Over $750 million worth of Bitcoin has been locked as DeFi drives tokenization of Bitcoin.

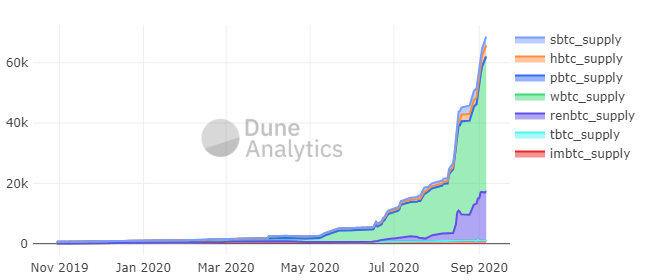

The amount of Bitcoin ‘locked up’ for use on the Ethereum network and in the booming DeFi ecosystem is close to 73,000, data shows.

Specifically, there were 72,843 bitcoins mapped on Ethereum, worth about $750 million of Bitcoin, at the time of publication.

Of the seven cross-chain bridge projects out to tokenize Bitcoin, the largest in terms of market share is wrapped bitcoin (wBTC).

Per data on Dune Analytics, there are 46,421 wBTC on the Ethereum blockchain worth about $476,239,516 as of September 8. That puts the percentage of wBTC at 64.5% of the total Bitcoin supply on Ethereum.

The Ren Protocol has the next biggest command at 16,671 renBTC, or just over 23% of the total number of synthetic bitcoins, in circulation.

Other projects with tokenized Bitcoin are hBTC with 4,810 bitcoins’, sBTC 2,897 tokens, imBTC 1,353, and pBTC with 45 bitcoins mapped on the Ethereum blockchain respectively.

On aggregate, the amount of synthetic bitcoins entering the DeFi space jumped threefold in August alone. Appetite for trades and loans denominated in Bitcoin from decentralized finance investors saw over 26,000, or nearly $300 million worth of new tokenized bitcoins, enter the space.

Alameda Research, co-founded by FTX exchange CEO Sam Bankman-Fried, reportedly accumulated 14,654 WBTC in August. That’s nearly 70% of all wrapped bitcoin (WBTC) released last month.

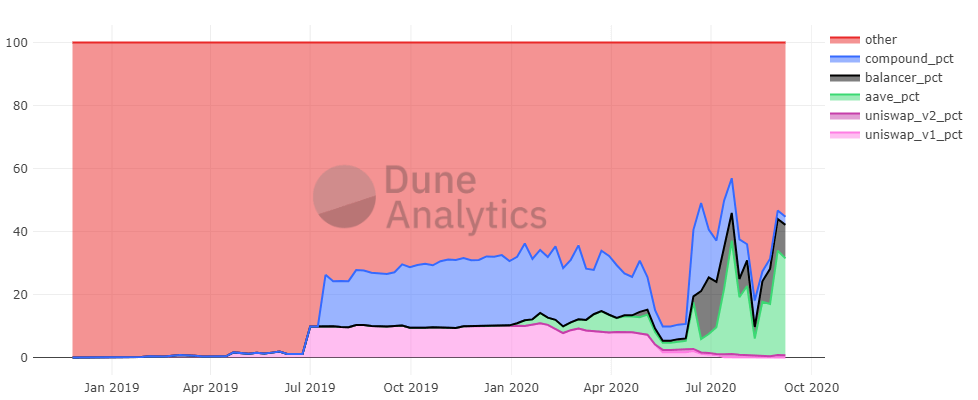

While a growing number of people hold tokenized bitcoin, the majority of supply is currently being used in DeFi projects. As can be seen below, Compound, Balancer, Aave, and Uniswap, have all seen a spike in the amount of wBTC.

As of today, tokenization has put nearly 0.4% of the total Bitcoin supply (21 million) on the Ethereum blockchain.

Notably, the growth in the supply of these synthetic bitcoins now means they make up nearly 2.0% of the total market capitalization of Ethereum.

The tokenization of Bitcoin involves locking BTC on the Bitcoin network and minting new tokens on Ethereum. The ERC-20 token is then used on the smart contracts platform, with the “burning” of the “wrapped” coins resulting in the unlocking of the real Bitcoin on the blockchain.