When delving into the field of decentralized development, competition is fierce, with more than Bitcoin and Ethereum to contend with. One of the most prominent and first to challenge is NEO, an ecosystem that also allows for the development of robust decentralized applications and the easy launch of new projects. As one of the most profitable cryptocurrencies in the midst of the 2017 upswing, many are looking for the moment when NEO will explode again. Here we present the best NEO price predictions and forecasts for 2020 after a series of fundamental, technical analysis and expert opinion research.

NEO Future for 2020

NEO is one of the most robust constructs for the development of new projects based on blockchain technology. One of its most solid characteristics is versatility, given mainly by the fact that anyone with programming experience could create their own token or decentralized project through the NEO ecosystem. This is due to the compatibility with a large group of programming languages for the coding of intelligent contracts, e.g. C++, C# and Java, among others. The ecosystem already hosts solid projects such as Ontology, RedPulse, Trinity or Qlink.

In spite of these advances, NEO has been one of the cryptosystems most affected by the 2018 downturn. The token that supports the ecosystem lost up to 97% of its value from its highs that year. By the time this article is published, the situation has not changed much and the gap is still 94% from historical highs. Although in 2019, some cryptocurrencies took advantage of the situation to gain space, NEO had experienced a rather insignificant rise. So, is the project on its way to completion? Actually, 2020 could be the year when NEO gets back in the game. A few months ago, the team began development of a new version of the platform; NEO 3.0. If the plan is fulfilled, NEO 3.0 will arrive in 2020 and could put the cryptocurrency back on the map.

NEO’s 2020 Predictions: Important Events, Updates and Key Data

In the list below, we present some arguments for a possible rise in NEO for 2020. Will it be a good year to buy NEO?

- The editor of “NEO Smart Economy”, Eric Zhang, put forth a few months ago, the roadmap for the launch of NEO 3.0. According to the data published in Medium, the launch of this new version is estimated for release in the second quarter of 2020.

- This update could take NEO to the next level. The platform would be capable of implementing large scale applications for commercial use. Among the new inclusions are the implementation of a delegated version of Byzantine Fault Tolerance (dBFT), a lower cost model, the possibility for contracts to have internet access at runtime, the NeoVM virtual machine, a NeoFS storage platform and a NeoID digital identification system.

- China’s interest in the cryptocurrency industry has prompted the Chinese president himself to urge support for an accelerated use of blockchain technology, at the official level. As a project with its roots in this country, this could be a very promising turn of events. In the last ranking of crypto coins prepared by the Chinese government -and published in December 2019– NEO occupied the 6th position.

Technical Analysis of NEO and Possible Scenarios (January 2020)

In the following technical analysis, we explore some of the possible scenarios for the future of NEO in 2020. The analysis was conducted in January 2020, on a daily basis. Although the situation may change dramatically throughout the year, the figures may serve to identify some key points of interest. Because of its wide divergence, we will analyse the price of NEO against the US dollar, but also against Bitcoin. Thus, two currency pairs are included (NEO/USD and NEO/BTC). This data may prove invaluable, and because of the volatile nature of NEO, it should be read carefully.

