IOTA’s (MIOTA) price posted double-digit gains in the past 24 hours, with its price reaching as high as $1.57

Fundamentals and past price performance

IOTA is a distributed ledger-based cryptocurrency that doesn’t actually use blockchain as its foundation. Instead, it has its own proprietary technology called Tangle. Tangle is a system of nodes that are used to confirm transactions. The foundation behind IOTA stated that Tangle offers much greater speeds than current blockchains, and at a fraction of the cost.

Since IOTA isn’t a blockchain, it doesn’t need miners, which means that it also has no fees. The cryptocurrency aims to provide a limitless amount of transactions per second (TPS) at minimal expense.

IOTA’s current push towards the upside was caused by two factors:

- The long-awaited Chrysalis network update alongside its upcoming smart contract framework, and

- Various partnerships that IOTA established in the past week.

Dominik Schiener, the co-founder of IOTA, posted a tweet regarding the Chrysalis update and its impact on the cryptocurrency:

The #MachineEconomy needs feeless micropayments, secure immutable data, smart contracts and tokenization of digital and physical assets. #IOTA is building all of it. The upcoming Chrysalis upgrade will push IOTA into entirely new ecosystems and use cases. https://t.co/9yTo3FQIUP pic.twitter.com/HLLcwG9xGi

— Dominik Schiener (@DomSchiener) February 18, 2021

MIOTA posted week-over-week gains of 29.22%, outperforming both BTC‘s week-over-week gains of 7.22% and ETH‘s 7.77% gain. IOTA is currently the 23rd-largest cryptocurrency by market cap, boasting a value of $4.09 billion.

At the time of writing, MIOTA is trading for $1.48, which represents a price increase of 256.37% when compared to the previous month’s value.

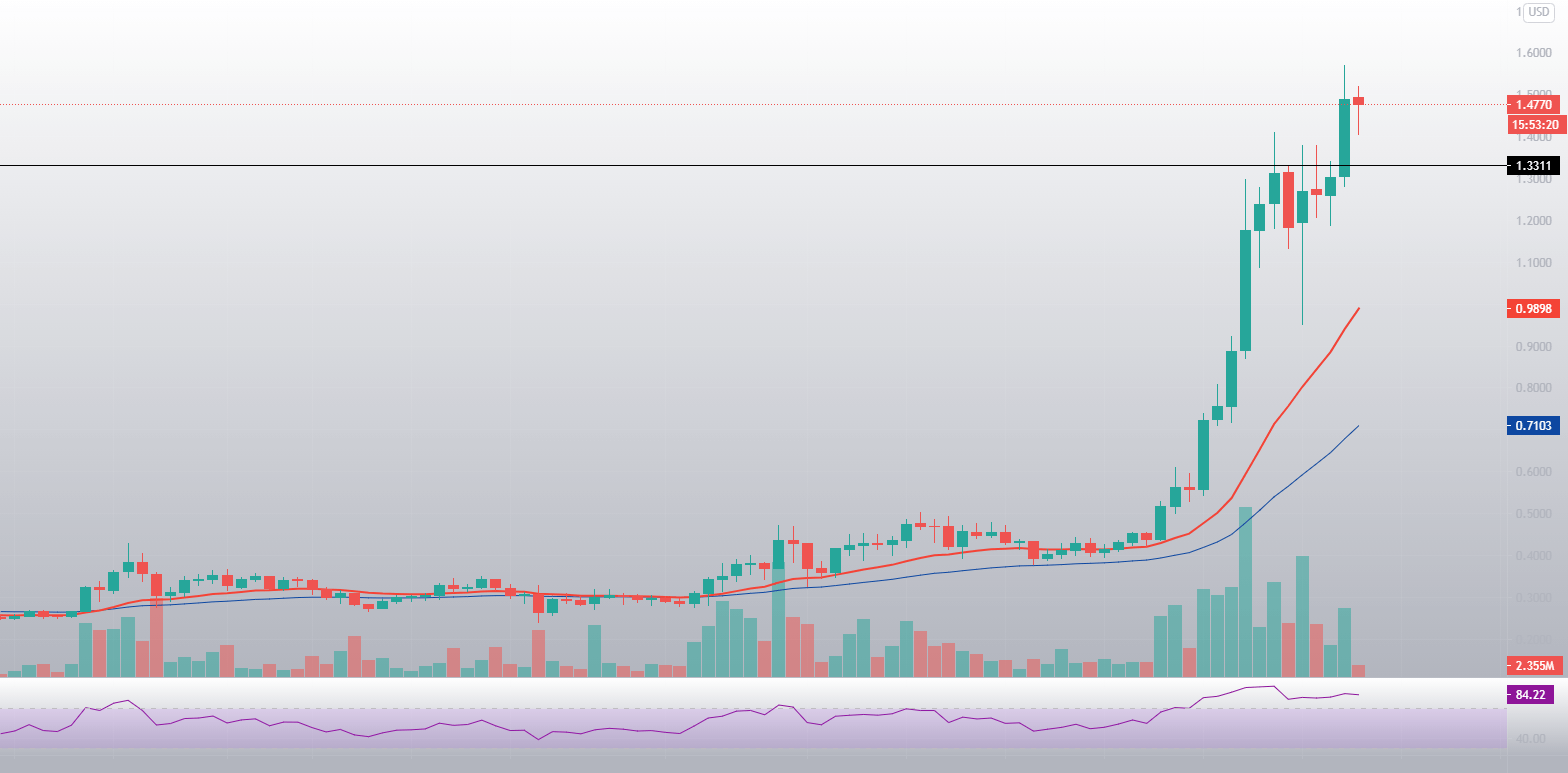

MIOTA/USD daily chart price analysis

MIOTA has managed to break above its $1.33 resistance level that dates back all the way from 2018. While many called IOTA’s push towards the $2 mark, the cryptocurrency seems to be losing in volume, and therefore, buying power. This was also confirmed by yesterday’s daily candle not closing above the $1.5 resistance level.

