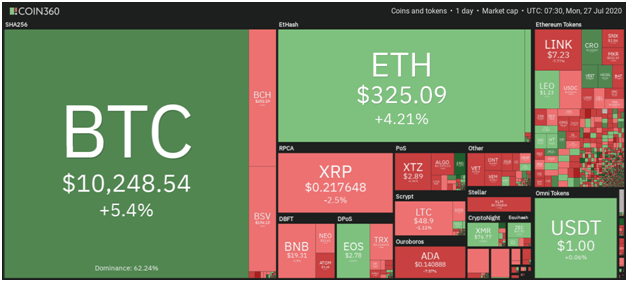

Ethereum is ready to test price levels above $350 but XRP/USD looks odds on for a breakdown to $0.20

Bitcoin has exploded above $10,000 and looks set to test resistance around $10,500, which could confirm an uptrend that might see the price of the top cryptocurrency climb to highs of $11,000-$12,000.

In the past 24 hours, the BTC/USD pair has added more than 13% to its value in a week, having struggled in a tightening range as DeFi led a surge in altcoin prices.

Ethereum has similarly rallied by more than 5% today and over 37% in the past seven days to hit price levels above $330. XRP, on the other hand, has failed to hold gains above $0.22 and could trade lower if selling pressure increases.

Overall, the market is mixed, especially for smaller altcoins and DeFi tokens. Although we may yet see an uptick similar to that of Bitcoin from some altcoins, the picture on Monday is rather uninspiring for much of the market.

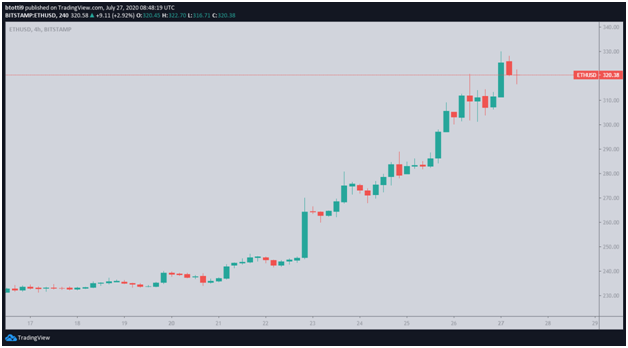

ETH/USD price outlook

ETH/USD could rally to $400 if bulls take control above $320 in the next few trading sessions.

Ethereum bulls have, for several weeks, been building upside momentum, with fundamental and technical strength supporting the observed rally. It is not surprising to see its breakout to highs of $336 contrast with the bearish grip still limiting several other altcoins.

An upside for ETH/USD is supported by the RSI and the Elliot Wave on the daily chart. While the RSI is within the overbought territory, bulls are likely to extend their upside move before hitting a barrier.

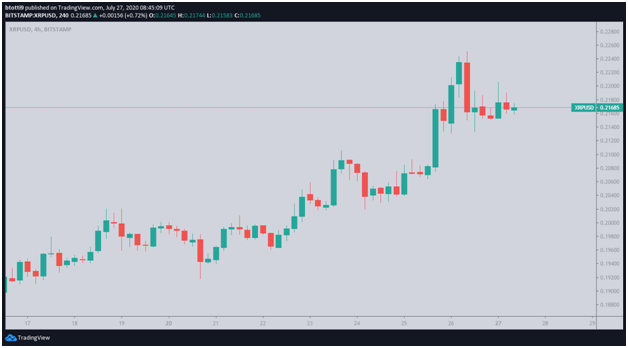

XRP/USD price update

Ripple has slipped from its perch above $0.22 after dropping more than 3% in the past 24 hours. The dip means XRP’s brief return to the top three by market cap above Tether was short-lived.

XRP/USD is trading at the tip of a head and shoulders pattern, which means the price is likely to fall within the next trading session. The short term bearish move may see the cryptocurrency hit price levels around $0.205 and $0.201.

Increased selling pressure could bring into focus price levels around the 100-day MA at $0.197.

On the upside, sellers are likely to put up an immediate barrier around the psychological $0.22 and above that the 24-hour high at $0.224.