Ethereum (ETH) entered price discovery mode after passing its previous all-time high of $1,764. What’s the reason behind the price increase and what’s next for ETH?

Ethereum fundamentals and past price performance

The second-largest cryptocurrency by market cap continues pushing strong towards the upside on amazing fundamentals. Not only that the DeFi sector reached a new milestone with $35.8 billion in total value locked, but 80% of the total institutional money inflow came into Ethereum in the past week. This type of institutional and retail involvement created the perfect environment for ETH to jump up in price.

Ethereum posted week-over-week gains of 26.78%, falling short to Bitcoin’s 35.81% gain. The second-largest cryptocurrency by market cap currently boasts a market value of $56.03 billion.

At the time of writing, ETH is trading for $1,817, which represents a price increase of 32.31% when compared to the previous month’s value.

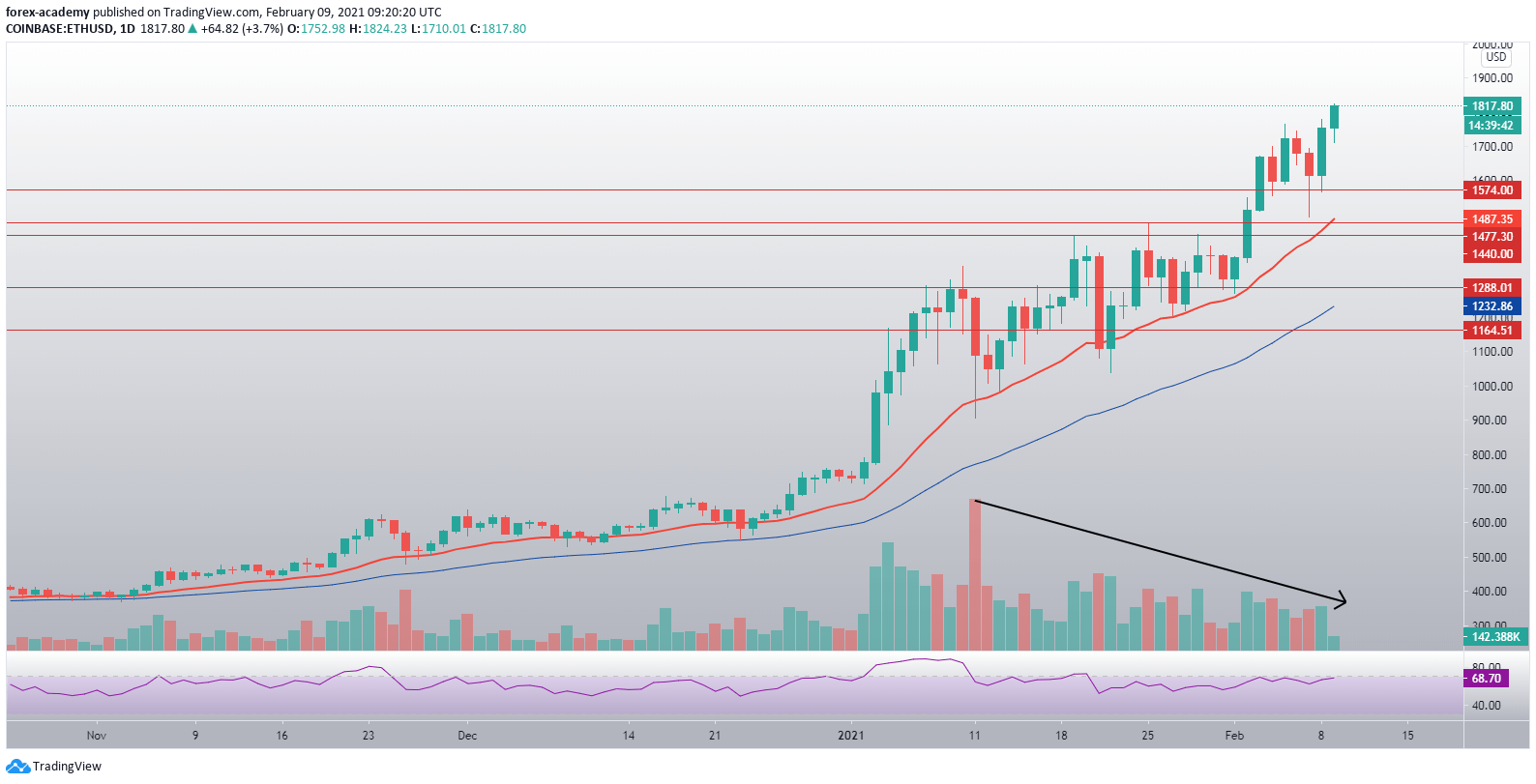

ETH/USD price – daily chart analysis

The second-largest cryptocurrency by market cap was trying to push past the level of high resistance near the $1,500 mark for over a week, but failed to succeed at breaking it. However, recent tremendous fundamental outlook, sparked ETH bulls to attempt another strong push.

