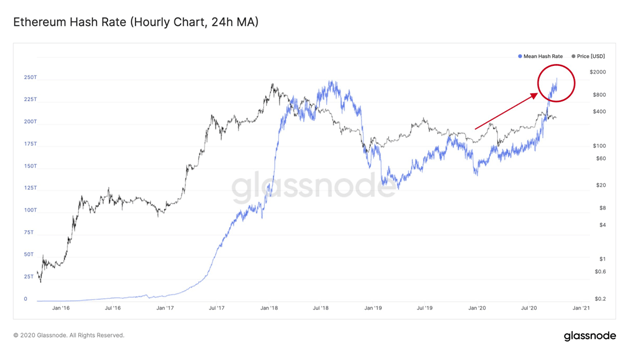

The hash rate on the Ethereum network has surged 80% since January, surpassing the previous highs set in August 2018

The amount of computational power needed to process transactions and secure the Ethereum network has spiked to hit a new high.

As of writing, the network’s hash rate is more than 250 terahashes per second, a new all-time high for the blockchain that is home to the second-largest cryptocurrency.

According to data by Glassnode, the 252 TH/s reached on October 6 is the highest the network has seen for over two years. The last time computational power on Ethereum cracked levels near the current one was in August 2018. At the time, Ethereum’s overall computational power needs rose to 246 TH/s.

In 2020, the hash rate has risen by more than 80%, up from lows of 139 TH/s in early January.

Glassnode has indicated that Ethereum’s rising hash rate is likely a product of the increased activity and volatility registered across key indicators.

Among metrics Glassnode highlights as the likely cause of the surging computational power needs is the mega boom witnessed in the DeFi space. As previously highlighted, Ethereum has been recording a surge in gas fees, contributed to by the increased activity linked to Ethereum-based decentralized finance protocols.

In August and September, increased activity in the DeFi space driven by the yield farming craze helped push transaction fees to new all-time highs. That was the case as miners on the Ethereum network earned more than $166 million in revenue accrued from transaction fees over September.

In comparison, miners on the largest cryptocurrency network Bitcoin earned far less from transaction fees in the same period. According to Glassnode, Bitcoin miners raked in a paltry $26 million over the month — clearly lower than their counterparts.

Similarly, Ethereum miners’ revenue is almost three times higher than those on mining for the Bitcoin network. As noted by mining firm F2Pool, profitability for Bitcoin miners in 24 hours stands at around $4.33 while it climbs up to $15.00 for ETH miners.

In the market, Ether prices have failed to climb above $400 since dropping below this level on September 4. As of writing, ETH/USD is trading around $340, down by around 3% in the last 24 hours.