The cryptocurrency market is marginally up today after a slight reversal yesterday. Bitcoin gained as much as 3% in early morning trading but it has since lost its steam, trading at $9,376 or less than 1% gain in the last 24 hours.

Ethereum posted better performance to trade at $765 gaining 2.29% in the last 24 hours. SEC’s hearing concerning Ethereum scheduled for May 7 did not take place.

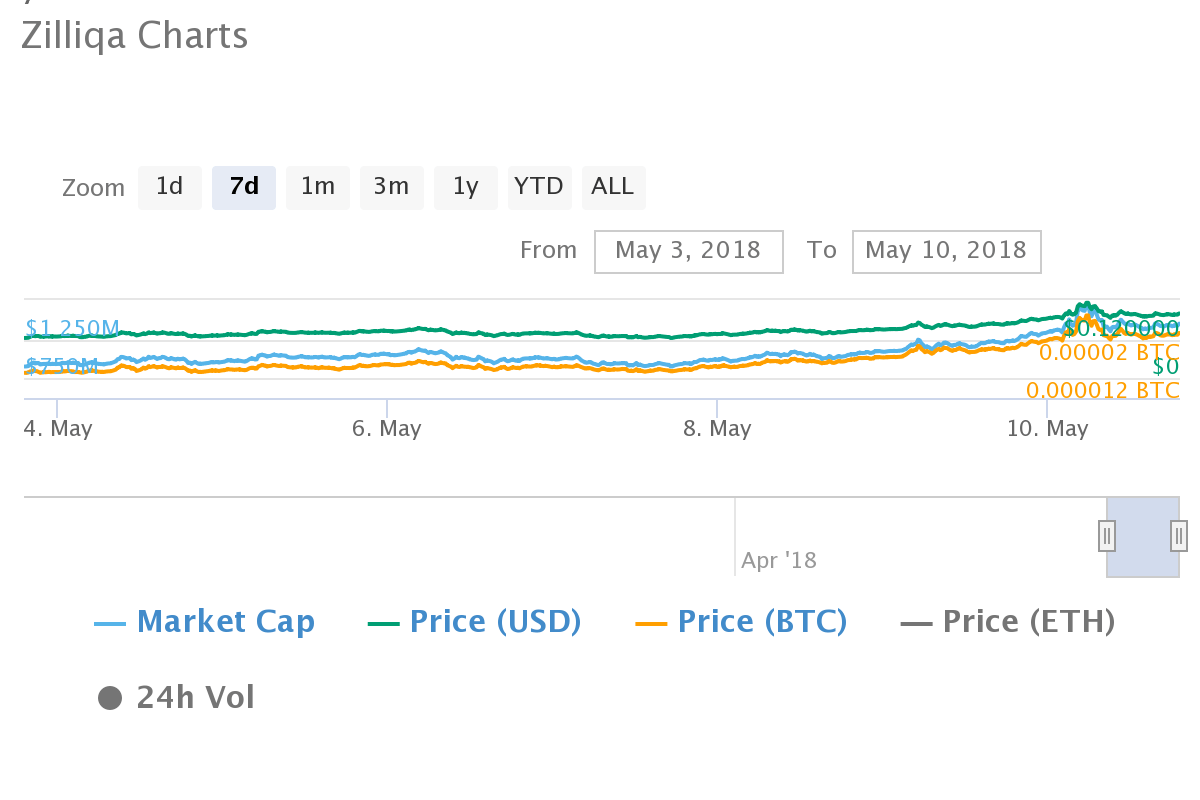

Bitcoin Cash is the best performing top currency today having gained more than 6%. Little known Zilliqa posted a massive 17% gain in the last 24 hours to trade at $0.19. The cryptocurrency has now entered the top 28 league of cryptocurrencies with a market capitalisation of more than $1 billion.

Zilliqa Crosses $1 Billion Milestone

Its market cap now stands at $1.4 billion having crossed the $1 billion mark on Monday. The steep rise came after its listing on OkEx was announced. OKEx is the third largest exchange by market capitalisation according to data from CoinMarketCap. The coin is also listed in other major exchanges including Binance and Huobi.

A Solution for Scalability

Zilliqa employs sharding, a technique used to solve scalability issues that many other cryptocurrencies like bitcoin face. Sharding is much more efficient and the project claims an improvement of one thousand times the transaction rates of ethereum. Zilliqa can process 1389 transactions per second. In many ways, Zilliqa sounds like an improvement of Ethereum with smart contracts and decentralised apps.

Ethereum’s planned introduction of sharding into its system however poses a threat to Ziliqa’s position.

ZIliqa’s value had almost quadrupled since early April. On April 1, the digital token was trading at $0.045 according to data from CoinMarketCap. Overall, its value has multiplied more than 25 times since it was launched December 2017.

Bytecoin and 0x are Some of the Biggest Gainers

Bytecoin and Ox have also been posting similar oversized gains in the past 24 hours. 0x is now trading at $1.88 after gaining more than 10% in the last 24 hours. ZebPay, an Indian cryptocurrency exchange added the 0x tokens on Tuesday.

Bytecoin is another big gainer climbing more than 20% in the last 24 hours. The sharp price can be attributed to the announcement of three trading pairs involving Bytecoin on Binance.

Bytecoin can now be paired with Bitcoin, Ethereum and Binance Coin, Binance’s native token. There is, however, a disparity in prices between exchanges with the jump mainly happening on Binance.

It’s also worth keeping in mind that there are few trading pairs with BCN outside Binance. Low trading volumes due to high centralisation is also to blame for the phenomenon.

Bytecoin is an anonymous blockchain project with CryptoNote which prevents tracking on the blockchain.

Bitcoin Futures Brought Down Bitcoin Prices

Elsewhere, a report by Federal Reserve has noted a link between the launch of bitcoin futures contracts by CBOE and CME to the stagnation of bitcoin prices.

“The peak bitcoin price coincided with the day bitcoin futures started trading on the Chicago Mercantile Exchange (CME). In this Economic Letter, we argue that these price dynamics are consistent with the rise and collapse of the home financing market in the 2000s,” the Federal Reserve of San Francisco said in the report.

The entry of institutional investors might be seen as a good thing but it also opens the floodgates for traders shorting the market.

Like the mortgage boom, the cryptocurrency market was driven by optimistic investors before more pessimistic investors entered after the launch of bitcoin futures, the report argues.

Others institutional investors like Goldman Sachs and NYSE’s parent company have recently expressed interest in making an entry. If this analysis is true, then this development might not be as good for the market.