Are the recent governance proposals and upcoming cross-chain support enough to counter the bearish market being experienced by Compound?

The rise of DeFi in the last year or so has seen many crypto platforms pop up that offer better services than their fiat counterparts. Compound is perhaps the most famous among all DeFi lending platforms and it allows people to lend and borrow crypto assets by leveraging smart contracts and eliminating the need for middlemen. Based on the Ethereum network, Compound fuels its whole ecosystem through its native COMP token.

Source: www.coinmarketcap.com

Already seeing an uptick during the last year, Compound’s COMP started 2021 at a decent price of $148.8 and quickly rose in value as DeFi really started to kick off. Its first major jump came in the starting days of February when the token achieved a price of $550 within two weeks. Its next big uptrend came about in April and extended into May, with COMP hitting $905 back then. Since then, it has been mostly in a downtrend and as of the writing, COMP is trading around $333.

As it drops by nearly a third in a few weeks, we will look at what forces are acting on Compound and determine its future prospects.

Compound Price Analysis

Source: www.marketcap.com

Exactly one year back, COMP was being traded at $97.64, a very moderate price. After rocketing nearly 3.5 times to $355.92 in a few days, it receded back and apart from a couple of jumps in August and September of 2020, it did not move much in terms of price. The turn of the new year heralded a boom in DeFi and Compound was quickly recognised as one of the best options and a flurry of interest saw it rise. Hitting the peak at $905, it has retreated and is back at what it was more or less 12 months ago ($333). If you had bought COMP at the start of the year and still hold it, you would not have seen any growth overall.

Where to Buy Compound

Events that Might Affect the price of Compound in June

As Compound keeps falling, what is in store for the DeFi platform? Let’s have a look at a few aspects that can and are playing their influence.

Crypto Exchange Listings

Compound’s COMP token was already available on a few large cryptocurrency exchanges, but recently it has been added by the social trading platform eToro. This gives the token larger market access and is helping in driving people to invest in the token, which can be further staked for farming.

The first week of June also saw COMP being added by Bitstamp in a promotional scheme where traders and investors can buy the Compound token without incurring any fee for the next three months.

Gateway

Source: Compound Labs Twitter

Compound is all set to launch its latest service called the Gateway in the coming months. This gives users access to a broad range of crypto assets including on other blockchain networks, potentially increasing the viability and usability of its COMP token as it unlocks previously isolated markets on other large DeFi blockchain networks.

Expanding Pools

Compound regularly introduces new investing pools, with the latest additions of TUSD and LINK in the last few months. As more are added over the coming days, this will drive more people towards it, pushing COMP’s value higher.

Broader Market Sentiment

While there is a lot going on at Compound’s end, the overall market sentiment cannot be ignored. The broader market has been in a bearish mode for a couple of weeks now. The price rise in the recent days has been largely due to Elon Musk’s changing stance on Bitcoin acceptance for Tesla purchases, but how long this will last until the bearish sentiment overtakes again is an open question.

Compound Price Forecast

Though the flurry of activity by Compound is always a good sign that the lending platform is actively working on giving more services and expanding on existing ones, the numbers game cannot be ignored. Let’s see what the technical indicators show and what can be analysed from these.

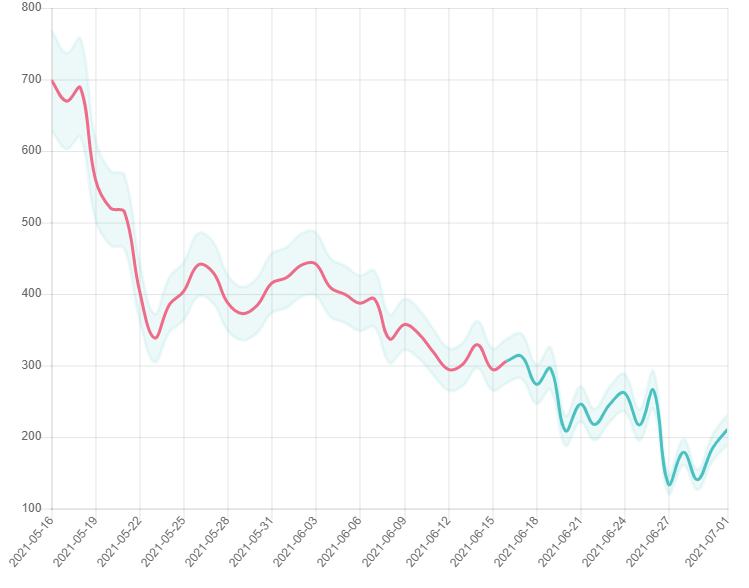

Source: www.gov.capital

Using its in-house AI system to make accurate predictions, Gov Capital has a little bleak outlook for the rest of June. In the next couple of days, COMP might see a small drop, followed by another one, estimating a monthly low of $134 (losing approximately one-third of its current value). There is an expected bounce back in the last days of June, but estimates range from an optimistic $184.34 and a pessimistic $165.89.

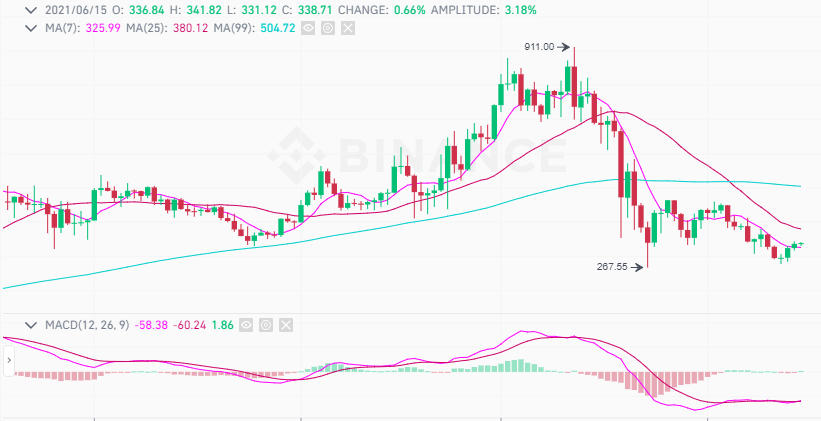

The one-day candlestick and moving averages from Binance charts also doesn’t show a positive outlook either.

Source: www.binance.com

The 7-day and 25-day moving averages, though reducing their falling values, are starting to converge. This might indicate that COMP might remain stuck within a tight range. The large scale 99-day MA shows a very different value, but it also seems to flatten.

This prediction is also supported by the MACD values. Both the 12 and 26-day values are crisscrossing very closely and unless there is a piece of very positive news that will cause a return of interest in Compound, the crosses will continue within this range.

This is a prediction and the market can change anytime as per the disclosure of positive or a piece of negative news. What must be closely followed are the upcoming regulations being tabled by different nations and any large changes in budgets that can potentially upset fiat strength and pump people to protect their investments as many Compound pools offer higher interest rates than paper currencies.

Please note, the above is a purely opinion-based piece, based on relevant data available. It should not be deemed as direct investment advice.