IOTA (MIOTA) has recovered from a steep weekend sell-off to trade near $2.50.

IOTA’s value against the US dollar crashed to lows of $1.60 over the weekend, alongside broader troubles that saw Bitcoin plummet to support around $55k. The overall market remains jittery as BTC struggles for an upside above $57k.

For IOTA, however, the imminent Chrysalis 2.0 network upgrade and mainnet migration are likely to buoy sentiment. A broader recovery in the altcoin market could also add to the upside impetus.

IOTA price outlook

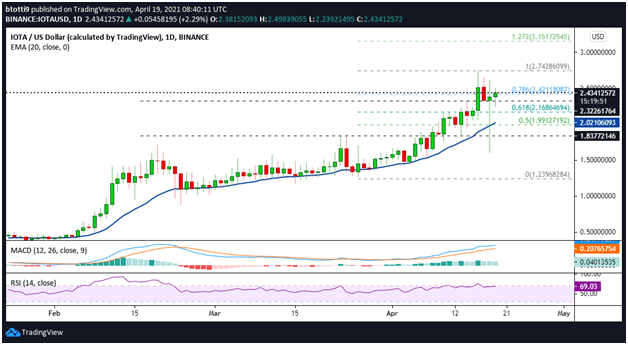

The long wick on Sunday’s candle shows that MIOTA bulls were able to ‘buy the dip’ that saw lows of $1.60. The sharp fall had seen prices break below the 20-day exponential moving average and a crucial horizontal support line near $2.00.

The rebound has the cryptocurrency’s price above a key bullish trend line, with bulls likely to be encouraged by the retest of the $2.50 level. The MACD remaining bullish and the RSI tracking the 68 point level suggest buyers hold the advantage.

If MIOTA/USD breaks above the immediate barrier at $2.42 (78.6% Fib level), a move to $2.50 would open up a new path to recent highs around $2.74.

From here, buyers can look towards $3.15, with a potential for momentum to thrust it to $4.00 in the short term.

The hourly chart shows that bulls continue to face sell-off pressure. The immediate picture, however, remains positive, as IOTA is above an ascending trend line support and the 100 SMA.

The contrary view will begin to materialise if bears drag prices below the trend line towards $2.30. If this happens, key price levels to watch are the 100 hourly SMA (currently at $2.28) and the $2.15 demand zone. A bearish flip below $2.00 could see IOTA revisit $1.60.