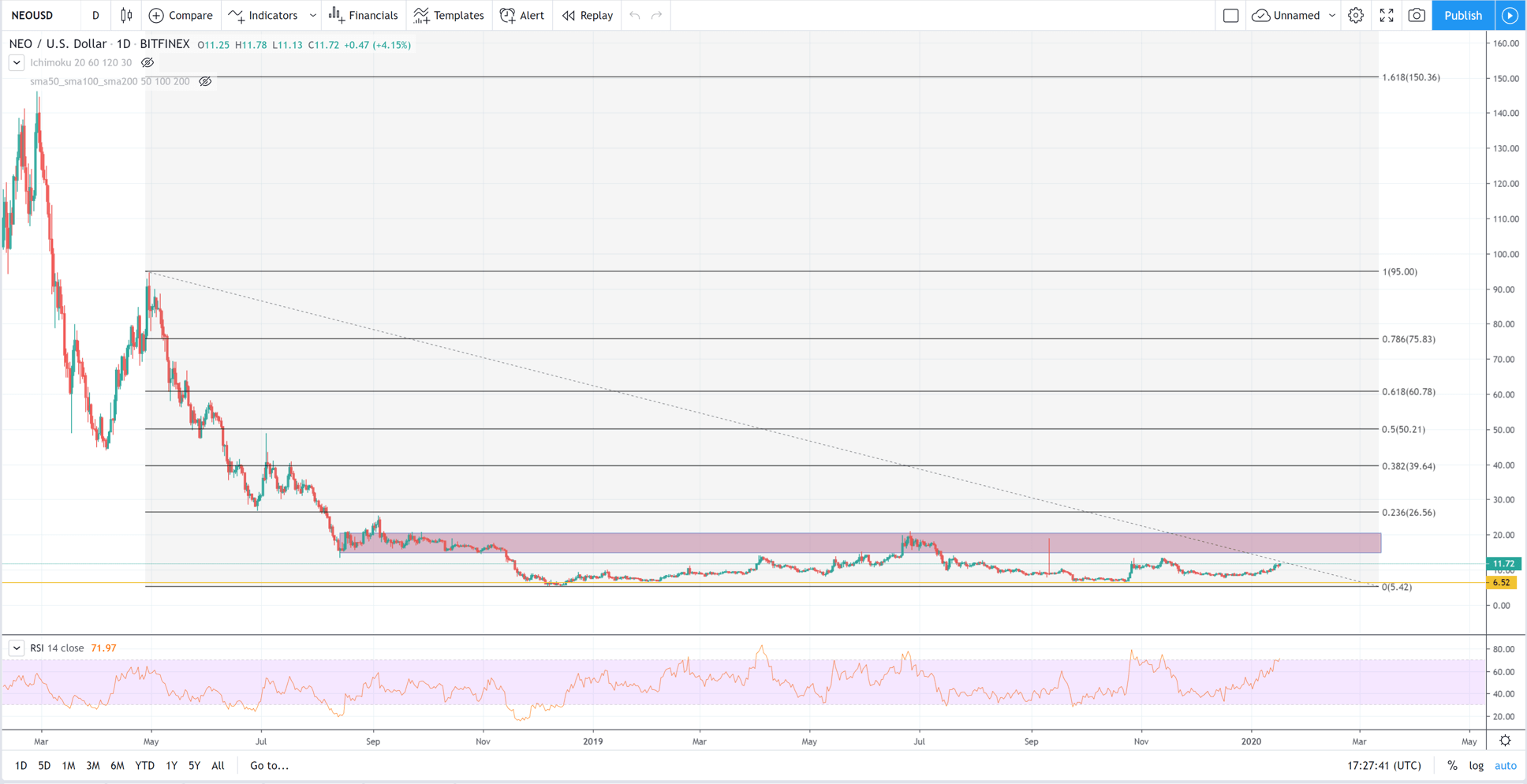

NEO/USD: Important Observations and Areas of Interest

The graph shows several important indicators and levels to follow:

- By doing the analysis of 1-day candles in a relatively extended time frame, we can see that the NEO path with respect to the dollar will not be a simple one.

- There is a first consolidation zone before the breakout in November 2018, where the token loses support around $15, leading it to record lows, since 2017.

- This consolidation zone will now be key to NEO’s performance in the future. The top is around $21 and we can see that NEO has already tried to overcome this resistance in mid-2019 (without much success).

- It is very likely that NEO will again seek asylum in this region, and the bullish side will have to act strongly to overcome this wall. Otherwise, NEO could fall again, testing support around $6.5 before falling to a ground of $5.4, its lowest level in over 2 years.

