The main aim behind the acquisition of BitTorrent by the cryptocurrency company Tron was to gain access to the network’s consumers, who may be able to push the mass market adoption of cryptocurrency, users can buy, sell, or trade to get faster download times.

P2P sharing technologies like BitTorrent rely on the power of hundreds of millions of computers connected to the internet. The new token will enable users of those computers to receive small rewards for allowing their computers to be used. Also, users can spend the tokens to get quicker download speeds on the BitTorrent network.

The BitTorrent token is compatible with TRC-10, the foundations for Tron’s own cryptocurrency, called TRX. It will come to market exclusively to non-US accounts on Binance Launchpad, the token offering platform by the cryptocurrency exchange Binance.

The BitTorrent token will first be put in place in the Windows-based µTorrent Classic client, BitTorrent’s most used application. BitTorrent token-enabled µTorrent Classic clients will be 100% compatible with other clients that support the BitTorrent protocol, and users who do not want to join the scheme can simply opt out.

What is BitTorrent?

BitTorrent is often abbreviated to BT and is a communication protocol for peer-to-peer file sharing (P2P) which is used to distribute and download data/electronic files over the Internet. BitTorrent is one of the most common protocols for transferring large files, like digital video files containing TV shows or video clips or digital audio files containing songs. BitTorrent consumes 12% of total Internet traffic in North America and 36% of total traffic in the Asia-Pacific region, according to a 2012 study.

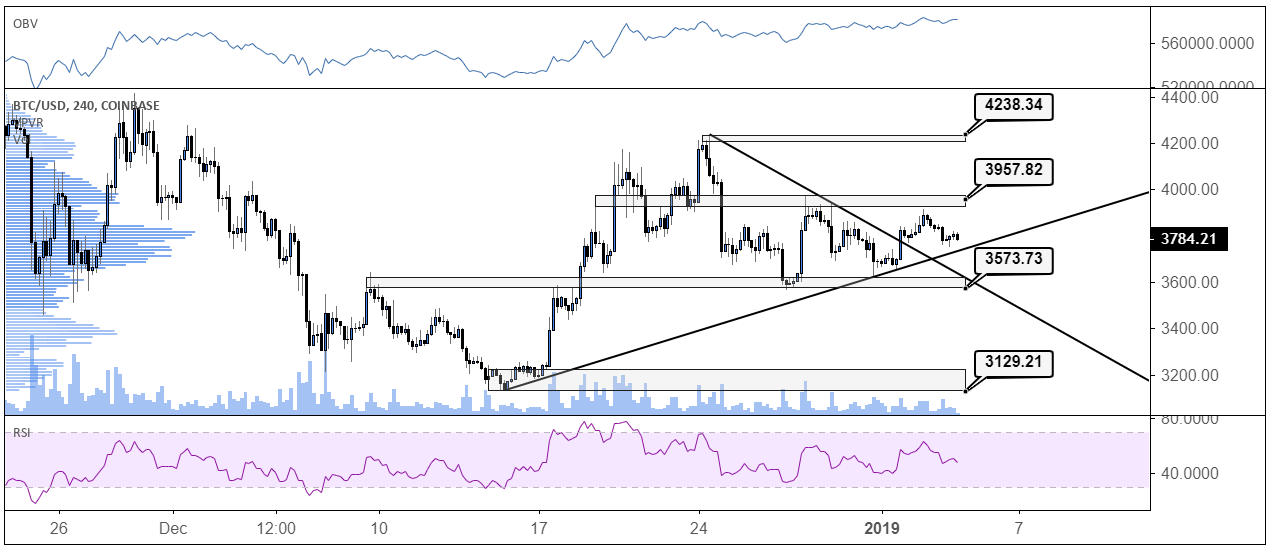

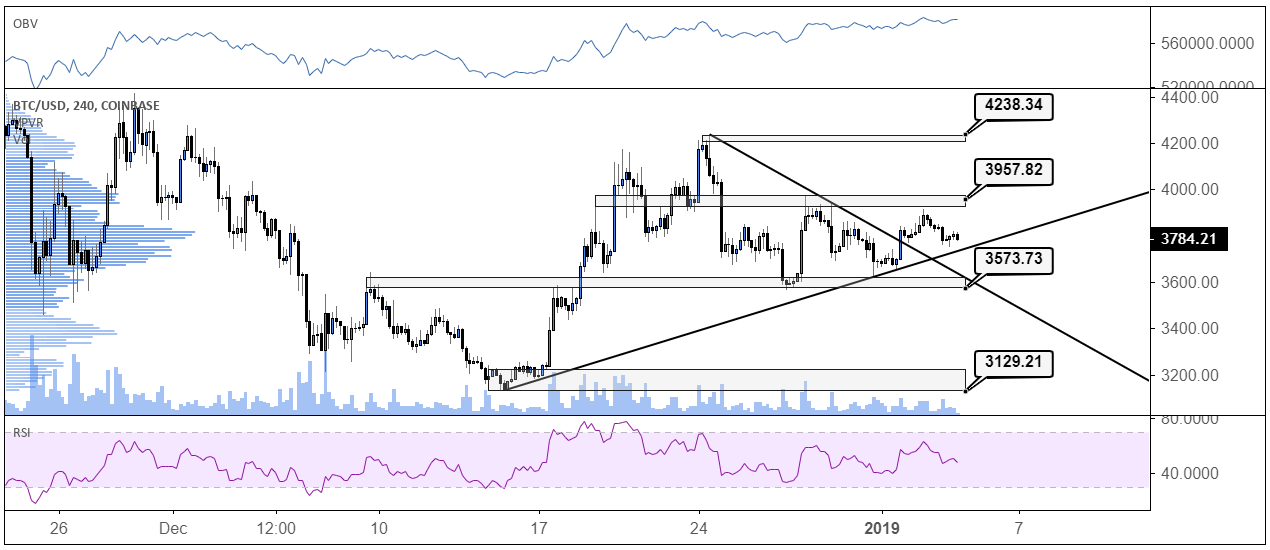

It makes sense for BitTorrent to use cryptos as many people look at the capitulation of price as a fall from grace many other companies have not been deterred as it could make them more accessible for the average user. As Bitcoin prices normalise let’s have a look at the price action today. Looking at the Bitcoin 4 hour chart we can see we have been consolidating between 3784 and 3967 in recent times. It seems the 4000 level is acting as an area of psychological resistance.

Interestingly the OBV (on balance volume) indicator at the top of the chart is showing that buying volume is increasing while the price remains in the static region. This would indicate there is more upside pressure but keep an eye on the turn negative if prices move back lower.

Volume is key when trading any market, it is essentially the number of buyers or sellers in the asset at any given moment. You can look at many metrics of volume of any timeframe you like, i.e. volume in the last hour or volume in the last day. Volume can also indicate if a market is popular and liquid. This could help you decide which asset classes or coins to trade. Trading a market with low volume may be a problem as if you are holding a certain coin and are looking to sell there may not be enough buyers to alleviate you of your position and you may have to accept a lower price.

The RSI indicator is languishing in the middle of the 30-70 zone and turning lower as price had started to retrace but overall the triangle chart pattern has broken to the upside and this may be a retest before a move higher but the upward trendline on the chart will be a key area for confirmation of this theory.

A break of either the 3957 resistance or 3573 support will be crucial in the coming days and will help determine longer term price direction but for now, we continue to consolidate until confirmation is achieved around the aforementioned levels.

(BTC/USD 4hour chart from Tradingview.com, OBV at the top and RSI at the bottom)