US President Donald Trump said he’d go into immediate quarantine

Bitcoin, which had sprung to $10,669 after plummeting over 4% to $10,382 on Thursday, retraced as momentum was cut short around $10,500.

It is the same picture across the rest of cryptocurrency, as prices slip on increased selling pressure. A similar scenario is seen in the stock market after US President Donald Trump confirmed via Twitter that he and First Lady Melania Trump have tested positive for COVID-19.

US stock futures as well as the Treasury yields fell as the largely knee-jerk reaction from traders kicked in.

In Europe, shares opened lower while the global equity index MSCI saw a slight 0.2% dip. ICE Brent Crude is down 3.2%, but Gold has recovered from lows of $1889 to trade around $1,907.

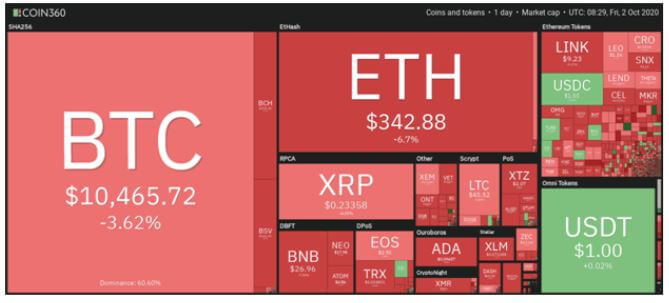

Crypto markets in red

Across the altcoin market, crypto assets are mirroring Bitcoin’s blandness, with Ethereum dropping more than 6% to trade around $343.

XRP has shed 4% of its value in the past 24 hours and is changing hands at around $0.232, while Bitcoin Cash, Binance Coin, Polkadot, ChainLink, Crypto.com Coin, and Litecoin are all down between 3%-10.6% to see all top 10 cryptocurrencies slumped in red.

ChainLink (LINK) with -10.64% and Polkadot (DOT) with -9.11% as of writing are the biggest losers among the top 10. Cardano (ADA) with -9.59% and Bitcoin SV (BSV) with -9.68% have also faced increased selling pressure and could decline double digits if the sell-off continues.

BitMEX connection

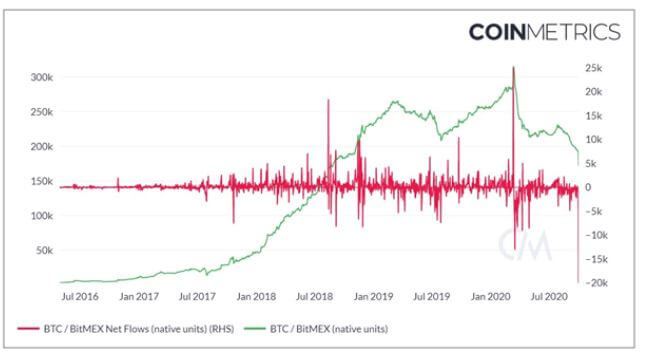

On Thursday, October 1, US regulators filed charges against crypto exchange BitMEX and its founders, a development that had an immediate impact on price. Trades also reacted by withdrawing huge amounts from the exchange

According to CoinMetrics, customers have withdrawn around 20.9K bitcoins from BitMEX since the indictment news. It is the highest number of coins withdrawn from the exchange, the analytics firm added.

Bitcoin is down by 3.65% to trade around $10,465. However, despite BTC/USD remaining poised above $10,450 as of writing, the likely dip in prices across the stock markets could make any bullish attempts to bounce above $10,600 even more difficult.