Ethereum bounced off of its ascending 21-day EMA (which it was following until then) and pushed past the zone of high resistance, creating new all-time highs along the way. The recent push past $1,800 is just one more confirmation of how strong ETH fundamentals are, but also how important BTC movement is to the market.

One thing to note is that, despite its rising price, Ethereum’s daily volume seems to be on a slight descent, which may ultimately limit its upside.

ETH’s RSI on the daily timeframe is hovering around the overbought area without actually entering it for several days now. Its current value is sitting at 68.70.

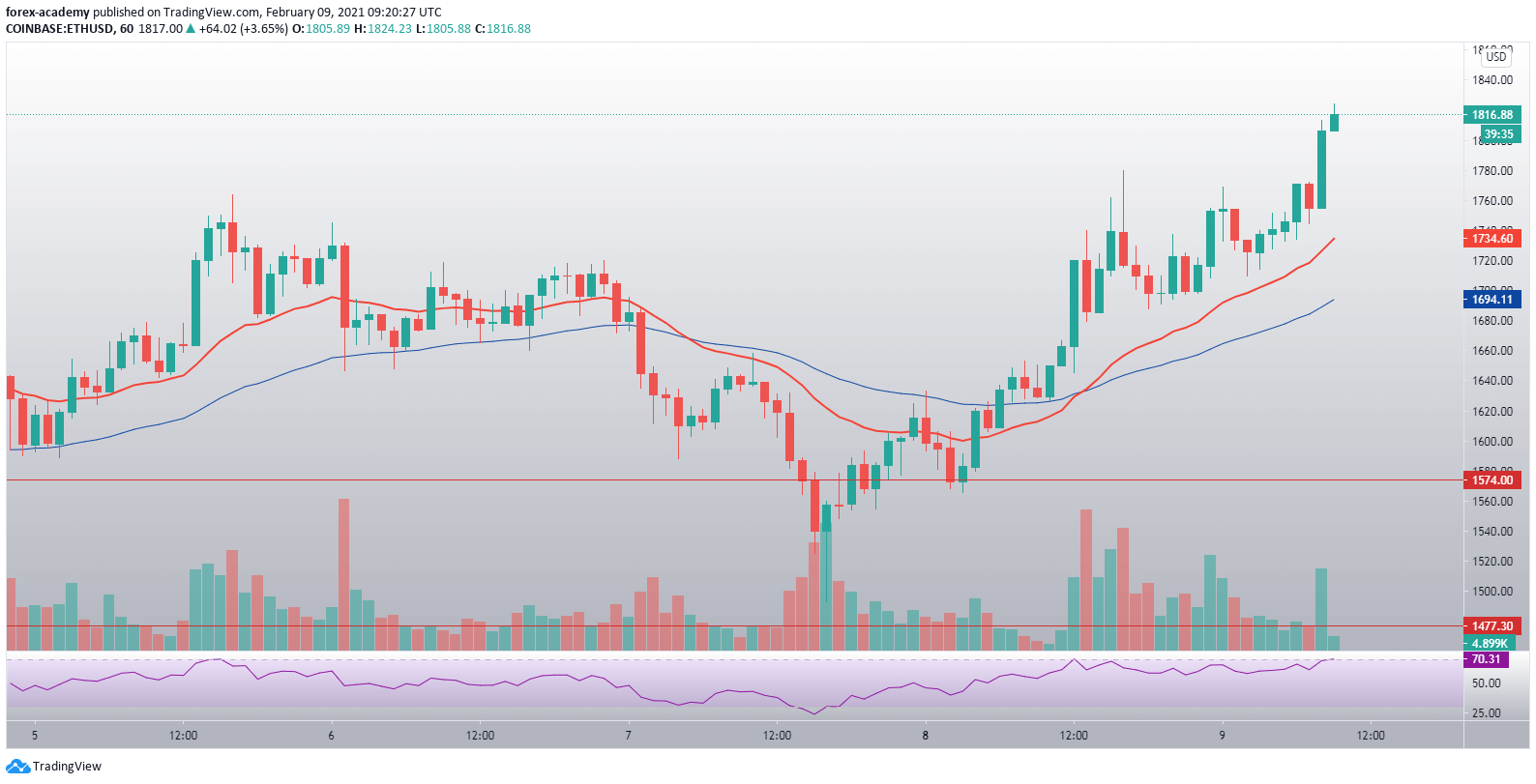

ETH/USD price – hourly chart analysis

Yesterday’s good news coming from Bitcoin pushed the whole crypto market up, and Ethereum was not excluded. ETH’s move past the $1,800 mark seems healthy and not overextended, as the cryptocurrency has the 21-hour EMA following it closely.

While a straight-up push to the $2,000 level is highly unlikely, Ethereum has very strong support levels at several stages (the previous all-time high, the zone around $1,500 as well as daily and hourly EMAs) that could protect its downside if needed.

If we take into account its booming fundamentals, the $2,000 mark seems inevitable, but in a slightly longer time span.