the figure is likely to drop as prices rise. In the past 24 hours, miners have liquidated 815 of the 875 bitcoins generated, meaning miners have begun hoarding newly minted coins as prices surge.

Weekly Hash rate has risen

Hash rate has dropped 13% in the past 24 hours from 106.73 Exahashes per second to 99.36 EHashes/second. The network hash rate rose to a high of 137 EH/s on May 11. On a 7-day average, the network hash rate has risen from 90.4 TH/s to 102 TH/s.

As such analysts have pointed out, it’s a bit early to say miners are capitulating. This is because Bitcoin’s price has been relatively stable in the time since the network halving on May 11. Despite its struggles below $10k, Bitcoin’s monthly close for May put it up nearly 10% above daily averages.

Price strength and an increase in hash rate are pointing to a return to the network by miners and that buyers are gearing up for a potential price surge in the coming weeks.

If prices drop to last week’s lows, then a fresh wave of miner sell-offs could materialise. In the meantime, traders are watching the market for signs of further upsides.