With the Bitcoin halving just 26 days away and its PoW proving it’s doing the business, Bitcoin could be ready for significant bullish push in the near future

Halving search volume explodes

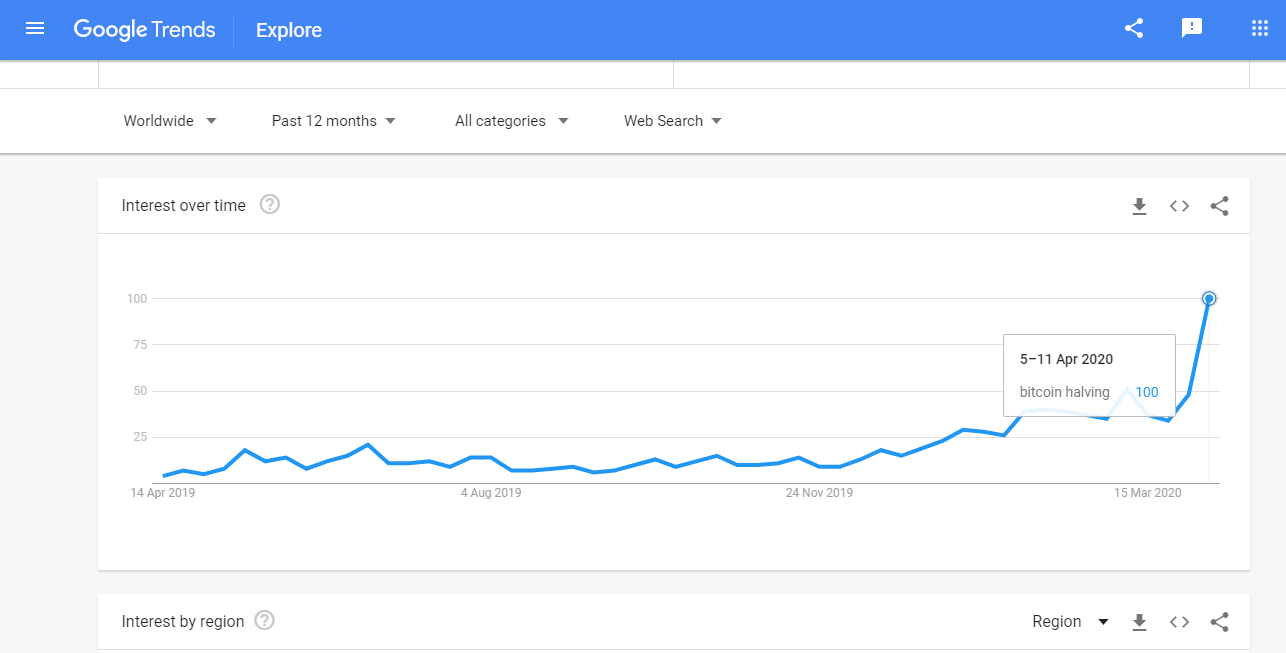

A look at Google Trends shows that search volumes for Bitcoin’s halving peaked last week, showing an increasing amount of interest in the coin, potentially meaning new buyers will enter the market in anticipation of a post-halving price rise.

Previous halvings over the course of Bitcoin’s lifetime have seen increases in the coin’s price range over the next four years and the next halving, as can be seen in the Tweet below.

The #bitcoin cycle pic.twitter.com/yme3YIQdlY

— ChartsBTC (@ChartsBtc) March 24, 2020

On the back of the coronavirus market slowdown and the uncertainty swirling around traditional markets, the spike in search volume could suggest that more ordinary people are looking for ways to invest that are shielded.

Bitcoin’s PoW is the strongest PoW network

According to new research by NiceHash, Bitcoin is the most expensive of the cryptocurrency networks to attack, citing an eye-watering $641,011 per hour to take control of its blockchain.

In order to hack Bitcoin’s network, one must take control of 51% of all mining hash rate, or computing power. Once achieved, you could feasibly change transactions on the blockchain, reverse payments or spend the same coins twice.

A hack of such a scale would require a huge amount of resources to both achieve and keep the attack undetected. This research shows that the Proof of Work algorithm works; hackers would be better using the vast resources needed to hack Bitcoin to instead of mine or purchase the coin as they would likely make more money, disincentivising attempted 51% attacks.

In second place is the Ethereum network, reportedly costing $84,307 per hour to take control. This huge difference in price speaks volumes for the popularity of Bitcoin and how distributed and mature its mining network is compared to the rest of the crypto market.

Zcash came in at $10,273 per hour, a worryingly low figure for a currency that focuses on privacy and security and also boasts a market cap of $349 million.