How high can EOS price rise in June given its latest fundamental and technical outlook?

EOS price is hovering just above $6.00, with an intraday price range of $6.54 and $5.78 at the time of writing.

The 24th ranked cryptocurrency’s price is down nearly 8% over the past 24 hours at the time of writing. EOS price has also dipped about 13% this past week, with the coin’s monthly performance showing that selling pressure has pushed EOS/USD lower by about 4.5%.

Yet, despite these seemingly poor returns over the mentioned timelines, EOS is 124% up year on year. I’d like to see it close the week above $7.50 to bring into play a monthly target of $10—$15. Let’s dig a bit deeper into EOS price prediction.

EOS one year price chart. Source: CoinMarketCap

EOS Price Overview

On 1 January, EOS traded around $2.73 and was double that price by mid-February when it touched highs of $5.6. The upward trajectory continued after a brief lull in March, reaching a new high of $8.82 on 17 April.

Another dip followed but EOS pumped hard between 3-7 May, accumulating more than 100% in gains as price raced to an intraday high of $13.23 on 7 May. From there, buyers pushed it to the year-to-date peak of $14.88 on 12 May.

But EOS price fell sharply by 38% in one day on 19 May and by more than 75% since the YTD peak as sellers pushed it to $3.58.

After the general price rot between 12 May and 23 May, EOS rebounded more than 87% over four days before the uptrend cooled off once more.

While the June trajectory has yet to feature such extremes, a dissimilar outlook will strengthen if the $5.60 zone holds and bulls manage to break above $7.50. If the price performance in June mirrors that of the last week of May, the EOS price could trade as high as $15 or as high as it has ever been.

As of writing, EOS is nearly 73% off its all-time high of $22.71 reached on 29 April 2018.

EOS price and the broader market

The majority of the crypto market is currently battling sell-off pressure, with most assets trading lower after a series of negative news.

This is the picture from last month, which saw the price of EOS, as with most other cryptocurrencies, face downward pressure largely because of the negative price action for Bitcoin. Two factors have been cited across crypto Twitter as having contributed to the massive losses: the Chinese ban on crypto trading and Bitcoin-mining related FUD.

The weakness has pushed the total cryptocurrency market capitalization down by 5% over the past 24 hours, which currently stands at $1.72 trillion from an all-time high of $2.55 trillion. EOS has a 24-hour trading volume of over $2.89 billion, and a market cap of $5.8 billion.

EOS Price Forecast for June

EOS price performance over the past week has tracked the major coins, and this might prove encouraging if prices begin to rally again.

Despite the momentum being with the bears, we can put a conservative price prediction for EOS at $15 by the end of June. The bullish bias for EOS will however become clearer if buyers achieve a weekly close above $7.00, a scenario that would open up a path for more gains.

Notably, investors might want to take note of the EOS price outlook over the past few months, especially the potential for massive swings anchored by market sentiment and network-related news.

EOS price: technical outlook

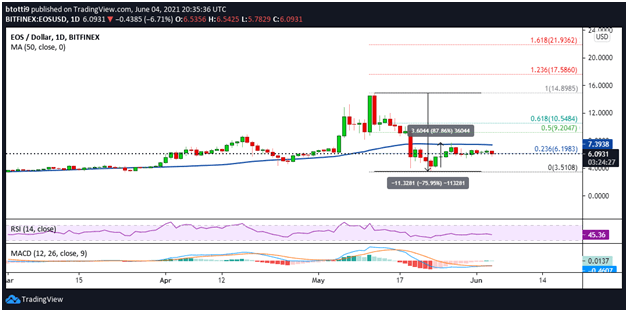

EOS/USD price chart and technical outlook for June 2021 as seen on TradingView

The technical picture for EOS/USD on the daily chart suggests bears are still in control, but a potential bullish pennant breakout could see prices break higher to retest the $14.00 level.

The Relative Strength Index (RSI) remains largely flat below 50, but the Moving Average Convergence Divergence (MACD) is suggesting a weakening of the bearish strength.

If bulls push EOS above immediate resistance at the 23.6% Fibonacci retracement level ($6.19), the next major hurdles would be at the 50 SMA ($7.39) and the 61.8% Fibonacci retracement level ($10.54) of the move from $14.86 high to $3.58 low.

Note that the relief rally registered on 20 May and the upside of 24-27 failed to breach seller congestion at the above moving average. This has kept the bearish hold EOS price has been in for much of last month.

Bulls, therefore, need to clear the zone before testing the 61.8% Fibonacci level and potentially rallying towards the $14.88 YTD high.

While I maintain a bullish bias for EOS, I must say that failing to clear the 23.6% Fib level would invite more sell-side pressure and stall the upside. If the price dips below $6.00 and $5.67, an extended reversal could target the monthly low of $3.58.

What might drive EOS Price in June?

EOS price could rise with positive sentiment from crypto-related news as well as overall network growth as the blockchain platform gains market traction.

Like the rest of the market, EOS suffered major losses in May as a result of negative sentiment around Bitcoin and news from China.

But as noted above, EOS saw a massive price move in early May after Block.one announced a proposal to enhance staking rewards for EOS network users.

ICYMI: We are calling on the #EOS and #EOSIO communities to test, review, and provide feedback on our Stake-Based Voting and Rewards Proposal. https://t.co/5v7KBRGrPZ

— EOSIO (@EOSIO) April 30, 2021

Block.one’s recent announcement of a $10 billion funding for a new decentralised exchange dubbed Bullish Global is also massive news as EOS looks to dive further into the DeFi space. The project has received backing from billionaires Peter Thiel, Alan Howard, Mike Novogratz and the global investment bank Nomura.

Also, improved network security and high scalability mean this Ethereum rival might see more growth even investors eye fast, low-cost platforms.

Investors should thus watch out for broader market sentiment and EOS-specific news that might influence price direction over June.

Please note, the above is a purely opinion-based piece, based on relevant data available. It should not be deemed as direct investment advice.