If the cryptocurrency manages to confidently push past the $1.5 mark, it will have a chance to ascend to the $2 mark. However, if that doesn’t happen, MIOTA will possibly try to retrace to find support in either its $1.33 support or one of its Fib retracement levels.

MIOTA’s RSI on the daily time-frame is currently very deep in the overbought territory, with its value sitting at 84.22.

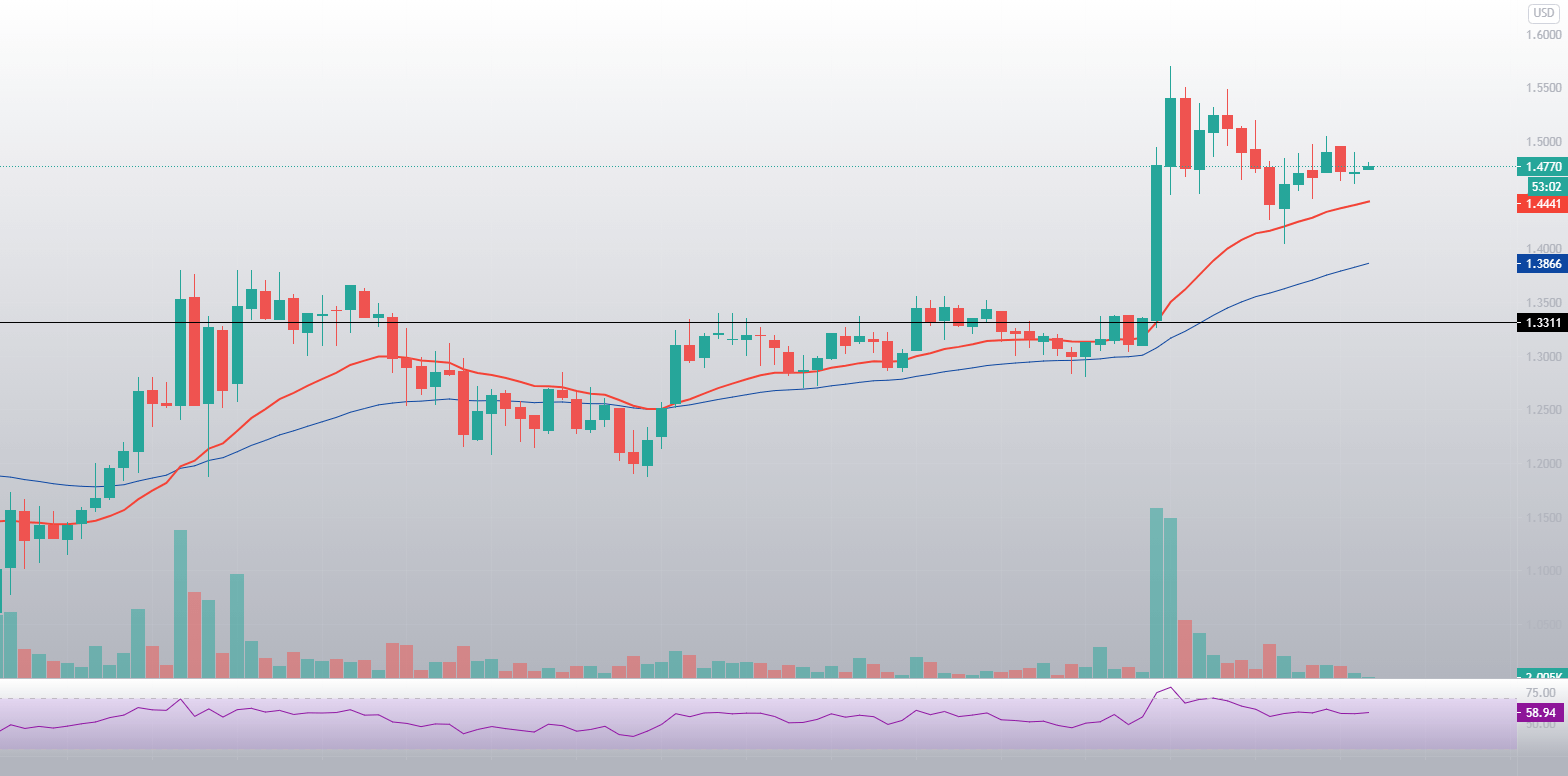

MIOTA/USD daily chart price analysis

Looking at the hourly time-frame, we can see MIOTA’s Thursday volume spike during its price surge. While both the volume and the buying power were incredible, they both faded extremely quickly. IOTA is now trading in a slightly descending fashion, with the 21-hour EMA acting as its immediate support.

We can also see that MITOA is responding well to both its 21-hour and 50-hour EMAs.This means that we can consider them moving support levels.

MIOTA’s price shouldn’t encounter extreme resistance until the $2 mark. However, the next couple of hours will show if the cryptocurrency even has the strength to go as far.