- On the other hand, if it manages to overcome the zone demarcated in red, we could begin to see a more upward panorama for that of decentralized multilingual development. Fibonacci marks several levels of interest relatively precisely. One of them is at around $26.5; but there is more prominent resistance at around $40.

- Despite the lack of NEO’s bellows, the RSI looks like it is starting to fall into an overbought zone, which could lead to a period of consolidation in the short-term at best.

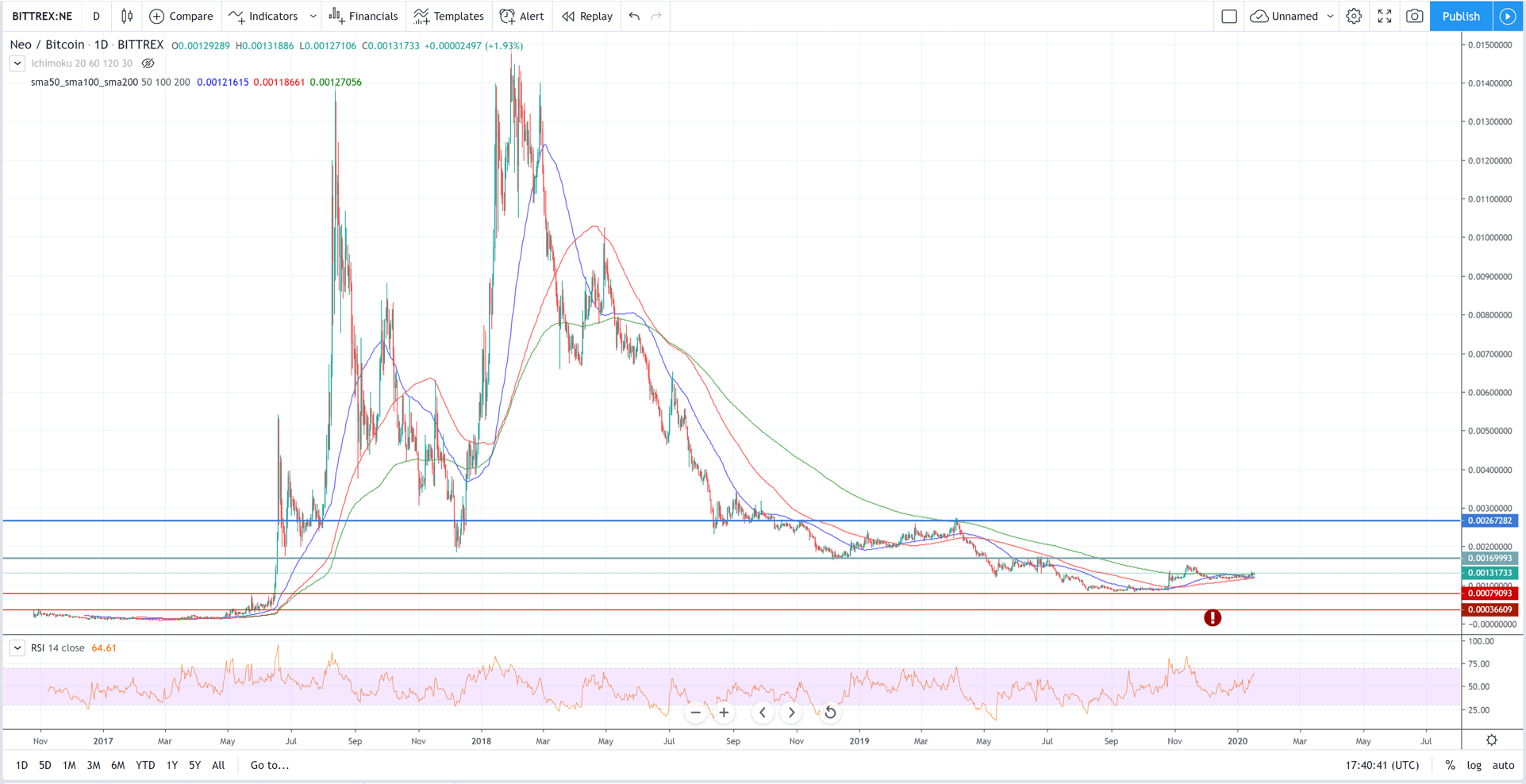

NEO/BTC: Important Observations and Areas of Interest

This chart shows high levels of volatility, making the information less clear. However, there are some observations that stand out:

