Clients can now earn income on their holdings without having to risk their funds on the speculative market.

Coinbase Custody has added support for staking Cosmos (ATOM), the US-based crypto exchange announced via a Medium blog post.

The addition of the cryptocurrency means that Coinbase Custody clients are now free to stake Cosmos (ATOM) tokens. Clients can now earn income on their holdings without having to risk their funds on the speculative market.

ATOM holders on Coinbase Custody will use the platform’s user interface to decide on what to stake, as well as to pick between delegating their stakes to Coinbase Custody or a third-party validator.

“We are excited to announce that we now provide clients a secure and seamless way to stake their Cosmos (ATOM),” Bryce Ferguson said.

According to the Coinbase Custody Product Manager, their Cosmos staking services will be offered in a manner similar to its Tezos (XTZ) staking services.

Ferguson added that Coinbase has worked hard on the offering to ensure clients benefit from its offline storage systems. This would allow customers to stake their tokens without worrying about asset security, as the case would be if they used hot storage.

Coinbase has not disclosed the rate of returns for the passive income, nor has it said what the fees would be for clients who use its platform to stake ATOMs.

Coinbase Custody supports staking for two other crypto assets: Tezos and Algorand. The platform has run a Tezos validator for over a year, first offering its service in April 2019. It is Tezos’ largest operator and has had “zero slashing incidents.”

Coinbase Custody, therefore, shields users from forfeiting part of their stake if a validator ‘breaks’ the staking rules.

However, there are higher fees for its staking service compared to other platforms offering similar services. At 25%, the platform’s fees are higher than Kraken’s, which charges a 7.25% fee for Tezos staking.

Binance, on the other hand, offers fee-less staking. The exchange’s staking services are for 15 tokens, including Tezos, Algorand, Cosmos, and EOS.

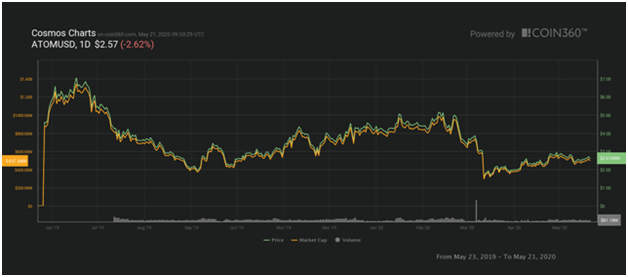

Cosmos traded at a high of $7 in July 2019, but dropped to hit lows of $1.9 in September. A mini-rally saw it climb to $5 in early January 2020, though it crashed to a new low on Black Thursday (March 12, 2020) when bears took it down to $1.55.

The cryptocurrency trades at around $2.61 against the US dollar as of press time with a market cap of $497 million, and now ranks as the 25th largest cryptocurrency — above Zcash and NEM and Ontology.