China has been experiencing some large mudslides in the Sichuan province, and the result has been the need to shut down some local hydropower plants and Bitcoin mining operations.

The mudslides were caused by heavy rain, and approximately 17 counties in China’s Sichuan province have been adversely affected. The death toll is currently at 7, and local power supply and communications have been disrupted by the weather.

The mining community has been devastated, with many mining machines now submerged in mud and full facilities destroyed by the mudslides. Poolin, the fourth-largest active pool on the Bitcoin network, has posted videos on their Twitter of workers digging through the mud.

Potential Effects on Price

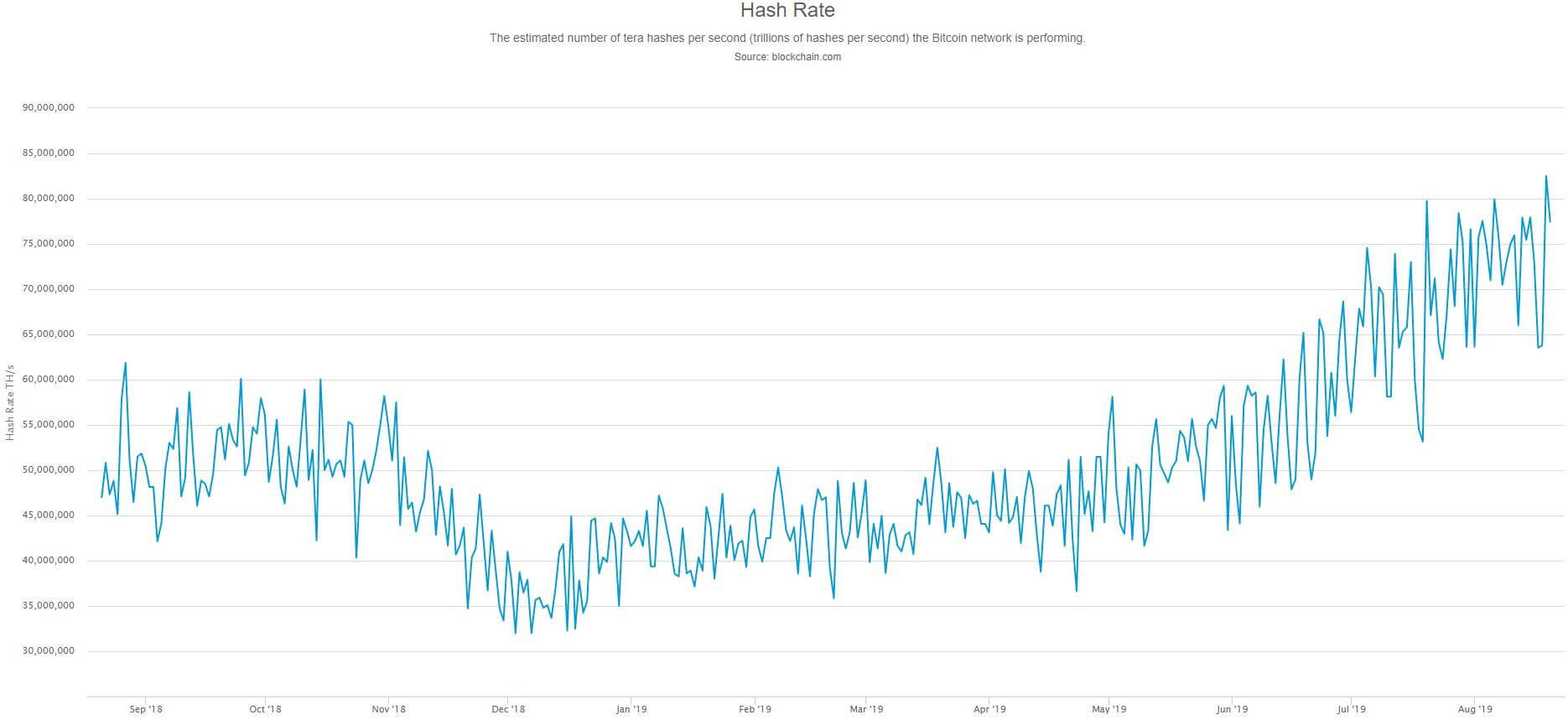

For the Bitcoin community, there is a slight worry that this weather could affect the hash rate of the cryptocurrency. The hash rate is a measure of the activity miners are performing on a particular blockchain, and represents the computing power being directed at the blockchain at that time.

With Bitcoin mining farms being destroyed and such a large proportion of these farms being located in China, it was possible that Bitcoin’s credibility as a decentralized cryptocurrency could be hurt. However, it seems as if even the mudslides can’t take down enough mining farms for China’s mining dominance to be a problem for Bitcoin.

In June of 2018, major floods knocked out several mining farms, and that resulted in a significant drop in the price of Bitcoin. At its nadir, the price was around $6,100 as mining activity dropped and a trough resulted.

This time is a little different, as Bitcoin is no longer in the middle of a crypto winter, and has a more competitive hash rate. Right now, the hash rate is at approximately 72 quintillion hashes (exahash) per second. Although this reflects a drop from the all-time high of 82.5 exahash that occurred several days ago, it isn’t nearly as bad as the last time poor weather conditions in China affected the mining of Bitcoin.

Fundamental Price Patterns

Bitcoin investor Max Keiser sees price following hash rate, indicating a continued increase in the price of Bitcoin. As the hash rate goes up, potential investors in Bitcoin see it as more secure and put money into it. This is because higher hash rates mean that even more computing power would be required to execute of 51% attack.

The trick here is remembering that when you buy Bitcoin, you are making a bet on the strength of the network. So this recent push to new highs in the hash rate is likely to drag the price of Bitcoin up as well.

On the flip side, we have the next Bitcoin halving occurring in May 2020. This usually has strong deflationary pressure on the price of Bitcoin, as fewer coins are being minted and the supply becomes limited, which results in a price increase. However, the halving will also half the incentives for miners on the Bitcoin network, and it is possible the hash rate drops as these miners shift to other cryptoassets that are more lucrative for them.