- At the end of 2019, NEO’s share price for Bitcoin bottomed out, reaching its lowest level since June 2017. Although this caused it to drift to oversold levels on the RSI, a retracement of this support of around 0.0008 BTC is not ruled out. If the bulls fail to respond, it could fall to a dangerous level nearing 0.00036 BTC.

- However, one indicator could change the outlook completely. We refer to the 50, 100- and 200-day moving averages (MA50, MA100, MA200). These curves have been key determinants of NEO’s behaviour over the past year in preventing its rise. Right now, the cryptocurrency has managed to overcome them, which is considered a bullish signal. However, confirmation of the breakout will be required in order to shift to a more positive outlook.

- If confirmed, NEO would look for volatile levels with resistance close to 131 KSATS (0.00131 BTC) and 267 KSATS (0.00267 BTC) as significant levels in relation to their historical behaviour as S/R (support/resistance) levels. Of course, there are intermediate levels, but these can distract from the bigger picture.

- The analysis will lose validity if it is not done in conjunction with a study of the Bitcoin ecosystem.

Other Technical Considerations and Projections for NEO

- NEO minimums in the last year: fell to $6.65 in October, 2019. In September of the same year, its price with respect to BTC sank to 0.00083 BTC.

- NEO highs in the last year: in June 2019, it rose very briefly above $20. With respect to Bitcoin, the NEO/BTC pair reached over 273 KSATS in March of the same year.

Analysis indicates a possible break for the NEO/BTC pair, but this will require further confirmation and appeasement in the Bitcoin domain, which could make this scenario less likely. With respect to the dollar, the consolidation wall will be the level to monitor this year before any accurate conclusions can be drawn.

NEO Predictions and Future According to Experts

- The YouTube channel BTC News, makes a NEO prediction with a value close to $1,555 USD for the month of December 2020. However, we consider this projection improbable and unrealistic.

- The LongForecast portal, which provides financial forecasts of different trading instruments, has a NEO price forecast of $13.00 USD for the end of 2020 (consulted at the time of this article’s edition). This would confirm the consolidation theory we have referred to.

- Meanwhile, the Coin.switch website considers that the arrival of NEO 3.0 will indeed have a positive impact on price during 2020. According to its publication, the token could close the year in a rally that would reach highs of USD $274.8.

- Another portal, known as the Bitcoinist, also leans prominently to the upside. According to the press release, the new upgrade in the NEO network would place bullish predictions for NEO in 2020. Although they make no mention of specific values, they believe that – in conjunction with BTC – NEO will be the winning cryptocurrency of 2020.

What do these Predictions Conclude about NEO in 2020?

This year could be a big surprise for a project that has remained in the shadows since its transition from Antshares to NEO, in 2017. The new 3.0 version would incorporate features that could really put the crypto back in the game and make NEO competitive again in a niche where competition is tough. If NEO manages to be one of the pillars of a smart economy, which is their vision, the price of their token could skyrocket – as it has in the past. The Chinese government could be one of the allies in making this happen and the opinions of experts coincide in a mostly bullish scenario for this cryptocurrency in 2020.

However, our technical analysis advises caution and appropriate risk management before the levels outlined above respond. We would also like to remind you that this token is available to trade through certain brokers, which is a great advantage for investors who want to take advantage of every move. Regardless of whether one is experiencing an upward or downward trend, NEO is a cryptocurrency for the bravest and most risk-tolerant; those who are looking for more significant returns.