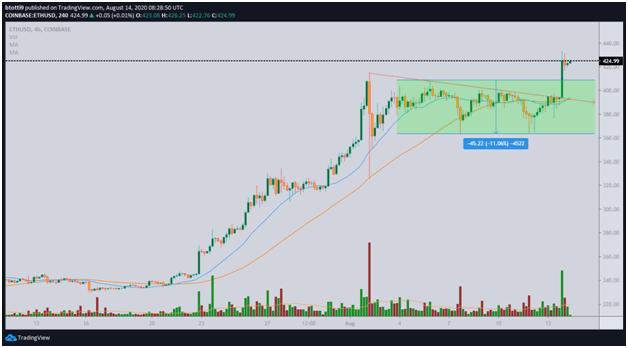

ETH/USD has hit a new local high at $431 and could extend to higher highs with another leg up over the next few sessions

After days consolidating around $390, ETH/USD has rallied to highs of $431 with little resistance. If bulls defend intraday gains, another attempt to break the psychological level of $500 could be attempted in the short term.

According to Blockfyre’s lead technical analyst Pentoshi, Ethereum is set for more upside that should see bulls test resistance at $450 on the weekly timeframe. The analyst suggests that more money from altcoins could be rotated into Ethereum to aid the expected uptrend.

The bulls have gigantic support around $390-$397, where the 20-day and 50-day simple moving averages are located at $394.40 and$392.19. An accumulation in this region already saw bulls break above the downward trendline, further strengthening near prevailing price levels could see an extended breakout as suggested above.

Yesterday, Ethereum’s daily transaction fees hit a record-high $6.8 million. Analysts have pointed to the surge in decentralized finance (DeFi) activity on the network as the reason for the rocketing gas costs.

Ethereum is inching closer to its ETH 2.0 implementation that would switch the blockchain from its mining-based consensus to introduce staking.

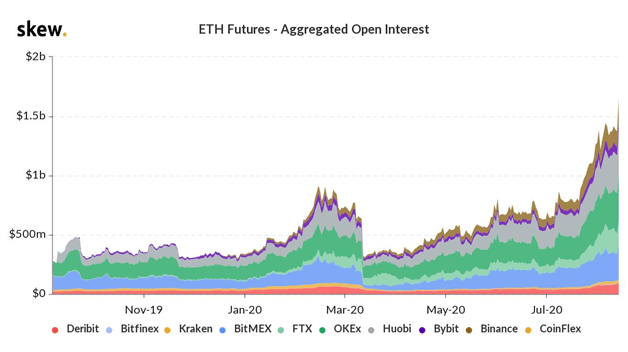

Meanwhile, interest in ETH Futures has reached all-time highs. According to Skew Analytics, Open Interest has hit a new all-time high after crossing the $1.5 billion mark.

ETH/USD was trading at around $426 at the time of writing, about 10.18% higher than its 24-hour opening value. This places the pair above its 2020 high of $415, reached on August 2, suggesting more momentum above could see another leg take prices higher to around $500.

As Ethereum bulls keep an eye on $500, Bitcoin has moved above $11,700 as buyers try to retake $12,000 for the third time.